This article first appeared in The Edge Malaysia Weekly on July 23, 2018 - July 29, 2018

This week could be exciting, if indeed the infamous fugitive financier Low Taek Jho, better known as Jho Low, has been arrested in China. News (and any photographs) of his arrest would no doubt make the headlines around the globe, judging by the media attention given to the alleged kleptocracy surrounding 1Malaysia Development Bhd.

At the time of writing, there was no official confirmation from the Malaysian authorities of online news portal Sarawak Report’s claim that a Hong Kong radio station had reported Low’s arrest in China, ahead of Prime Minister Tun Dr Mahathir Mohamad’s visit next month. Many will no doubt be on the edge of their seats, until the report is officially confirmed or denied.

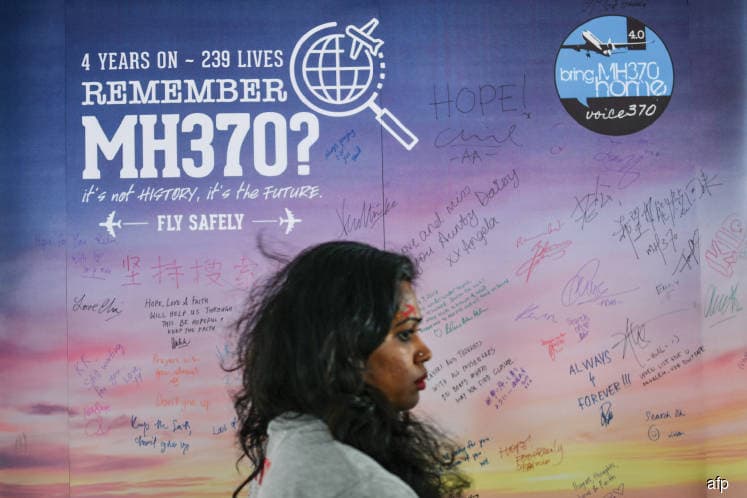

The spotlight will also be on the long-awaited report on the disappearance of Malaysia Airlines flight MH370. It is slated for release on July 30, Transport Minister Anthony Loke says. The privately-funded search for the aircraft was discontinued in May.

In what has been called one of the greatest aviation mysteries, flight MH370 vanished on March 8, 2014, with 239 people on board, during a routine flight from Kuala Lumpur to Beijing. Loke says the investigation team will brief the families of those on board before the report is released later in the day.

For investors, details of the ongoing lawsuit filed by Top Glove Corp Bhd against former business partners Wong Chin Toh, Low Chin Guan and ACPL Sdn Bhd, and the hearing against Adventa Capital Ltd, will continue on July 24 after adjourning last Thursday.

To recap, on July 6, Top Glove announced that it had commenced legal proceedings to claim at least RM714.86 million from Adventa Capital, managing director Low, Wong and ACPL for alleged “fraudulent misrepresentation” that resulted in Top Glove acquiring Adventa’s surgical glove producer unit, Aspion Sdn Bhd, for RM1.37 billion. The deal, which was completed in April, was touted to have made Top Glove the world’s largest surgical glove maker, with Low joining Top Glove’s board at the same time. Adventa has said that Top Glove’s allegations and lawsuit “have no merit and are denied”.

Meanwhile, companies holding annual general meetings (AGM) this week include Sapura Resources Bhd on July 24; Datasonic Group Bhd on July 25; and Talam Transform Bhd and Pantech Group Holdings Bhd on July 26.

Radiant Globaltech Bhd will debut on the ACE Market on July 24. The retail technology solutions provider aims to raise RM29.5 million from its initial public offering. The IPO entails a public issue of 128.1 million new shares, representing 24.4% of the group’s enlarged issued share capital, at 23 sen per share. The public portion of 11 million shares was oversubscribed by 6.73 times.

Bank Negara Malaysia is releasing its June monthly highlights and statistics this week. Many analysts expect to see an improvement in loan growth between June and August as the tax holiday spurred consumer spending and auto sales.

Malaysia Automotive Association has already announced that the total industry volume of new vehicles for June has jumped 50.1% to 64,502 units compared with 42,983 in May. This comes on the back of the zero-rating of the Goods and Services Tax and attractive Hari Raya Aidilfitri promotions by car manufacturers.

The benchmark index is worth paying attention to this week. After nine consecutive days of gains, the FBM KLCI slipped last Friday, closing 0.26% lower at 1,754.67 points. This comes as investors took profit on telecommunications stocks, particularly Telekom Malaysia Bhd and DiGi.Com Bhd.

In international news, Alphabet Inc, which owns Google, is releasing its earnings for the first quarter ended June 30, on July 23. Based on 14 analysts’ forecasts, the consensus earnings per share forecast for the quarter is US$9.51. For the same quarter last year, the reported EPS was US$5.01.

On July 26, Amazon.com Inc will announce its earnings for the first quarter ended June 30. The consensus EPS forecast for the quarter is US$2.49, while it was 40 US cents a year ago.

Attention will also be on crude oil prices as concerns about the escalating trade clash between US and China appear to have overshadowed assurances from Saudi Arabia that it will not flood the global crude market. Last Friday, Brent crude closed at US$72.89 per barrel, down 3.24% from a week earlier.

Eyes will also be on the ongoing US-China tariff war, specifically whether US President Donald Trump will indeed slap tariffs on US$500 billion of imports from China. The US currently has tariffs on US$34 billion worth of Chinese imports. China has retaliated by imposing taxes on the same value of US imports.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.