This article first appeared in The Edge Malaysia Weekly on May 29, 2017 - June 4, 2017

THESE days, Deky Yahya, a field staff at IJM Plantations Bhd, does not have to manually key in the statistics that he collects from the group’s estates in the Sugut region in Sabah. With the Samsung tablet that he uses to gather information on harvesters’ fresh fruit bunch (FFB) collection, Deky can quickly upload the data to the computers back at the estate’s office instead of having to perform the tedious task of data entry that he had had to do in the past.

Deky can also capture images of bunches, along with their precise locations, using his tablet since the device is GPS-enabled. This means that estate managers not only have the ability to easily track and trace harvesters’ real-time activities on the ground, they can also see for themselves the quality of the fruits and know exactly where problem areas are without having to be in the field.

Apart from the ease of transferring the field data into Excel sheets and the instant generation of reports on the quality of fruits, data such as staff attendance is also captured and processed for payment of wages and incentives. Other aspects of field inspection are also included.

The digitalisation of IJM Plantations kicked off at its Desa Talisai Estate in Sandakan last November. It plans to have its entire Sabah operation — covering 25,051ha of planted area — digitalised by the end of the financial year ending March 31, 2018 (FY2018).

The cost of the exercise — both for hardware and software — is expected to total RM500,000.

“The digital supervision enables us to harness the GPS signals with Android-based hand-held devices in tracking plantation activities with a web-based back-end system,” says IJM Plantations CEO Joseph Tek.

“Our motivation is to have a culture of continuous improvement within our organisation, appreciating the cost-benefits and managing the change in our people,” he adds.

The response from its workers has been encouraging.

“It is gratifying to observe the behaviour change and how digitalisation has created excitement and a sense of accomplishment, especially among the younger Gen Y staff,” says Tek.

According to him, IJM Plantations is still at the early stage of implementation, with digitalisation still being rolled out at its estates where there is no replanting as yet. It is envisaged that digitalisation will lead to more transparency, a proactive staff force and effective supervision, along with enhancement in quality assurance.

The group has also adopted geospatial technologies, drones and unmanned aerial vehicles for slope analysis, mapping of its estates, terrace measurement and assessing the growth of its oil palm trees, among others.

The capture of its workers’ harvesting activities is only the first phase of IJM Plantations’ digitalisation move. The company hopes to expand it to crop evacuation and manuring monitoring under the second phase.

“Pragmatic and site-specific mechanisation initiatives are being carried out to address the shortage of workers. This involves implementing various approaches to date for in-field crop evacuation. More thrusts on mechanisation will be pursued to cover other aspects of estate operations,” says Tek.

The mechanisation efforts refer to the use of scissor lifts, motorised wheelbarrows, hook lifts and bin systems, among others.

It is worth noting that the shortage of labour in the plantation sector has been the driving force for companies to focus on mechanisation.

IJM Plantations is a 56.1%-owned subsidiary of IJM Corp Bhd. It owns and manages 59,595ha of oil palm estates in Sabah as well as Sumatra and Kalimantan in Indonesia.

It is noteworthy that IJM Plantations has chosen a different route for its sustainability certification from some of its larger peers, which have opted for the Roundtable on Sustainable Palm Oil certification.

“We decided to adopt a staged certification process in our Malaysian operation with the Malaysian Sustainable Palm Oil certification, and then the International Sustainability and Carbon Certification (ISCC), whereby we receive premiums when selling ISCC palm oil … [We have] the Indonesian Sustainable Palm Oil mandatory certification at our Indonesian operation,” Tek explains.

He says the decision was based on the varying requirements of the different certification schemes, set against the priorities and resources of a mid-sized organisation that recognises the financial prudence in managing cost containment measures while meeting the assurance required.

“We have deemed that these are adequate to provide the required assurance on sustainable palm oil production while not compromising on our many ongoing sustainability-related initiatives covering both the social and environmental aspects of our business and our continuity to embrace the many principles and criteria for sustainable palm oil production,” says Tek.

Last Friday, IJM Plantations announced net profit of RM22 million for its fourth quarter ended March 31, 2017, compared with net loss of RM16.5 million the year before. Revenue rose 67.4% to RM192.63 million.

For the full financial year, it saw net profit of RM115.08 million — almost five times higher than that in FY2016 — while revenue rose 35.2% to RM753.711 million.

The improved financial performance was mainly due to higher commodity prices and net foreign exchange gains compared with losses the previous year.

Tek tells The Edge in an email that an increase in earnings will be seen in FY2019 when IJM Plantations’ FFB production hits one million tonnes. For FY2017, the group produced 862,000 tonnes of FFB.

The increase will come from its Indonesian estates when the oil palm trees reach prime age. At present, the average age of the group’s palm trees is 9.3 years while that of its Indonesian palm trees is close to six years.

But the weather, availability of workers, pests and diseases are factors that could affect production.

In fact, IJM Plantations expects to see the lingering effects of 2015’s “monster” El Niño up to the third quarter of this year.

“We could still be subject to the latter lag effect arising from the El Niño drought of 3Q2015 at our Indonesian operation, along with a similar tail-end effect at our Malaysian operation. However, this will have a lesser impact vis-à-vis the immediate lag effect from El Niño,” Tek explains.

“With more areas at our Indonesian operation reaching maturity, we hope that a full recovery in crop production will be realised by end-2017 and moving into FY2019. Our relatively young age profile will continue to put us in a favourable position in terms of the recovery of crop production and to capture long-term growth and enhance shareholder value,” he says.

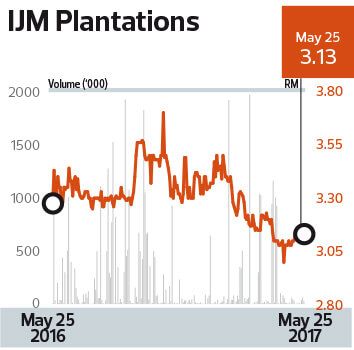

Last Thursday, IJM Plantations closed at RM3.13, giving it a market capitalisation of RM2.76 billion.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.