This article first appeared in Personal Wealth, The Edge Malaysia Weekly on November 12, 2018 - November 18, 2018

Asia’s asset management industry is in “hyper-growth mode”, with last year’s revenue pool of US$66 billion projected to reach US$112 billion in the next five years. The region is currently the fastest-growing asset management market in the world, says McKinsey.

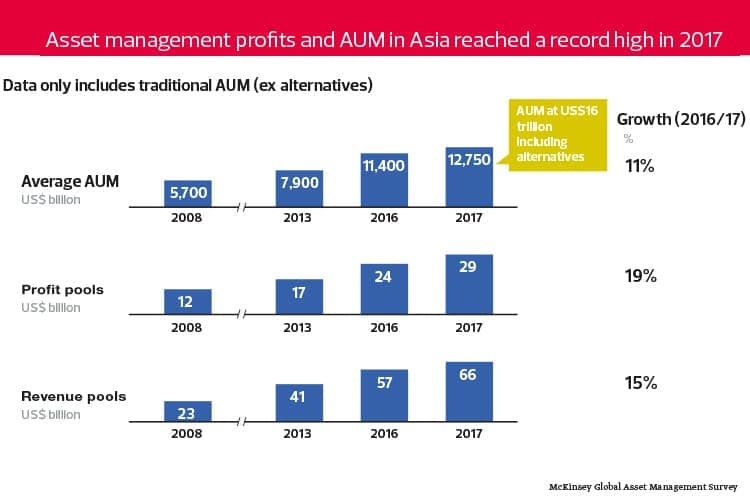

According to its report, “Will the good times keep rolling for Asia’s asset managers?”, the region captured nearly 45% of the global investment flows over the past five years while assets under management (AUM) increased 11% year on year to a record US$16 trillion last year. In the past decade alone, AUM increased by US$9 trillion. Asia now represents 18% of the global AUM of US$89 trillion.

A large part of the pickup will likely come from some of the under-managed assets shifting to third-party professional managers. Nearly 90% of the financial assets in Asia (US$110 trillion) currently fall outside the asset management industry.

According to Anu Sahai, McKinsey senior adviser and lead author of the report, there are several reasons for this. “Asset management is definitely under-penetrated in Asia, but it is not very severe relative to the US and European markets. That said, a lot of these untapped assets are not going to move into asset management anyway. A lot of them are sitting as bank deposits or are managed internally,” she says.

“However, banks are outsourcing more, as the complexity of investments increase in line with the growing desire for diversification. A lack of investment talent in the market is also part of the reason we are seeing more outsourcing.”

She cites a lack of financial education among the wider Asian population as being a key barrier to the region’s asset management industry. “If you look at many of these markets, funds have traditionally not been a top priority. These people would think mostly of fixed deposits,” she tells Personal Wealth.

“Then, there are those who may consider a fixed-income fund of some kind. But only much later on, and with a more sophisticated population, will you see equity funds emerge as an investment option.”

Another barrier is due to the fact that certain segments of the Asian population go directly into the stock markets. “You tend to see a lot of investors in China, India and many parts of Southeast Asia who invest directly in the stock market. It is important to remember that funds are a relatively recent evolution in Asia and that a lot of people have been investing well before. These people are unlikely to park a lot of their funds with asset managers,” she says.

Revenue pools in Asia expanded last year not only due to burgeoning AUMs but also from increased demand for higher-margin multi-asset products and alternative assets. From a product perspective, growth in 2017 was a story of alternatives and multi-assets. Although retail investors in emerging Asia and elsewhere in the continent bought into fixed income (26% of the portfolio mix last year), alternatives and multi-assets grew the fastest across Asia, driven mainly by wealthy customers in search of hedged and asset allocation strategies.

Multi-asset is very popular among institutional investors as well. Almost 70% of institutional mandates last year were multi-asset and alternative investments.

“I think this has been a very natural shift. Most of the institutional mandates are now focused on non-traditional equity and multi-asset strategies,” says Sahai.

“By non-traditional, I mean those mandates could entail a full equity strategy, a highly thematic strategy, or even an environmental, social and governance (ESG) strategy. We are no longer seeing much of the standard, benchmarked equity or fixed-income strategies among institutions.”

According to the report, profit margins have been exceptional, driven primarily by higher revenue. However, operating cost margins were up last year.

Although firms believe that the cost margins are contained, given the higher AUM growth, McKinsey is of the opinion that Asia’s asset management industry lacks efficiencies of scale. “This is the prime reason why absolute-cost pools rose by 13% in 2017,” says the report.

Active investing is a popular strategy in the region because alpha-generation opportunities are plentiful in the inefficient markets found in many parts of Asia. The distribution and commission structures also slow down the adoption of passive products. The report says that for the most part, Asian investors are comfortable with active products, accustomed to high returns and are less sensitive to active fees. Passive strategies, however, are gaining significant share in Europe and the US.

McKinsey predicts that the current revenue pool of US$66 billion will almost double to US$112 billion by 2022. Driving this five-year growth will be three major themes: The institutional retirement boom, the so-called “great wall” of Chinese capital and the “new wealth horizon” play.

Institutional retirement boom

Much of Asia is seeing rapidly ageing populations and with it, aggressive pension reforms. This will create a lot of opportunities for third-party asset managers, says McKinsey. “In the next three years alone, we expect at least US$1.2 trillion of new inflows to become available to Asia’s managers.”

The institutional business represents US$11 trillion of AUM in Asia and is expected to grow at double digits over the next five years. Retirement will drive a big part of that. “If we compare the ratio of AUM from retirement to GDP in Asia, it is only 29% compared with 84% in Europe and 96% in the US,” says the report.

The rising demand for pensions in Asia will force institutions to seek higher risk-adjusted returns to serve their growing liabilities. This could result in institutions outsourcing more of their investment management as they seek to diversify their investments and fill the gaps in their in-house capabilities.

According to the report, large pension funds such as Japan’s Government Pension Investment Fund and South Korea’s National Pension Service are becoming more expansive in their asset allocation, adding more global products along with alternatives. “For example, GPIF has increased its foreign asset allocation by 5% in the past two years,” says the report.

New wealth horizon

Today, China represents 37% of Asian AUM and accounts for more than 41% of revenue. AUM is expected to grow at more than 17% annually for the next five years.

Growth in China is being driven by an increase in wealth and demographics, and this is driving the demand for more retirement solutions. Also, regulators are pushing for the development of a “real” asset management industry.

“Institutions such as insurers and commercial banks are growing the fastest but lack active investment capabilities, especially in equity-related assets. They are outsourcing much more to professional managers. Digital financial services companies have also transformed the retail market, initially through online sales of money-market instruments and now, by adding a bouquet of active funds as well,” says the report.

“Regulators have also fast-tracked growth in asset management by clamping down on the shadow banking sector and its wealth products, reopening quotas for offshore products and opening doors for more foreign players to enter the market.”

China’s dominance in the region is well known by now, but Southeast Asia is fast becoming a serious player. Although its main markets — Indonesia, Malaysia and Thailand — are comparatively small, they collectively represent US$600 billion in AUM.

According to the report, these markets are expected to grow rapidly and asset managers are not paying enough attention to this opportunity. “Changing customer behaviour towards low-cost advisory models, and the transition of offshore to onshore wealth management with tax and regulatory changes, will underpin this opportunity. We expect AUM in these markets to nearly double over the next five years,” it says.

McKinsey’s report found that local and multinational firms have all made big bets on China, which underpins the industry’s strong growth. Many of the firms polled have built-in initiatives to find and develop talent. “They have all invested in new digital and analytical capabilities, primarily for retail marketing and to lower costs,” says the report.

Recipe for success

McKinsey identified five key attributes that may result in greater market share for asset managers in Asia. First, firms must have strong capabilities in terms of coming up with financial products. The industry also needs to build skills in multi-assets and alternatives via new hires, partnerships and acquisitions.

Crucially, the report found that firms in the region with distribution-only capabilities have registered lower than average growth, with some even losing market share. On the other hand, firms that have strong capabilities in coming up with new products registered a 24% growth in AUM over the last five years.

Second, asset management firms should have a presence in China. One CEO told McKinsey, “You do not need to be the first firm in a given Chinese market, but you can’t be the 10th. We like being the second or third.” The report found that at the very least, a strong distribution partner is necessary for success in China.

The third key attribute is to have a long-term outlook. McKinsey points out that the fastest-growing firms in the region have had their CEOs and management teams in place for a long time. Their strategies are stable and not subject to passing fads or the influence of managers who know they will rotate out soon and are intent on leaving their mark.

Successful Asian asset managers also have a strong talent management culture. According to the report, top firms have carefully nurtured a supportive culture and cultivated top talent, including local talent, with an emphasis on specialised skills and diversity.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.