This article first appeared in The Edge Financial Daily on July 24, 2017

VS Industry Bhd

(July 21, RM2.09)

Maintain outperform call with an unchanged target price (TP) of RM2.36: VS Industry Bhd’s (VSI) Hong Kong-listed subsidiary VS International Group Limited (VSIG) has announced a rights issue on a 1-for-4 basis to raise between HK$105.8 million (about RM57.54 million) and HK$114.5 million for expansion of China operations.

VSI’s 43.5% stake in the company will see it forking out about RM25.2 million to subscribe for its entitled portion based on the subscription price of HK$0.23 (about 12.6 sen) per rights share, which will be of no issue given its huge RM301.2 million cash pile as of April 30, 2017, though it has indicated that it will be financed entirely via borrowings.

VSIG is reportedly in discussions to secure multiple large contracts from new customers, hence,this exercise in preparation for that potential likelihood. We are positive about this development, with the group also having the opportunity to potentially increase its shareholding in the China-based operations which are set to record stronger growth numbers ahead.

Done on a 1-for-4 basis, VSI has undertaken to fully subscribe for its entitled portion (that is 43.5%). Other key shareholders of VSIG — namely Datuk Beh Kim Ling, Datin Gan Chu Cheng and Datuk Gan Sem Yam who collectively own 9.7% in VSIG — have also undertaken to subscribe for their respective portions.

To ensure the success of this exercise and in a strong show of confidence in the future prospects of VSIG, both VSI and the trio have also fully underwritten all the remaining shares in issue in the event other shareholders choose not to subscribe.

Should that actually happen, their collective holdings will increase from 53.2% to 61.2%. They have, however, been given exemptions from making a mandatory offer on shares they do not own in case of this eventuality. Funding will be of no issue.

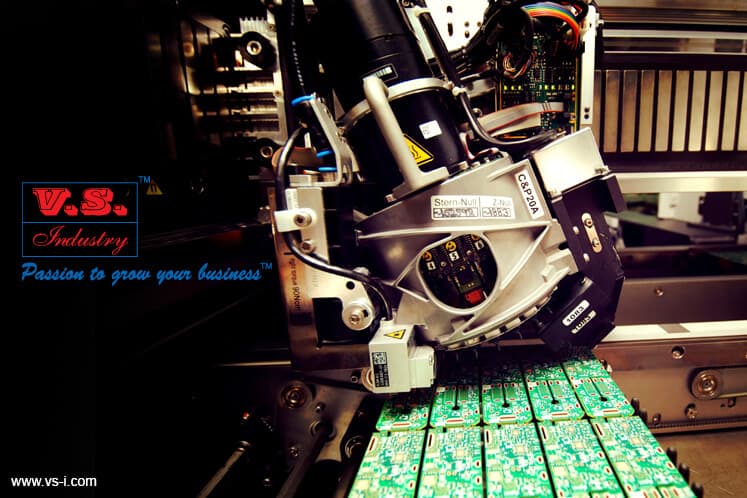

From the proceeds, HK$35 million will be used to repay short-term borrowings taken previously to fund construction of new warehouses and for working capital, HK$9 million for the purchase of a new dual-lane Surface Mount Technology (SMT) assembly line, HK$12 million to purchase new high-tonnage injection machines, HKD23 million to enhance automation and the rest for working capital.

On a separate note and at last check, management remains undecided on its 20% shareholding in NEP Holdings (M) Bhd, pursuant to the Ozner Water International Holding Ltd deal with the owner and major shareholder. What is uncertain is the manufacturing-related arrangements with NEP Holdings now that the ownership may change hands.

We reckon VSI should just exercise its option to tag along in the transaction and sell all of its shareholding in NEP at the same valuation, pocket a tidy RM56.4 million gain on its RM60 million investment and focus its attention on other growth prospects (that is the discussions they are in right now). — PublicInvest Research, July 21