KUALA LUMPUR (Oct 29): The Employees Fund (EPF) said it was on track to achieve its targeted return at inflation plus 2% this year despite the general challenging global economy outlook.

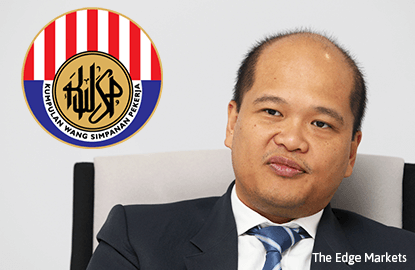

EPF chief executive officer Datuk Shahril Ridza Ridzuan said the fund had always surpassed its investment goal.

"We have always been able to deliver roughly about inflation plus 3% or 3.5%, and our target has been inflation plus 2%. Hopefully this year we should be on track to manage that.

"It will still depend very much on the performance for the third and fourth quarter this year. We have already announced our results for the first half of the year, which was pretty decent. But given where the markets have moved since the middle of the year, we are a bit cautious on making predictions," Shahril said at a press conference in conjunction with the EPF Global Private Equity Summit 2015 today.

The Statistics Department's latest data showed that Malaysia's inflation, as measured by the consumer price index (CPI), rose 2.6% in September this year from a year earlier. Cumulative nine-month CPI climbed 1.9% on year.

Today, Shahril said the EPF was mindful of the challenging investment landscape.

He said it had been a very difficult year for global markets, noting that the Malaysia's FBM KLCI had fallen substantially since the start of the year.

The EPF has diversified investments. Sharil said 50% of the EPF's investments were in fixed income while equities made up 40%.

Private equity and alternative investments account for 2% and 8% respectively.

The fund's alternative investments include domestic and foreign real estate and infrastructure assets.

At a glance, the EPF's investment mix, which includes a substantial portion in fixed-income assets, denotes a conservative fund-management strategy. Fixed-income assets include bonds, which offer regular and predictable interest payments to investors.

EPF chairman Tan Sri Samsudin Osman said the EPF would continue with its long-term investment strategy amid the uncertain economic outlook.

"We are very long-term and we are very conservative. We are not very adventurous in our investments. A big part of our investments is still in fixed income. Our whole policy has always been conservative and to do investment within our risk appetite," he said.