This article first appeared in The Edge Malaysia Weekly, on May 16 - 22, 2016.

SOME of today’s fastest-growing companies started out very small, with their shares listed on the ACE Market. As their businesses grew in size, the wealth of their shareholders grew along with them.

Take Inari Amertron Bhd, for example. After doubling its net profit in FY2013 and FY2014, the electronics manufacturing services provider “graduated” from the ACE Market to the Main Market in 2014. Investors who saw the company’s growth potential during the early stages would have made massive gains as the stock jumped a staggering 15-fold from 24 sen to RM3.64 from 2013 to 2015.

However, finding the next multibagger stock in the ACE Market is not without its challenges and risks. The vast majority of companies listed there are penny stocks, with share prices of less than RM1 per share and thin trading liquidity. Compared with their blue-chip counterparts, the share prices of low-priced illiquid shares are easier to move and thus are riskier and more volatile.

In addition, many penny stocks do not have particularly strong fundamentals — and that is putting it mildly. In fact, the ACE Market as a whole is loss-making and about half of the 109 companies are in the red. With only nine companies currently covered by analysts, the lack of research and analysis also makes it difficult for investors to make informed decisions.

Smaller caps have historically lagged large caps in performance and have become more volatile in the last two years. In 2013, the FTSE Bursa Malaysia ACE Index entered a bull market, catching up with the multiyear bull run in the FBM KLCI. The rally lasted 19 months, and then the ACE Market slid sharply in December 2014. It recovered shortly, only to suffer another crash in August 2015. Investor interest in the space has been muted lately with its year-to-date return underperforming larger caps.

The negative connotations associated with penny stocks notwithstanding, the segment is highly fragmented and inadequately covered by analysts, resulting in inefficient markets. This opens up opportunities for experienced investors to generate alpha, or excess returns on a risk-adjusted basis, through active stock selection.

Commenting on investment strategies for ACE Market stocks, Areca Capital Sdn Bhd CEO Danny Wong advises investors who intend to dig up hidden gems in this segment to do more homework, especially on the companies’ management teams and their future trends and developments, as most of them are not rated and have weak financials. He says investors should take a long-term view on their investments as ACE Market stocks could be subject to speculation.

“Furthermore, investors should not chase fast-rising stocks based on hearsay or rumours. If volume disappears, you will be stuck. And more importantly, diversify your investments by holding a portfolio of stocks. You will make a decent return if 50% to 60% of your stocks outperform. Over the long term, your winning stocks will eventually graduate and transfer to the Main Market,” says Wong.

Based on historical fundamental data compiled by The Edge, 10 stocks show growth potential or offer attractive yields (see table). During the process of narrowing down our list, companies that posted any losses in the past three years were eliminated to reduce the downside risk.

Stocks with high trailing price-earnings ratios of more than 40 times were filtered out. Additionally, China-based counters were also left out — at least until we see more sustainable improvement in investor confidence and sentiment towards red chips.

Save for YTL e-Solutions Bhd, which is more of a yield play, all companies on our list have demonstrated positive revenue and earnings growth, at least in the past three years. Each also possesses a strong balance sheet, with eight out of the 10 in a net cash position and the rest with net gearing ratios of less than 10%.

The list is ranked by earnings risk, namely the consistency of earnings growth in the past 10 years. For instance, the top three stocks — OpenSys (M) Bhd, Brite-Tech Bhd and Mikro MSC Bhd — have achieved double-digit compound annual growth rates in earnings since 2005 without posting any annual losses. They tend to pay steady dividends with little need for a cash call.

Moving down the list, the companies have a shorter track record of delivering earnings growth and could come with higher risks. The bottom two companies — Eduspec Holdings Bhd and Vivocom Intl Holdings Bhd — have negative free cash flows and may need to raise equity capital to fund future growth.

Earnings growth aside, corporate exercises could be another share price catalyst. The growing net profit enables companies to capitalise their earnings reserve and carry out a bonus issue to improve trading liquidity and public visibility.

As many of them have met or are about to meet the profit requirement, perhaps a more significant catalyst would be the transfer to the Main Market, which would raise investor confidence and render the companies more accessible to more institutional investors.

(1) OpenSys (M) Bhd

OpenSys, which provides cash and non-cash payment solutions such as bill payment kiosks and cheque processing services, is a beneficiary of the ongoing efficient self-service trend in the banking sector. In 2001, the company pioneered the design and development of non-cash efficient service machines (ESMs) that are installed at bank branches.

In recent years, it has partnered Japan’s Oki Electric to supply cash recycling machines (CRMs) that are more cost efficient — they provide both cash dispensing and cash deposit functions. Moving forward, OpenSys sees huge market expansion opportunities in the local ATM market as the penetration rate of CRMs currently stands at a mere 4%.

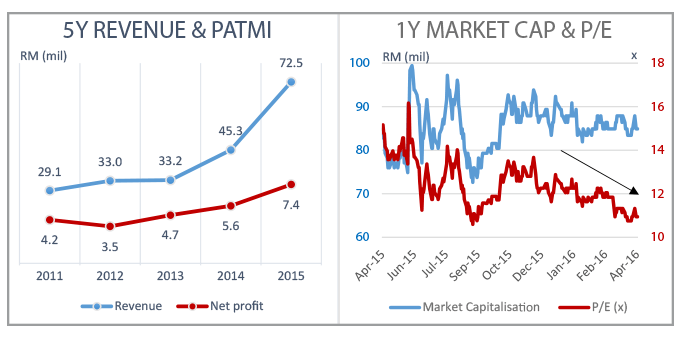

After securing orders worth RM20 million for CRMs in 2014, the company saw its revenue for FY2015 soar 61% year on year to RM72.5 million and net profit expand 32% to RM7.4 million, even though its margins were hit by higher import costs arising from the weaker ringgit last year.

Having completed its bonus issue, its share price has stabilised somewhat but is still struggling to break out of the 24 sen to 33 sen range. Thanks to its earnings growth, the stock currently trades at a trailing price-earnings ratio (PER) of 11 times, down from 15 times a year ago. It has consistently paid dividend of one sen in the past five years, giving a yield of 3%.

(2) Brite-Tech Bhd

Listed in 2002, Brite-Tech provides integrated water purification and wastewater treatment solutions to a wide range of industries in Malaysia. Thanks to the expanding manufacturing activities in Malaysia, the company’s revenue has registered a steady 10% compound annual growth rate in the past five years.

Despite a 13.7% increase in sales, net profit for FY2015 fell 2.3% year on year to RM4.7 million, sending its share price down 17% over the past year. However, excluding income derived from investments, which distorted its earnings figures, pre-tax profit rebounded 34.7% to RM6.0 million — in line with its top-line growth.

The company has raised its dividends every couple of years since 2005, from 0.2 sen per share to 0.63 sen last year. The stock currently trades at a trailing PER of 14 times and a historical yield of 4.8%, compared with industry leader Salcon Bhd’s PER of 77 times and 4.7% yield.

With relatively stable cash flows and low capital expenditure requirements, Brite-Tech has maintained a net cash balance sheet in the past 10 years. The company bought RM14.2 million worth of investment properties last year and is constructing a warehouse in Nilai Industrial Park in Negeri Sembilan. As at end-2015, it still has some RM8 million net cash, sufficient to sustain dividend payments for another five years.

(3) Mikro MSC Bhd

The consistent earnings growth of Mikro, an electrical distribution equipment maker, has certainly not gone unnoticed. Over the past year, the stock has risen 46% to 53 sen and is now trading at a slight premium valuation of 16 times its trailing 12 months earnings.

Established in 1997, the company specialises in the manufacturing of protective relays, which are used in the integrated electrical system of buildings. Thanks to its strong in-house R&D team, its products match those of major international brands in quality, at competitive pricing.

Mikro’s products have since gained market acceptance in the domestic and overseas markets, with its revenue almost doubling between FY2010 and FY2015. It maintained a net cash position during the five-year period while its return on equity improved 8.4 percentage points to 24.1% on continuous margin expansion and lower taxation (pioneer status).

As at FY2015, Mikro derived 63% of its sales locally, with the rest coming from Vietnam (15%), India (4%), Iran (3%) and other countries. In 2QFY2016, the company completed its RM11.7 million acquisition of a larger factory in Klang, Selangor, to consolidate its entire operations under one roof.

It has undertaken two bonus issues in the past 10 years and recently raised RM8.3 million via a private placement for the new factory. Dividends totalled one sen for FY2015, giving a yield of 1.9%.

(4) SCC Holdings Bhd

A distributor of non-antibiotic animal health products for local feed mills and farms, SCC expanded into the supply of food service equipment, ingredients and speciality products to the food and beverage industry shortly after it was listed in 2010. Although the two businesses do not appear to complement each other, its asset-light model has enabled it to consistently churn out cash over the years.

This allows SCC to pay generous dividends. The company increased its dividend payments from 5 sen per share in 2010 to 6.5 sen in 2011, and subsequently to 10 sen for 2012 to 2015. Sitting on net cash of RM14.3 million — or 16% of its market capitalisation — it should have little trouble sustaining its dividend payments in the next three years.

For FY2015, revenue jumped 42.9% year on year to RM60.4 million, thanks to the introduction of new lower-margin essential amino acid for animal feeds. Net profit, however, dipped 3.1% to RM6.4 million as its food service business suffered a margin contraction due to higher import costs.

In the past year, the low beta stock has been trading at historical yields of 4% to 6%. Following a recent rebound in its share price, SCC currently trades close to the midway point of its historical valuations with a 4.9% yield.

(5) YTL e-Solutions Bhd

YTLE is a 74.1%-owned unit of YTL Corp Bhd. Its crown jewel is its 60%-owned subsidiary Y-MAX Networks Sdn Bhd, which holds the licence for 30MHz of the 2.3GHz WiMAX spectrum in Peninsular Malaysia. This is, in turn, leased to YTL Communications Sdn Bhd — a 60%-owned subsidiary of YTL Power International Bhd — the operator of the Yes mobile and internet services. Under the spectrum-sharing agreement, YTLE will receive a minimum of RM75 million annually or 15% of the revenue from WiMAX services, whichever is higher.

As the company derives most of its profits from leasing its WiMAX licence to YTL Communications, its net profit has been relatively steady, ranging from RM31 million to RM36 million in the past five years. In 2014, YTLE doubled its dividend payments to four sen per share, distributing its huge cash pile back to shareholders.

Two years later, it still has RM163.4 million in cash, equivalent to 23% of its market capitalisation and enough to sustain its dividend payments until FY2018. At its current share price, YTLE offers an attractive 7.6% yield, making it the highest-dividend-paying stock among the network service providers.

That said, the heavy reliance on YTL Communications could be a risk. As the lack of a developed ecosystem has hindered the WiMAX market’s growth, YTL Communications has acquired 80MHz of the 4G spectrum and plans to add LTE services to its network in the near future.

(6) Oceancash Pacific Bhd

Over the past 10 years, Oceancash has evolved from a domestic firm into an export-oriented business, with diversified revenue from Malaysia (31%), Japan (31%), Indonesia (17%) and Thailand (16%).

Established some 20 years ago, Oceancash manufactures and supplies non-woven fabric to the disposable hygienic product industry as well as felt, an insulator, to the component makers in the automotive and air-conditioner sectors. The hygiene business contributes to about two-thirds of its revenue, with the rest coming from insulation.

The felt business has been stagnant since 2012 due to sluggish automotive sales in the region, although it has been partially helped by the strong growth in the air-conditioner industry. However, the hygiene division is still growing at a strong double-digit rate as its new non-woven products are gaining recognition in overseas markets, particularly in Japan and Thailand.

Anticipating rising demand for non-woven disposable hygiene products in China and Southeast Asia, Oceancash increased its capital expenditure from RM8.3 million to RM14.1 million in 2015. It has ordered a spooling machine to upgrade its production capability of premium grade non-woven products, which would bring in more sales in the second half of this year.

(7) ES Ceramics Technology Bhd

ES Ceramics manufactures and supplies ceramic hand formers to the rubber glove industry. The company is likely to benefit from the RM3 billion capacity expansion plan in the glove industry over the next five years to cater for the growing demand for gloves in the healthcare sector.

In FY2011, ES Ceramics undertook a kitchen-sinking exercise and reported a pre-tax loss of RM6 million. Excluding these one-off charges on investments, inventories and assets, it would have registered a pre-tax profit of RM1.1 million. As part of its restructuring efforts, it disposed of a factory in Thailand and liquidated the subsidiary in 3QFY2013.

Since then, ES Ceramics has achieved 12 consecutive quarters of year-on-year earnings improvement, with its net profit doubling in the last two years. Return on equity surged from 6% in FY2013 to 20% in FY2015, largely driven by a threefold jump in operating margin from 8% to 23%.

It has also pared down its high borrowings and turned net cash in 3QFY2014. The company — which is sitting on net cash of RM17.6 million, or 15% of its market capitalisation — has not paid any dividends since 2008. Having gained 95% in the past year, the stock now trades at a trailing PER of 17.6 times vis-à-vis the glove sector’s 18.5 times.

(8) Solution Engineering Holdings Bhd

Solution Engineering designs and develops teaching equipment under the trademark of SOLTEQ for engineering education at institutions of higher learning. The company is the exclusive distributor of QVF Engineering’s borosilicate glassware, and also distributes process control automation and data acquisition systems.

Although it has ventured overseas, the lion’s share of its revenue is still derived from the domestic market, particularly the public education sector. To be sure, revenue could be volatile in the short term. For instance, it slipped into the red in 2012 due to a reduction in development budget by the government.

Nevertheless, Solution Engineering commands the highest net margin of 18.8% and return on equity of 19.1%, as well as the lowest trailing PER of 15.1 times, compared with other education and training solutions providers. With minimal borrowings and net cash of RM15.7 million, it has paid one sen dividend consistently for the past three years, giving a 2.4% yield.

Last month, it proposed a bonus issue and a bonus warrant issue, on the basis of one bonus share and one bonus warrant for every two existing shares held. The bonus warrants, with an exercise price of 20 sen vis-à-vis an ex-bonus price of 27.3 sen, would be in-the-money when issued.

With a strong order book and potential contracts in the pipeline, Solution Engineering is optimistic that it will perform better this year.

(9) Eduspec Holdings Bhd

Eduspec Holdings specialises in providing e-learning products to primary and secondary schools. In 2010, the company exited its Guidance Note 3 (GN3) status after it was acquired by Eduspec Sdn Bhd — which has an established customer network — in a reverse merger transaction.

Recently, Eduspec Holdings signed various exclusive distribution deals to distribute cutting-edge learning products and is aggressively expanding its market reach in Southeast Asia. Notable deals include a US$21 million agreement with US-based iCarnegie to distribute its e-learning products for STEM (science, technology, engineering and maths) subjects.

Eduspec Holdings’ shares currently trade at a trailing PER of 27 times, down from 40.1 times a year ago. Despite the higher earnings, the stock has declined 22% over the past year, underperforming the FBM KLCI, which fell 3.8%.

This is probably due to its long gestation period and negative operating cash flow, which led to frequent cash calls and earnings dilution. It raised RM60.9 million from private placements and rights issues in the last two years and is now looking to raise RM23.7 million to RM35.4 million to fund its expansion.

On the positive side, Eduspec Holdings has relatively low gearing of just 9% and enjoys sticky client relationships due to the level of integration of its products with school systems. For investors with a longer investment horizon, the stock offers an opportunity to tap the huge growth potential of e-learning in schools in the region.

(10) Vivocom Intl Holdings Bhd

Last year was definitely a busy one for Instacom Group Bhd. The Sarawak-based telecommunications tower builder diversified its earnings base into aluminium manufacturing and construction through the acquisition of two companies for RM132.4 million. It later changed its name to Vivocom to reflect its new focus and aspiration to be a regional construction player.

Having completed the asset injection, a rights issue, a bonus warrant issue and a bonus issue, the company’s market capitalisation jumped sixfold to RM643.6 million last year. Subsequently, its market capitalisation continued to grow — by 45% to RM931.4 million — buoyed by positive news flow of job wins and various private placements to institutional investors.

Vivocom is viewed as a beneficiary of China’s “One Belt, One Road” development policy, thanks to its close ties with state-owned China Railway Construction Corp Ltd (CRCC). Analysts expect it to clinch major infrastructure projects from CRCC Malaysia Bhd later this year, which could see its outstanding order book swell to RM3 billion from RM1 billion currently.

The stock now trades at a high trailing PER of 34 times and it could take years to translate its huge order book into earnings. Based on analysts’ estimates compiled by Bloomberg, Vivocom currently trades at a forward FY2017 PER of 5.8 times vis-à-vis the 8 to 17 times of its peers.

The risks ahead would include the execution of projects and earnings dilution due to the expansion of its share base.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.