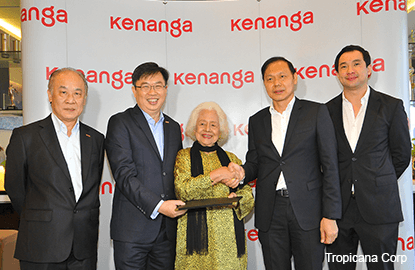

KUALA LUMPUR (Jan 28): Tropicana Corp Bhd, controlled by tycoon Tan Sri Danny Tan, is disposing of the Dijaya Plaza office building at Jalan Tun Razak here to Kenanga Investment Bank Bhd for RM140 million cash, which will be used for working capital and/or to repay borrowings.

In a statement today, Tropicana said the asset sale comprises a piece of freehold land measuring approximately 3,674 sq m, together with an en-bloc 19-storey office tower with two levels of basement car park containing 322 parking bays. The building is approximately four years old.

The building, with a total net lettable area of 156,488 sq ft, is currently 70% occupied.

Following the disposal of Dijaya Plaza, Tropicana said the cash inflow is expected to improve the group's financial position by freeing up net proceeds of RM51.6 million.

"Based on Tropicana group's unaudited results as at Sept 30, 2015, the group's total borrowings will reduce from RM1.75 billion to RM1.66 billion resulting in further improvements in the net gearing position of Tropicana group," it added.

In a filing with Bursa Malaysia today, Tropicana said the original cost of investment was RM110.62 million. The building's net book value stood at RM130 million as at Dec 31, 2014.

In a separate filing, K & N Kenanga Holdings Bhd said its wholly owned subsidiary Kenanga Investment Bank has entered into a conditional sale and purchase agreement (SPA) with Tropicana's wholly owned subsidiary Tropicana Plaza Sdn Bhd.

The acquisition will be financed through internal funds and/or bank borrowings.

Barring any unforeseen circumstances, the disposal is expected to be completed in the second quarter of 2016.

K & N Kenanga said the price was arrived at based on a willing buyer-willing seller basis after taking into consideration the indicative market value by an independent firm, Rahim & Co International Sdn Bhd.

The disposal of Dijaya Mall comes on the heels of its sale of Tropicana City Mall.

On Tuesday, Tropicana had signed a SPA with CapitaMalls Malaysia Trust to sell Tropicana City Mall for RM540 million cash.

Shares in Tropicana closed one sen or 1.03% lower at 96 sen today, for a market capitalisation of RM1.39 billion.

(Note: The Edge Research's fundamental score reflects a company's profitability and balance sheet strength, calculated based on historical numbers. The valuation score determines if a stock is attractively valued or not, also based on historical numbers. A score of 3 suggests strong fundamentals and attractive valuations.)