This article first appeared in The Edge Financial Daily, on May 5, 2016.

SHAH ALAM: Telecommunication firms have to be nimble and flexible to grow their subscriber base, the lifeblood of telcos, in the face of fierce competition from rivals and demanding customers.

The priority of DiGi.Com Bhd (DiGi) — whose blended subscriber base has ballooned to 12.34 million, exceeding its rival Maxis Bhd that served 10.89 million users as at March 31, 2016 — now is to offer flexible products for customers to spend according to their needs.

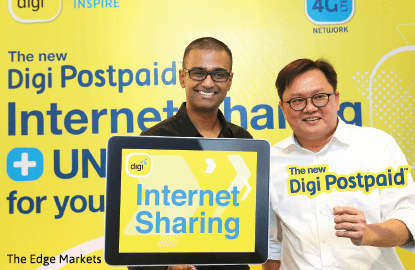

“Focusing on what customers need is our priority; we believe everything else comes after that,” head of postpaid and digital services Praveen Rajan told the media at the launch of DiGi’s postpaid Internet-sharing feature.

However, DiGi’s blended average revenue per user (Arpu) has fallen to RM42 for the first financial quarter ended March 31, 2016, 8.7% lower than RM46 in the previous corresponding quarter.

In comparison, Maxis’ blended Arpu for the same quarter was RM55, which was a slight increase of 3.77% from RM53 a year ago.

DiGi chief marketing officer Loh Keh Jiat said this was because DiGi had always wanted to provide a lower entry point for customers.

“At DiGi, we always want to be easy for customers to start, and once they are in, [the] Arpu will all depend on their usage pattern,” he said.

Loh is of the view that pricing DiGi’s products on the high side in the first place would eventually drive customers away.

“Customers are much smarter today. Month after month, if they [have] committed [to a certain amount], but do not use up their quota, they will leave,” he said.

Therefore, he said, DiGi introduced its Internet-sharing feature yesterday, which allows customers to customise the allocation of their Internet quota among a principle line and up to six of its supplementary lines.

Digi isn’t the first to offer Internet-sharing feature. Maxis introduced a similar feature last month.

As at market close yesterday, DiGi, which is 49% owned by Norwegian Telenor Group, saw its share price drop one sen to RM4.39, valuing it at RM34.21 billion. Meanwhile, Maxis’ share price gained one sen to RM5.55, giving it a market capitalisation of RM41.98 billion.