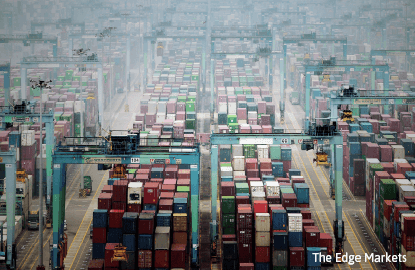

Logistics Sector

Maintain neutral: We maintain our neutral call for the logistics names under our coverage on a challenging operating environment with a high risk of accelerated rise in costs. Earnings prospects for most of the companies under our coverage should remain subdued amid our expectations of a weak domestic environment (decline in gross domestic product growth rate) and slowdown in global trade.

However, earnings for courier players should remain resilient. We prefer GD Express Carrier Bhd over Pos Malaysia Bhd. While a potential upside could be found in the sustainable recovery of the US economic growth, we maintain our conservative stance.

Westports Holdings Bhd saw its bottom line grow from the gateway tariff hike and a lower effective tax rate due to the investment tax allowance. Pos Malaysia’s courier business revenue was boosted by a hike in courier rates and increased volume.

Tasco Bhd’s core earnings grew on stronger export shipment volume from its electronics and aerospace customers. While first quarter 2017 (1QFY17) (June) revenue, for Freight Management went up, earnings were dragged down by e-commerce start-up losses and share of losses from its oil & gas joint venture.

GD Express Carrier delivered strong growth to its earnings in 1QFY17 (June), driven by year-on-year growth in its express delivery segment.

A sustainable weakness in the ringgit poses challenges for import-oriented logistics companies under our coverage. Tasco’s air cargo business is poised to face a decline following depreciations in the ringgit hurting demand for imported high-value goods.

We expect the impact of forex fluctuations on Freight Management to be fairly mitigated, as it has a captive and diversified customer base among export-oriented small- and medium-sized enterprise players.

Domestic consumer sentiment is at a 10-year historic low following the goods and services tax implementation. However, we expect earnings for courier players to remain resilient as local e-commerce activities continue to generate robust growth, albeit coming from a low base.

With more and more new entrants into the online retail space, players continue to aggressively discount their products, as they have lower operating costs as compared with traditional retailers.

We believe this would continue to drive volume growth for the courier companies under our coverage, which include GD Express and Pos Malaysia. We continue to favour the former over the latter on the composition of its customer base, which comprises of aggressively growing players such as Astro Go Shopping and Lazada.

While we continue to believe Westports would remain the port of choice in the region — due to cost advantages with shipping rates at historically low levels — we believe its superior fundamental qualities have been largely priced in at current price levels.

On the other hand, a potential rerating catalyst could arise from a persistent weakness in the ringgit, which leaves room for the port operator to raise tariffs and still remain attractive, costwise.

We maintain our neutral call for the sector due to the challenging operating environment with high risks of accelerated costs. Key risks for the sector include a sharp slowdown in the Malaysian and global economy, as well as in international trade. — RHB Research, Jan 4