This article first appeared in The Edge Financial Daily, on November 5, 2015.

KUALA LUMPUR: Maybank Asset Management Group Bhd (Maybank AM) has teamed up with Australia’s Hastings Management Pty Ltd to explore the possibility of setting up the first Malaysia-domiciled US dollar-denominated global infrastructure fund.

Maybank AM group chief executive officer Nor’ Azamin Salleh said the company is looking to set up an open-ended fund to be co-managed by Hastings, with an estimated fund size of US$1 billion (RM4.26 billion).

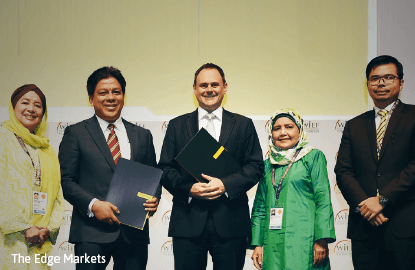

“We target to sell between US$200 million and US$250 million under the first tranche of the fund,” he told reporters after the signing of a memorandum of understanding (MoU) between Maybank AM and Hastings on the sidelines of the 11th World Islamic Economic Forum yesterday.

“The group is looking at [issuing a total of] US$1 billion at the end of the second tranche, and we hope to launch the fund as early as the second quarter of 2016. The investment in infrastructure assets by the fund will open up opportunities for the syndicate of Malaysian Islamic banks to provide the syariah debt support both at the acquisition stage and sukuk at the expansion stage,” said Nor’ Azamin.

Together, Maybank AM and Hastings aim to provide investors with the benefits of access to infrastructure investment opportunities in emerging markets like Asean economies, India and China, through a pooled-fund.

Maybank AM noted that research by McKinsey Global Institute found that Asean economies will collectively need a cumulative US$7 trillion for infrastructure needs from 2014 up to 2030.

“Maybank AM sees the market opportunity in infrastructure funds which will provide steady returns, moderate risk, lower market volatility, as well as opportunities for portfolio diversification,” Nor’ Azamin explained.

Maybank Islamic Asset Management Sdn Bhd chief executive officer Ahmad Najib Nazlan noted that there is a dearth of traditional assets coming through the pipeline such as fixed income and sukuk-based assets.

“Allocations into fixed assets, infrastructure or real estate are not open to market fluctuations, as we have seen severe market fluctuations affecting traditional equities and fixed income in this cycle and hence, the reason why we came up with this alternative strategy,” Ahmad Najib said.

He added that the group is currently working to establish partnerships with counterparties in China, North America and Europe.