This article first appeared in The Edge Financial Daily on July 21, 2017

KUALA LUMPUR: VS Industry Bhd is injecting HK$46.01 million (RM25.25 million) into its 43.49%-owned subsidiary listed in Hong Kong, which is undertaking a one-for-four rights issue to raise at least HK$102.8 million, mainly to repay borrowings and raise production capacity.

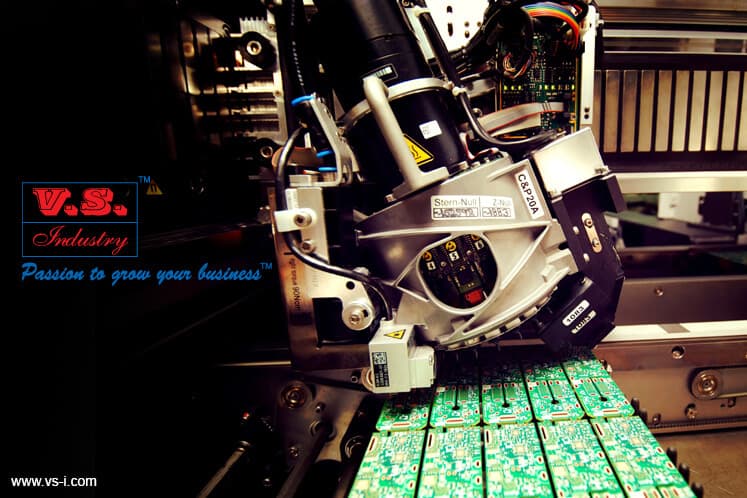

The fund injection is undertaken via a subscription for the portion of the rights issue it is entitled to in accordance with its shareholding in the unit, VS International Group Ltd (VSIG), a plastic and electronic products manufacturer.

The exercise will involve the issuance of at least 459.95 million rights shares — or at most 497.89 million, which could raise as much as HK$114.5 million.

“The subscription of the rights issue is funded entirely via borrowing from financial institution,” VS Industry said in a Bursa Malaysia filing yesterday.

The subscription will not have a material impact on its net assets, earnings or gearings of the VS Industry Group for the financial year ending July 31, 2017, it added.

VS Industry also inked an agreement with VSIG to underwrite all rights shares not subscribed by other shareholders.

“The proceeds raised from this proposed exercise [will] allow us to expand and enhance our manufacturing capabilities and capacities of our plants in Zhuhai, China. VSIG is currently in advanced talks to potentially secure multiple large contracts. This opens up yet another new chapter for our China operations,” said VS Industry managing director Datuk SY Gan in a statement.

“We believe we are on the cusp of rapid growth over the next few years. When our new contracts materialise and start contributing to our earnings, it will elevate VSIG to the next level of growth ... which will ultimately benefit VS [Industry] as well, being the largest shareholder and holding company of VSIG,” he added.

Gan, together with other key shareholders of VSIG, Datuk Beh Kim Ling and Datin Gan Chu Cheng, who collectively hold a 9.7% stake in VSIG, also gave their undertaking to subscribe for their respective allocations.

The rights issue, which will amount to 20% of VSIG’s enlarged share capital, is priced at 23 Hong Kong cents apiece, is at a discount of 18.73% to the average closing price of VSIG shares of 28.3 Hong Kong cents apiece for the past five and 10 days up to and including Wednesday.

Of the rights issue proceeds, about HK$35 million will go to repay borrowings, HK$44 million to improve production and storage capacity, and the remainder to be used for general working capital.

VS Industry halted its shares from trading for an hour from 9am yesterday.