This article first appeared in The Edge Financial Daily on April 20, 2018

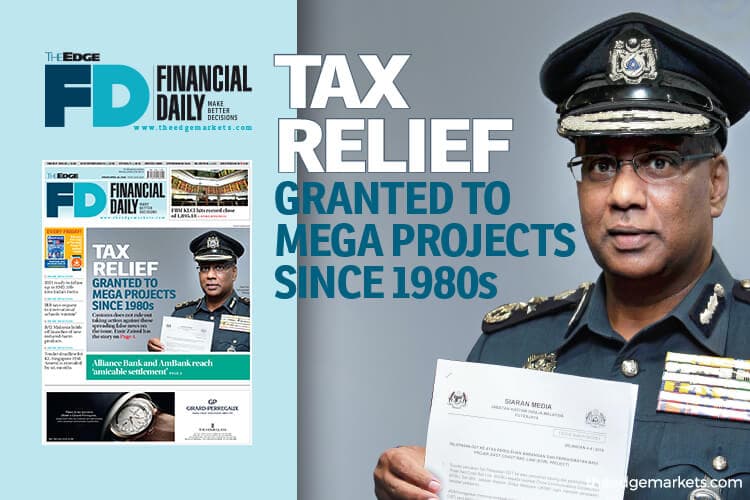

KUALA LUMPUR: Various tax reliefs have been commonly accorded to mega public infrastructure developments as a government incentive since the 1980s, the Royal Malaysian Customs Department asserted yesterday, following the brouhaha over the granting of goods and services tax (GST) relief for the procurement of materials and services related to the RM55 billion East Coast Rail Link (ECRL) project.

Some of the past projects granted tax relief to reduce the cost of construction, in the period when the sales and services tax (SST) was in effect, included the construction of independent power plants, the Stormwater Management And Road Tunnel, the Bukit Jalil National Stadium, the Kuala Lumpur International Airport, the Express Rail Link and the mass rapid transit.

Under the Incentives for Approved Service Projects, these projects not only benefited from a sales tax relief, import duties were waived as well, Customs director-general Datuk Seri Subromaniam Tholasy told a media conference.

“As a government institution, we support [the tax relief]. Otherwise, the cost of the project will increase and the government will be forced to take more loans, which will further increase the national debt. Is this what those people want?” Subromaniam said in reference to individuals who had criticised the tax relief for its perceived favouritism.

“This issue should not be twisted out of context because the government also gave tax reliefs like this during the era of the SST for several large projects in the 1980s, during Tun Dr Mahathir Mohamad’s time,” he said, adding the issue had been unnecessarily played up by opposition lawmakers.

Subromaniam said when the SST reliefs were given, the government would have lost out on revenue it was supposed to collect.

But he maintained GST relief for businesses in the supply chain will not cause the government any revenue loss as the end user in this case is the government as the owner of the project.

Although Customs makes recommendations, Subromaniam said the final decision for government-approved service projects rests with the ministry of finance (MoF) and is only granted to projects under transportation, telecommunications and utilities.

He asserted the GST relief granted to the ECRL project was aimed at benefiting the project owner and the MoF’s special purpose vehicle, Malaysia Rail Link Sdn Bhd (MRL), and not the overseas main contractor China Communications Construction Co Ltd.

As MRL benefits from the tax relief, the company would not be allowed GST refunds and it would also not be passing on any tax costs to consumers.

“By granting the tax relief to the ECRL project, the government has actually made the best decision to benefit the people. This is a strategic project that is expected to be a game changer, connecting the states in the East Coast and West Coast in Port Klang,” Subromaniam added.

He said the tax relief was granted after taking into account the soft loan (and lower interest rates) granted by the Chinese Exim Bank to finance the project, although he did not clarify the estimated amount clawed back by the government as a result of the tax relief.

Subromaniam also indicated Customs did not rule out using the recently gazetted Anti-Fake News Act to take action against people who he claimed had been spreading false news on the issue. “These are irresponsible people that have manipulated the facts to confuse the rakyat.”

Notwithstanding his explanations, many contend such GST exemptions could send the wrong signals to investors as they create the impression of unfair competitive advantage.

Institute for Democracy and Economic Affairs (Ideas) chief executive officer Ali Salman has said if a company or a sector is granted a tax exemption, then others would also seek a similar relief.

He pointed out tax holidays could be granted instead, which has been done before.

When asked for his opinion, Deloitte Malaysia GST leader Tan Eng Yew said GST can result in a significant cash flow cost to a business as there is a time difference between when the GST is paid and when the benefit of the offsetting credit is received as a refund.

For large infrastructure projects, Tan said there will be a substantial outlay in the development of the project including the cost of construction services, building materials and land purchases — all of which attract GST.

“If the time taken to recover the GST on these costs becomes lengthy, it would increase the cost of funding and financing these projects, which would increase the cost of the overall project.

“To alleviate these cash flow costs on such projects, the government may grant special GST relief on a ‘case by case’ basis based on the guidelines set out by the MoF,” he told The Edge Financial Daily in an email.

Another accountant differed, saying, “Technically, there is no real cash flow benefit because the companies involved should be able to claim input tax regardless of the tax relief.”

The GST exemption for the ECRL became public this week after Parti Amanah Negara vice-president Husam Musa disclosed documents including a certificate of GST relief for the procurement of goods and services for the ECRL project. The GST relief was effective Sept 26, 2016.

Husam wants Putrajaya to reveal the amount of GST collection foregone from the ECRL’s exemptions.