KKB Engineering Bhd

(Nov 21, RM1.59)

Upgrade to “trading buy” with unchanged target price (TP) of RM2.15: Harum Bidang Sdn Bhd, a subsidiary of KKB, has received a supply order worth RM10.1 million from CMS Infra Trading Sdn Bhd for the supply and delivery of mild steel polyurethane-lined pipes and specials for the construction and completion of the proposed water supply project in Miri. The contract will be for a period of four months effective November 2014 until March 2015.

We are positive on the contract as the group has at least replenished its steel pipe backlog after a dry spell for the past 12 months. The award is also within our expectations as KKB has a strategic alliance with Cahaya Mata Sarawak Bhd.

Should oil and gas fabrication projects in Sabah and Sarawak be delayed, we opine it should not be viewed as negative for KKB given that its organic earnings growth is driven by current steel-related operations. As such, we view the recent knee-jerk reaction resulting in its share price slump as being overdone. Thus, we reckon the current price does not reflect its fundamental value. Hence, we expect a recovery in share price in the near term.

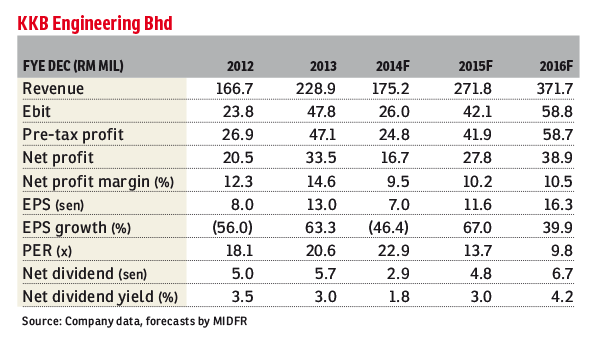

With this contract in the bag, and hopefully more to come in the next 12 months, our earnings numbers for KKB should be intact. We retain our earnings forecast at this juncture, as this contract is part of our contract replenishment assumption for KKB in our earnings projection.

KKB has a strong proxy to steel-related works in the robust Sarawak region development (Sarawak corridor of renewable energy).

We upgrade our call on KKB to “trading buy” from “neutral” with an unchanged TP of RM2.15. — MIDF Research, Nov 21

This article first appeared in The Edge Financial Daily, on November 24, 2014.