KUALA LUMPUR: Bursa Malaysia Bhd introduced several new enhancements yesterday to the ACE Market listing requirements (LR) as part of its efforts to incentivise and attract more eligible small and medium enterprises (SMEs) to consider initial public offerings (IPOs) on the alternative market.

The changes include allowing corporate finance advisers to act as independent advisers to facilitate transactions related to related-party transactions, major disposal and voluntary withdrawal of companies listed on the ACE Market.

Previously, only investment banks could act as independent advisers.

The enhanced regulatory framework also requires the ACE Market applicant’s investment bank or sponsor to meet a set of qualitative admission criteria for its listing, including performing all reasonable due diligence on the applicant’s corporate governance records and internal controls.

This follows a review of the ACE Market LR by the stock exchange regulator, following a market consultation conducted between Nov 18, 2014 and Jan 9, 2015.

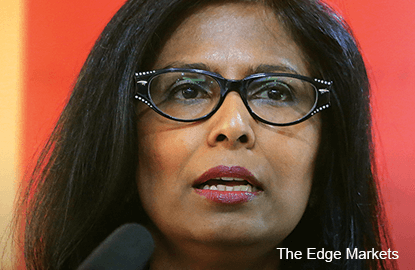

According to Bursa Malaysia chief regulatory officer Selvarany Rasiah, the enhanced ACE Market LR provides greater clarity of emerging companies that wish to raise capital on the alternative market.

These include clarifying companies which are unsuitable for listing, introduction of a new pre-IPO consultation service and the requirement to have an independent market research report in IPO applications.

“(The enhanced ACE Market LR now clarifies that) ACE Market applicants who are unsuitable for listing include those with a loss-making business, showing declining profits which may raise doubt on its potential, and those suffering from growth profitability without any growth in financial results,” Selvarany told a media briefing on the enhancements to the ACE Market LR yesterday.

Nevertheless, if the sponsor or investment bank is able to show acceptable justifications for the prospects of the business, the companies may be accepted for a listing, she said.

In addition, a new free pre-IPO consultation service will be provided to applicants to check on their suitability before embarking on an IPO.

“We are not making the requirements more stringent; we are merely providing greater clarity of the requirements to assist applicants in deciding whether or not they want to list,” Selvarany pointed out, adding that the review was the result of intensive consultation with the industry, and benchmarking with other markets to identify areas for improvement.

She said four companies have been approved for ACE Market listing this year, two of which have already been listed. This compared with three ACE Market listings on Bursa in 2014.

“Investors can expect another five applications for IPOs on the ACE Market this year,” said Selvarany, adding that at a price-earnings ratio of 16.5 to 20.8 times, valuations for the ACE Market are relatively competitive compared with other alternative markets of its peers.

Currently, there are 107 ACE Market-listed companies with RM10.77 billion market capitalisation.

Selvarany noted that the ACE Market has been recording steady growth since 2009. As at June 2015, its market capitalisation more than doubled since 2009. Between 2009 and 2014, trading volume and trading value have also increased sevenfold and sixfold, respectively.

“About 30% of the companies listed on the ACE Market to date have either transferred or are eligible for transfer to the Main Market, reflecting the overall positive performance of ACE Market-listed firms,” she said, noting that Main Market listing requirements are more stringent than the alternative market.

Five of 11 Malaysian companies on Forbes Asia’s “Best under a Billion” 2015 list are companies that had been transferred from the ACE Market to the Main Market — Inari Amertron Bhd, Elsoft Research Bhd, GD Express Carrier Bhd, My E G Services Bhd and Vitrox Corp Bhd.

Bursa director of securities market Ong Li Lee said year to date, the average daily trading value on the Main Market is marginally lower at RM1.99 billion compared with RM2 billion last year.

“We’re monitoring what’s happening in the market and we do hope to achieve RM2 billion in average daily value, but we have to take into account sluggish growth [in the world economy] which will affect our market as well,” she said.

This article first appeared in The Edge Financial Daily, on July 14, 2015.