SINGAPORE (Apr 21): Genting Singapore’s bottom line has been hit by a spike in bad debt provisions, as more customers who lost the bet refuse to pay up.

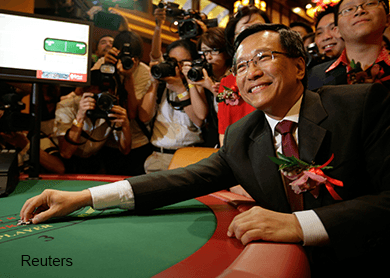

From the perspective of Lim Kok Thay, the high level of provisions is just an indication that the company is prudent in the way it runs the gaming business.

“We tend to be more prudent -- it is the legacy of the Genting group -- we’ve always provided prudently, so that we can sleep better at night, in case a nuclear bomb falls,” says executive chairman Lim at the company’s annual general meeting on April 21.

Lim also tries to assure shareholders that not all this bad debt will be eventually written off as some of it can still be recovered. In any case, providing for such bad debts is something the company has planned for as part and parcel of doing business and which it has factored into its margins, he adds.

For FY14 ended Dec 31 2014, the company provided for a total of $262 million in bad debt, up 42% from the previous year. This amount represents 13.3% of its VIP revenue in the same year, up from 9.3% in FY13.

Warning of a “storm” ahead for the gaming industry, Lim said RWS will now be more stringent when extending credit terms to high rollers.

For one, business in Macau has already dropped by half although it was not clear this was caused by the visitor cap imposed by China or its crackdown on corruption.

Shareholders were also not entirely happy that the company again chose to pay only one cent per share in dividend, while maintaining an active share buy-back programme that saw a total of nearly 143.6 million shares cancelled in December last year.

Lim explains that the company wants to take a “more diversified” approach in enhancing shareholders’ value and to also conserve the resources to fund future projects.

“It is responsibility of the board to keep the company on a good position, to take advantage of any good opportunities,” says Lim.