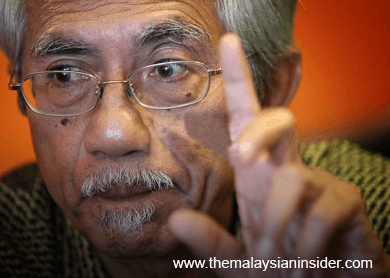

(July 1): Malaysia could be the most affected among Asian countries by Greece's potential exit from the euro zone, veteran journalist Datuk A. Kadir Jasin said today, noting a report by an investment magazine that Malaysia had the largest exposure to European bank claims.

Kadir was referring to a report by American magazine Barron's, and said Malaysia's situation did not boost confidence in the economy, even as defenders of Putrajaya's debt-ridden strategic investment firm 1Malaysia Development Bhd (1MDB) rejoiced over the arrest of an alleged informant.

"What is Greece to us? Literally nothing. But believe it or not, we are likely to be most badly-affected among the Asian countries by its bankruptcy.

"So while the arrest of the former PetroSaudi International (PSI) executive, Xavier Andre Justo by the Thai police might have caused elation among the Umno elite, it does nothing to shore up the confidence in our economy.

"Some say it’s a put on – a ruse to throw us off the 1MDB track," Kadir wrote in his blog today.

Justo was arrested in Thailand last week for alleged blackmail and extortion of the oil company over confidential information about its joint venture deal with 1MDB.

He is being investigated by Thai police for blackmail but Putrajaya has also accused him of tampering with emails taken from PetroSaudi and fabricating information to paint a negative picture of 1MDB.

Various Umno leaders have now said that Justo's arrest proves that allegations of misdeeds by 1MDB were false.

The article in Barrons said that although Greece was not a major trading partner for Asian markets, its exit from the euro zone could affect the region should European banks cut back their debt holdings in Asia to repair their balance sheets from Greece's exit.

Greece has already missed its deadline today to repay €1.5 billion (RM6.3 billion) to the International Monetary Fund and will hold a referendum on July 5 whether to accept more austerity measures for the country. Rejecting these measures will likely see it leave the euro zone.

The Barron's report quoting Nomura Securities noted that Malaysia would likely be the most affected by this.

This was because Malaysia had the largest exposure to European bank claims, apart from Asia's financial hubs of Hong Kong and Singapore.

As of the end of 2014, European banks had debt claims the size of 17.7% of Malaysia’s gross domestic product (GDP).

In comparison, Korea only had 8.7% of its GDP in the form of debt held by European banks, Barron's said.

The report also noted that money had already been leaving Malaysia this year even without the Greece poser. It said Malaysia, an oil exporting country, had a financing gap of 4.1% of its foreign exchange reserve.

Indonesia was also vulnerable to Greece's problems, the report said, with its financing gap at 3.9% of its GDP, while India was safer as its financing gap was only at 2.9%.

Yesterday, Prime Minister Datuk Seri Najib Razak said that Malaysia was closely monitoring developments in Greece and the euro zone for any impact on Malaysia.

Najib said Greece's potential exit might not have a "systemic effect" on Malaysia, but could still have an indirect impact.

"The key is to see if Greece will remain a part of the Eurozone. There is no systemic risk to the Malaysian economy. But it might affect global sentiments," Najib was reported saying after a meeting of the National Financial Council yesterday.

Najib is also finance minister and chairman of 1MDB's advisory board. – The Malaysian Insider