This article first appeared in The Edge Financial Daily, on October 29, 2015.

KUALA LUMPUR: Maxis Bhd, the country’s largest mobile operator, reported a 1.8% rise in third-quarter net profit to RM509 million from RM500 million in the same period last year, after adjusting for accelerated depreciation due to network modernisation as well as unrealised foreign exchange (forex) losses.

KUALA LUMPUR: Maxis Bhd, the country’s largest mobile operator, reported a 1.8% rise in third-quarter net profit to RM509 million from RM500 million in the same period last year, after adjusting for accelerated depreciation due to network modernisation as well as unrealised foreign exchange (forex) losses.

The group’s revenue for the three months ended Sept 30, 2015 (3QFY15) grew 4.9% to RM2.17 billion from RM2.07 billion in 3QFY14, driven by the strong performance of the prepaid and postpaid segments.

Maxis said the growth was driven by higher data use, supported by attractive customer propositions and superior Internet experience.

In a statement yesterday, Maxis said the growth in prepaid revenue was fuelled by higher data use while for postpaid, growth came from high value customers subscribing to the MaxisONE plan.

The group also declared a third interim dividend of 5 sen per share for the financial year ending Dec 31, 2015 (FY15), payable on Dec 29.

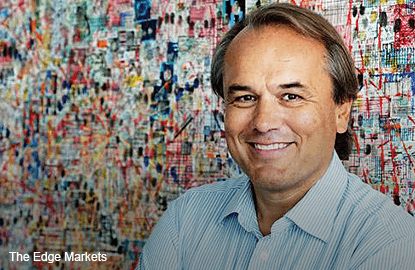

Maxis chief executive officer Morten Lundal said during the quarter under review, Maxis spent RM359 million to further improve its high performing network.

“4G LTE (long-term evolution) coverage now extends to 55% of the population, making Maxis the market leader with the fastest and widest 4G LTE coverage in the country. It means Maxis has 95% coverage in key market centres and 60% in all state capitals,” he said in the statement.

For the nine-month period (9MFY15), revenue rose 2.5% to RM6.43 billion from RM6.27 billion a year ago, driven by the strong performance of the prepaid segment.

“Year to date, service revenue grew 4% to RM6.379 billion. Prepaid service revenue grew 7.2% to RM3.143 billion, while postpaid service revenue was relatively stable at RM2.92 billion,” Maxis said.

Maxis said prepaid subscribers rose to 8,850 from 8,120.

Net profit for 9MFY15, however, was down 7.8% to RM1.27 billion or 16.9 sen a share from RM1.38 billion or 18.4 sen a share in 9MFY14.

Earnings before interest, taxes, depreciation and amortisation (Ebitda) for 9MFY15 also fell to RM3.17 billion from RM3.23 billion in 9MFY14.

“The decline in Ebitda was primarily driven by unrealised forex losses from the weakening ringgit, and higher staff costs largely due to a non-recurring reversal made in the same period last year,” said Maxis.

“This was partially offset by lower prepaid service tax. The group will remain focused on strengthening its market position in a competitive environment,” it added.

Year to date, the service revenue Ebitda margin, normalised for unrealised forex losses, was at 52.5% against 53.2% in the previous corresponding period.

Looking ahead, Maxis (valuation: 1.1, fundamental: 1.15) expects service revenue growth to be in the low single digits in FY15, while Ebitda is seen at similar levels as in FY14.

The group also anticipates its FY15 capital expenditure to be in the range of RM1.2 billion to RM1.3 billion to cater for high data traffic growth. Maxis has nine million mobile Internet users to date.