This article first appeared in The Edge Financial Daily, on May 3, 2016.

KUALA LUMPUR: Hans-Peter Ressel, chief executive officer of Ecart Services Malaysia Sdn Bhd, the company behind the e-commerce group Lazada's Malaysian operations, agrees with other retailers’ assessment that 2015 was a challenging year for retail.

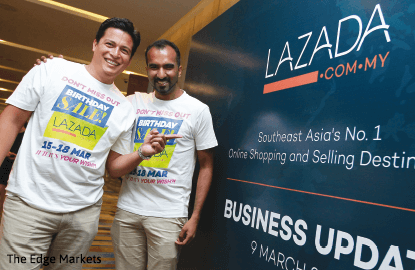

Even so, Lazada’s sales grew by at least double digits last year, though the group, which turned four on March 27, is still making losses, shared Ressel at a recent media briefing to update Ecart Services’ business performance.

Ressel, who describes Lazada as “basically a rural company with 80% of our customers outside the Klang Valley”, said the focus now is on making its service more accessible to the general masses, particularly to those in east Malaysia.

“Our goal is to essentially reduce that average spend [cost] on one order, so then the [expenditure] share of a wallet will be lower and more people will be able to afford [our service],” he said.

It will start with improving its logistics and distribution centres in east Malaysia, said Ressel, where the company saw an 80% sales growth last year.

Though the growth was impressive, Ressel revealed that the net merchandise value growth in its east Malaysia segment last year was actually lower than in other regions, which saw a minimal 110% year-on-year growth.

“Just look at the sheer size [of east Malaysia]. It’s completely untapped. We need to crack it. It’s one of our focus areas this year.”

Malaysia’s consumer sentiment in the first quarter of this year barely rebounded from the all-time low of 63.8 points seen in the prior quarter, as the Malaysian Consumer Confidence Index has stayed below the 100-point confidence threshold since the second quarter of 2014.

Malaysia Retail Chain Association president Datuk Liaw Choon Liang, who reportedly said sales of its 300 members had fallen by 20% last year, also suggested retailers tap into the potential of e-commerce, as the penetration rate of local retail players in the virtual market was still low.

Ressel estimated that online retail sales now account for only 1.5% of the country’s total retail sales.

Lazada, Ressel said, would appeal to a majority of Malaysians because of three reasons: affordability, accessibility, and convenience. Its complex supply chain would allow Lazada and its 10,000 third-party sellers now to offer products below at-store prices, and many of the 5.5 million items sold at the virtual shopping application are not even available in physical stores here.

Lazada also had the most application downloads among other e-retailers in Malaysia, at 2.3 million (as at December 2015). 11street.my comes in second, at half of Lazada’s downloads, while fashion application Zalora saw 700,000 downloads. Malaysia’s smartphone user base stood at 10.3 million last year, according to mobile marketing firm Vserv.

Ressel said gone are the days when Lazada was heavily associated with cheap smartphones. Instead, customers are going for items of even lower values — with its current top-selling products being power banks, food containers, and baby diapers.

He said the implementation of the goods and services tax also affected the average value per order. But there is a silver lining to it.

“If we look into what people spend on average per order today, it dropped by 50% [year-on-year]. That sounds like bad news, but the good news is they come back more often.

“They buy products in a broader range. They don’t buy a phone, but products in a broader range. They buy power banks, phone cases, strollers, and diapers,” Ressel said.

In essence, Lazada is playing a volume game. And with its big ambition to reach as many Malaysians as possible and providing a variety of products, Ecart Services would need to continue investing as it is still a fairly new company.

Ecart Services wants to double its items in inventory to 10 million stock-keeping units this year. The company will also have a third warehouse measuring 250,000 sq ft, which is 16 times larger than its maiden warehouse in Subang Jaya. There is another 14,000-sq ft warehouse and distribution centre in Sarawak.

In its financial year ended Dec 31, 2014 (FY14), Ecart Services’ net loss grew by 72.94% to RM87.54 million. But its top-line growth is at a rate of 142.22%, to record sales of RM114.81 million from RM47.4 million in FY13, according to checks on the Companies Commission of Malaysia. FY15 figures are not available yet, and Ressel confirmed that the company has yet to break even.

This also means that Ecart Services has narrowed its negative earnings margins. In FY14, the margin stood at -76.25%, or an average spend of RM1.76 for every ringgit of sales made, versus FY13’s 106.79%.

As for Alibaba Group Holdings Ltd's purchase of Lazada Group SA, which was founded by German Internet company Rocket Internet SE in 2012, Ressel said he looks forward to more synergies between the two e-commerce giants, which he sees will bring more products from around the world to Lazada’s customers.

“With Alibaba's e-commerce know-how, systems and processes, we will also be better able to help our sellers grow their businesses,” Ressel added.

The US$1 billion (RM3.92 billion) acquisition was seen as a deal that will broaden the revenue base of the Chinese e-commerce giant. Besides Malaysia, Lazada Group operates in Indonesia, the Philippines, Singapore, Thailand and Vietnam.