Imagine reaching your destination but not remembering the journey. When you are living mindfully, you are fully aware of what is going on around you and of everything that you do.

When you are living mindlessly, it means that you may be living your life based on other people’s values and making choices that do not support your well-being. Living mindlessly is a life on autopilot, in which you are not in control of your own actions. It is a state of living in which you are doing things just to keep busy.

Living mindfully means you are present and aware, and making decisions that improve your current lifestyle. You are in control of your actions. You are able to achieve financial goals and progress towards your vision for your life. At the same time, you are able to enjoy life as it happens.

There are many things in life we cannot control, but the one thing we do have control over is our thoughts. Self-awareness increases your ability to recognise thoughts that are either destructive or supportive. Living mindfully is addressing negative thoughts and curtailing them while allowing positive thoughts to control your actions. These mindful actions help you progress towards living your dream lifestyle.

Take control of your life by practising mindfulness and doing the following:

Be deliberate with your thinking. Even with clear values and a vision for your life, your environment can still impact your thoughts; give attention to thoughts that improve your situation.

Seek to understand, not react to, a situation. Many things will happen that are out of your control, but how you react is up to you. Your initial reaction may be based on an unhealthy mindset, so give yourself time to understand your feelings and thoughts.

Remain present in the moment by observing, listening and engaging. You do not need to have a reaction or response to every situation. Think about how the information or situation applies to your current life. Ask questions that can help you clarify how the information or situation impacts your future.

Give time to things that matter. Stop checking your social media networks, text messages and email whenever you are bored. Instead, use the time to complete a task that contributes to your happiness, such as reading a book, learning a new skill or calling a loved one.

Living mindfully means awareness that today is as good as any to create your path to early retirement, to change your relationship with your employer and to have new experiences. Living mindfully means you are aware of how money impacts your relationships, and the value of investing and insurance to secure and protect the life you are creating.

Building your freedom fund

When you are living mindfully, you are aware of the decisions you make daily that can help you achieve retirement sooner. You are saving more than you spend and controlling lifestyle inflation. You are purposeful in your saving to gain your freedom to pursue work that matters to you.

Imagine, for instance, that your cost of living is US$35,000 per year and that you have saved US$350,000. You have given yourself 10 years in which you won’t have to work. Imagine what you could do or the things you could pursue within that time frame.

Have you ever wished you could take a six-month break from work?

Start a freedom fund. Similar to an emergency fund, a freedom fund is focused on saving enough money to cover your living expenses. However, the purpose is quite different: instead of planning for an emergency, you are planning for a lifestyle change.

For example, let’s say your income is US$4,000 per month and you currently spend US$2,000 per month on living expenses. If you saved half your income for one month, you would buy yourself one month of freedom. If you continued to save half your monthly income for an entire year and kept your lifestyle at the same reduced level, you could save US$24,000, giving you an entire year of freedom.

Think about your living expenses and your current income. If you are living below your means, you are able to save much of your income to pay for living expenses in future months. Conversely, if you are living above or at your means, it gets much tougher to buy your freedom.

There are three things that you can do today to help you lower your living expenses and contribute towards your freedom fund: cut expenses, save money on all purchases and stop spending.

It is easier to reduce expenses than it is to earn more money. Again, reducing expenses has the dual effect of lowering your required monthly payments and lowering the amount you will need in the future for living expenses.

When you cut expenses, you are finding more money without exchanging more of your time for it. This is the best way of increasing your monthly cash flow. Look at your budget to identify areas where you can reduce expenses.

All the small purchases and expenses may fall through the cracks, which can derail your efforts. However, do not forget about the big items you have financed, such as your car, home or college education. You can find substantial savings by refinancing or finding the cash to pay off big-ticket items. To help you determine what expenses can be reduced or eliminated, answer the following:

Do you need cable or any of the other subscription services that you are paying for but not using?

Can you reduce the interest rates on your loans and credit cards, thus reducing your payments?

Are you able to negotiate with your landlord to pay less rent, or can you refinance your home mortgage?

Save where you can and decrease the amount you pay for things you need and want.

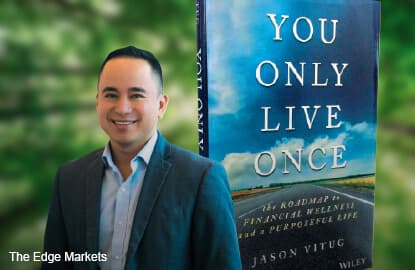

Reproduced with the permission of John Wiley & Sons

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.