This article first appeared in The Edge Financial Daily, on June 9, 2016.

KUALA LUMPUR: As the global economic outlook turns gloomier, economists opine that Bank Negara Malaysia (BNM) may have to opt for an interest rate cut to stimulate domestic growth.

“While policymakers and economists are hopeful for exports to rebound modestly in the second half of this year, this is not assured and if exports continue to languish in the second half, there is a downside risk to the country’s economic growth this year,” RHB Research’s chief economist Lim Chee Sing told The Edge Financial Daily.

Lim noted that weaker global growth will point to a weak export outlook for Malaysia, citing that the global trade declined 1.7% quarter-on-quarter (q-o-q) in volume and 2.9% q-o-q in value in the first quarter of 2016.

He stressed that weak exports would create a chain effect to the domestic economy, ranging from private investments, employment to wage payments and consumer spending.

“All these will culminate in dampening domestic demand and economic growth over time,” he said.

ForexTime (FXTM) said in a note yesterday that there could be a likelihood that central banks unleash further accommodative monetary policies in a bid to retain stability in view of the International Monetary Fund’s (IMF) and World Bank’s cut to global economic growth.

“Although stock markets displayed a miraculous rebound during trading on Tuesday after the abrupt appreciation in oil prices that elevated global sentiment, the lingering fears over the health of the global economy could force equities to relinquish previous gains as risk aversion intensifies,” FXTM added.

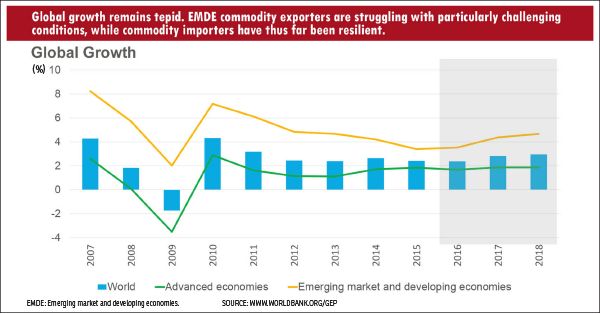

Yesterday, the World Bank cut this year’s global economic growth forecast to 2.4% from the 2.9% projected in January.

The move is due to “stubbornly low commodity prices” and faltering demand in advanced economies at a time when “the horrible combination” of mounting Brexit anxieties, ongoing China woes, and depressed commodity prices have exposed most major nations to downside risks, the World Bank said in a statement.

In April, the IMF cut its global economic growth outlook for this year to 3.2% from 3.4% previously. The Organisation for Economic Cooperation and Development (OECD) had lowered its growth forecast for the combined economy of the 34 OECD countries to 1.8% this year from an earlier projection of 2.2%.

Lim said the revision of all three institutions on the global economic growth for this year points to the fact that world economies are still struggling to sustain growth, which has been sub-par and below trends since the recession of 2008 to 2009, and despite significant policy ease.

BNM has kept overnight policy rate (OPR) at 3.25% — a move to adopt the accommodative monetary policy. The last revision on OPR was in July 2014 when it was raised by 25 basis points.

Lim commented that although Malaysia has grown to be less dependent on exports over time, exports still account for about 73% of the country’s gross domestic product in real terms.

Lim expects the government’s projection of economic growth is likely to register at the lower end of the 4% to 4.5% growth range, with the research firm expecting a 3.9% growth for 2016.

The mitigating factors in Malaysia’s economy, according to Lim, are the continued implementation of sizeable infrastructure-related projects under the Economic Transformation Programme such as the mass rapid transit lines, light rail transit Line 3, the Pan Borneo Highway, and the Pengerang Integrated Petroleum Complex in Johor.