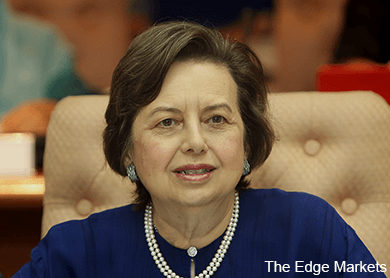

KUALA LUMPUR: Bank Negara Malaysia (BNM) governor Tan Sri Dr Zeti Akhtar Aziz, on announcing that the domestic economy saw a 5.6% growth in the first quarter of 2015 (1Q15) last Friday, said deposit funds placed in the local banking system are secure.

Dr Zeti said the country’s banking system was solid in terms of capitalisation, so there was no systemic risk to the banking system due to the activities of highly-leveraged entities, for instance, 1Malaysia Development Bhd (1MDB).

“These highly-leveraged entities may have debts outside the banking sector, but where the banking sector is concerned, it is incumbent upon us (BNM) to let our depositors know that their funds placed in our financial systems are secure,” she said at a press conference in conjunction with the release of the first quarter economic data.

Dr Zeti said companies with borrowings exceeding RM2 billion would be on the central bank’s watch list. “Malaysia has one of the most transparent reports that describe the assumptions used in stress tests conducted on banks. Based on these stress tests, which are done regularly and discussed during financial stability committee meetings, our banks are solid in terms of their capitalisation and soundness, and can absorb any eventuality that occurs,” said Dr Zeti.

On calls by Transparency International Malaysia for the central bank to investigate 1MDB’s transactions, Dr Zeti said BNM cannot comment on any individual institution. In practice, she said BNM will investigate irregular practices involving money transfers, but stressed that the central bank will not discuss the findings of its investigations unless they are finalised.

Meanwhile, she said the country’s 1Q15 growth was driven by private sector demand, but that 2Q15 and 3Q15 will see a moderation in consumer spending, due to the implementation of the goods and services tax (GST) in April this year. “Our gross domestic product (GDP) growth of 5.6% on-year was better than expected. Like other countries that have implemented GST, we expect a moderation, but only temporary as we believe there is a steady rise in income and wages. We [also] have a low level of unemployment at 3%. Therefore, we expect consumer spending to resume thereafter,” she said.

GDP growth in 1Q15 was lower compared with a real GDP growth of 5.7% in 4Q14 , mainly due to the sluggish performance in the exports of services and imports, which eased to 1% (4Q14: 2.6%) following a moderation in both imports of goods and services.

This article first appeared in The Edge Financial Daily, on May 18, 2015.