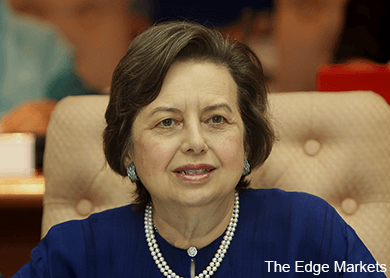

KUALA LUMPUR (Mar 11): Bank Negara Malaysia (BNM) Governor Tan Sri Dr Zeti Akhtar Aziz has dismissed concerns that 1Malaysia Development Bhd (1MDB), which has accumulated debts totalling RM42 billion, is a contributing factor to the weakening ringgit.

The ringgit slid to its weakest in six years, to touch a low of 3.7170 per US dollar today.

“From time to time, there is an entity that is highly leveraged and we will look at the potential implication of that highly leveraged entity on our banking system,” she told reporters after launching Bank Negara Malaysia’s Annual Report 2014 today.

The central bank conducts stress tests on a quarterly basis and the tests will indicate, for example, if the country is going into recession or if there is going to be a collapse in financial markets should there be a loan default by a highly leveraged entity, she explained.

Based on the results of the stress tests, BNM made its quarterly assessments on whether any vulnerabilities in the financial system had been detected, Zeti added.

“If there is any vulnerability to our financial system that might cause economic disruption, we will take action well before it happens,” she said.

The governor added that the main factors for the depreciation of the ringgit against the greenback since September last year were due to external developments such as monetary policy changes occurring in the international environment, besides the drop in crude oil prices.

On reports alleging that 1MDB had resorted to offshore financing activities to avoid BNM regulations, the governor declined to comment.

“We cannot comment on any single borrower or any single institution, [as]I am prohibited by law to talk about any single borrower or institution,” she said.