SINGAPORE (June 24): The Brexit referendum has grabbed investors’ attention in the past week. And, we will be scrutinising the global financial markets intently to see how they will react to the aftermath. Amid this backdrop, we have identified some novel stocks with attractive micro-fundamentals that could be included in our portfolios in the weeks ahead.

This week, plastic component manufacturer Fischer Tech could be in the spotlight, following a story on the company in the latest issue of The Edge Singapore (Issue 734, June 27). We are exploring opportunities in the market to pick up the stock for our high-growth portfolio.

Fischer Tech makes infotainment panels and various other control panels that go into cars. Some changes in the automobile industry in recent years have been to Fischer Tech’s advantage. The company now has greater ability to improve its efficiency and boost its margins. And, as the industry continues to grow, there is room for Fischer Tech to expand.

Notably, Fischer Tech is benefiting from automakers’ increasing use of a common platform for several vehicles. Components and parts for a Ford Focus compact car, for instance, could also go into its Escape sport utility vehicle. According to Detroit-based consulting firm IHS Automotive, the top 10 platforms are expected to be used in the production of 27.8 million vehicles by 2020. That would be an increase from 19.2 million vehicles in 2014.

Automakers have turned to these common platforms in a bid to cut costs. They can spend less developing and designing new components for each platform. By leveraging economies of scale, the automakers can also ask their component suppliers for bulk discounts.

However, Fischer Tech views this as a win-win arrangement, as it can maximise its machine utilisation, and focus on its processes to make it robust so that it can achieve high yields and consistent quality. Also, because of the increased scale of orders, automakers are even more particular about the suppliers they engage.

For FY2016 ended March, the company posted a 73.3% y-o-y surge in earnings to $13 million on the back of an 11.7% increase in revenue to $187.9 million, mainly attributed to higher customers’ orders from the automotive sector.

Spindex delivers steady growth

Spindex Industries, a producer of precision machined components and assemblies, could be another stock that we are looking to include in our high-growth portfolio. The company was also profiled as an investing idea in a previous issue of The Edge Singapore (Issue 717, February 29).

Spindex produces precision turned parts such as shafts and sleeves for the imaging and printing industry, components in automotive sensor assemblies as well as mini fasteners, transmission shafts and bearing shafts used in irons or bicycles. Its production facilities are located in Singapore, Malaysia, China and Vietnam.

Spindex has a diversified customer base of MNCs such as Hewlett-Packard, Canon, Robert Bosch, Stanley Black & Decker, Texas Instruments and General Electric. This pool of customers has helped the company weather changes in market demand. Over the past five years, Spindex’s full-year earnings and revenue have been increasing consistently.

For 1HFY2016 ended December, Spindex posted a 26.7% y-o-y growth in earnings to $7.5 million on the back of a 13.7% increase in revenue to $61.2 million. The company’s largest business segment, machinery and automotive systems, saw a 19% increase in revenue contribution to $29.5 million.

Spindex attributed the increase in revenue contribution from the machinery and automotive systems sector to its marketing efforts, which led to higher orders from customers, as well as new projects for both its automotive and machinery components. Sales of machine tools grew 22%, while sales of automotive systems increased 18%.

ThaiBev posts beer breakthrough

We are also exploring to include beverage maker Thai Beverage (ThaiBev) in our blue-chip portfolio. A previous issue of The Edge Singapore (Issue 729, May 23) reported on the company’s beer breakthrough and beverage business turnaround.

ThaiBev has all the attributes of a blue-chip company. It has a stable of well-recognized beverage brands and a relatively large market value of around $23 billion. After years of struggling in the red, ThaiBev’s beer business has finally staged a solid turnaround. Meanwhile, its expensive acquisitions carried out between 2011 and 2013 to boost the non-alcoholic beverage business also appear to be paying off.

Things began to move quickly for ThaiBev after a major overhaul of its beer business last October. Under the restructuring, its Chang beer received a total image revamp as Chang Classic and all other variants of the brand, such as Chang Light and Chang Draft, were withdrawn. A new emerald-green, embossed bottle for the beer — exuding a more contemporary and premium image — was also introduced. Meanwhile, the alcohol content of Chang Classic was reduced, giving it a smoother finish and making it easier to drink. Lower alcohol content also resulted in lower costs and higher margins.

So far, there have been no significant countermeasures from Boon Rawd Brewery, maker of Leo and Singha, to win back its lost market share. That is positive news for ThaiBev, as it can now focus more on rolling Chang Classic out into the region to further expand volumes and revenues after losing out on several opportunities to do so in the past.

For 1QFY2016 ended March, ThaiBev reported a 20.7% y-o-y growth in revenue to THB55.2 billion, while its earnings were up about a third to THB8.6 billion. This was driven mainly by its beer business, which saw revenues jump 71.3% y-o-y to THB18 billion, backed by a 61% y-o-y rise in volumes sold and higher selling prices for its Chang beer. As a result, beer earnings surged 174.6% in 1QFY2016.

What’s next?

While our portfolios are holding purely cash now, we are monitoring the market keenly and will be selecting a number of stocks, apart from the ones highlighted this week, for inclusion in our portfolios in the weeks ahead.

These may include new stocks that were previously not included in our portfolios. At the same time, we are also re-evaluating some of the stocks that we have sold, and mulling the prospects of re-including them. And, as mentioned previously, we will be guided by The Edge Singapore’s coverage of the local corporate sector.

All portfolios outperformed

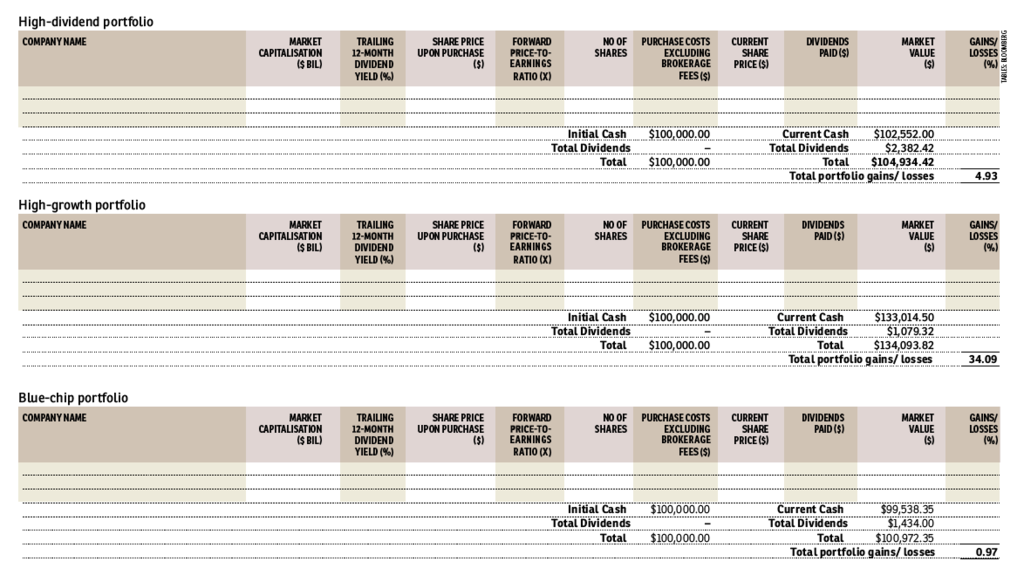

Our high-growth portfolio was started on November 13, 2015 with $100,000 and is now up 34.09%. The Straits Times Index (STI) has declined 6.50% since this portfolio was started.

Our high-dividend portfolio was started on July 24, 2015 with $100,000. It has since gained 4.93%. The STI has tumbled 18.41% since this portfolio was started.

Our blue-chip portfolio was started on July 10, 2015 with $100,000, and has since risen 0.97%. The STI has fallen 16.60% during the same period.