This article first appeared in The Edge Financial Daily on September 27, 2017

KUALA LUMPUR: The recent declines in local equities along with the global markets amid escalating tensions between North Korea and the US are seen by market analysts as a buying opportunity.

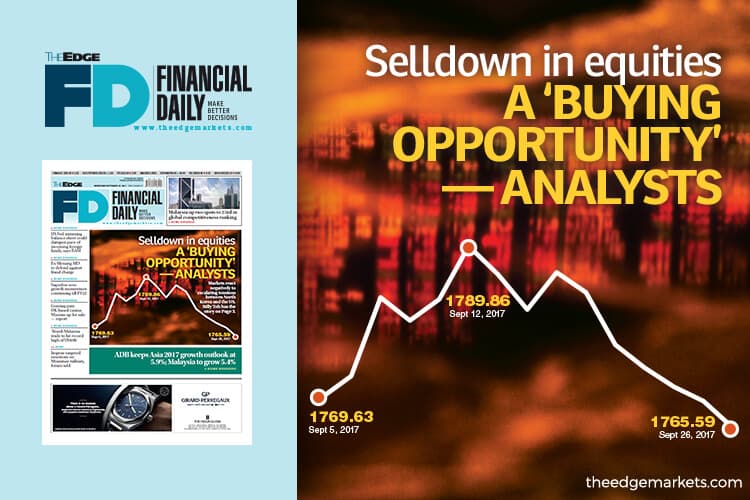

The FBM KLCI has been on a downtrend since mid-September and slipped 3.55 points yesterday to close at 1,765.59 points.

“I think it’s a knee-jerk reaction from the market following the heightened tension between the US and North Korea. I think the selldown is a buying opportunity for investors,” Rakuten Trade Sdn Bhd vice-president Vincent Lau told The Edge Financial Daily over the telephone.

North Korea Foreign Minister Ri Yong-ho said on Monday in New York that US President Donald Trump had declared war on North Korea and that Pyongyang reserves the right to take countermeasures.

“Since the US declared war on our country, we will have every right to make all self-defensive countermeasures, including the right to shoot down US strategic bombers at any time even when they are not yet inside the aerospace border of our country,” Ri said.

The comments made by Ri were in reference to Trump’s tweets on Saturday saying that he and North Korean leader Kim Jong-un “won’t be around much longer” if they acted on their threats. White House press secretary Sarah Sanders has responded to Ri’s comments by saying that the accusation that a declaration of war is made by the US is absurd.

According to Lau, despite the exchange of words between the two countries, there are about four to five other ways that the North Korean crisis could be resolved according to most reports and going to war is still not the base case scenario at the moment.

Lau also pointed out that despite the decline seen in the technology (tech) and semiconductor sectors, there is still room to grow. However, he agreed that there are those who have jumped on the bandwagon of the oil and gas (O&G) sector as they switched from tech and semiconductor companies, taking profit after a good run in their share prices this year.

“With the recovery seen in the oil price, the momentum in the O&G counters is good and should be sustained. While there are those who have taken profit and rotated from the semiconductor and tech players to O&G, I think the tech counters still have legs to go. This recent selldown seen in the tech counters in the US is more of a correction,” he added.

Besides the oil price rally that saw crude oil prices rise past US$59 (RM248.18) a barrel, Lau said that expectations of awards of maintenance, construction and modification (MCM) contracts by Petroliam Nasional Bhd (Petronas) to O&G support service providers also provided the catalyst for the run-up among O&G counters.

O&G counters including Hibiscus Petroleum Bhd, Sumatec Resources Bhd and UMW Oil & Gas Corp Bhd dominated Bursa Malaysia’s most active list yesterday.

Hibiscus gained 5.6% to 66.5 sen with 206.1 million shares traded, Sumatec was unchanged at six sen with 62.3 million shares traded, and UMW O&G fell 7.4% to 31.5 sen with 93.9 million shares traded. Hibiscus, UMW O&G and Sumatec were Bursa Malaysia’s second, fourth and ninth most active stocks respectively.

Affin Hwang Investment Bank analyst Tan Jianyuan said the momentum seen in the O&G counters was a result of strong news flow rather than fundamental improvements. “It’s more of the second liners or cheaper stocks that are seeing these gains even though fundamentally, they are still suffering.”

Crude oil prices rose past US$59 a barrel, its highest level in two years, before moderating to US$58.66 at the time of writing, supported by Turkey’s threat to cut crude flows from Iraq’s Kurdistan region to the outside world.

Affin Hwang Asset Management portfolio manager Khoo Hsien Liang said despite the heightened geopolitical tension, the company’s investment position remains unchanged and it would look to add if there are compelling discounts or when value emerges.

Khoo added that while the market reacted to the North Korean-US standoff, other factors were at play including Germany’s election results, property cooling measures in China and profit-taking in the tech sectors.

“Markets have responded negatively, mainly as a result of knee-jerk reactions. However, it’s difficult to fully attribute current market weakness to just North Korea as other factors were at play,” he added

The MSCI’s broadest index of Asia-Pacific shares outside Japan fell as much as 0.5% to a near three-week low and was last down 0.3% following losses on Wall Street. The KLCI fell by 0.2% or 3.55 points to 1,765.59 points, the lowest level since Aug 29 when it was hovering at 1,761.14. The FBM Top 100 Index, the FBM Mid-70 Index, the FBM Small Cap Index and the FBM ACE Index have all also fallen by 0.27%, 0.47%, 0.41% and 0.89% respectively.

Another analyst who declined to be named pointed to the recovery in the stock market towards the end of the day as a sign that the weakness seen yesterday could be temporary.

“We see a spontaneous reaction from the market to a scenario that is deemed as the worst- case scenario [if a war were to break out], but as the day went by and more information is digested, the market slowly rebounded from its intraday low of 1,761.21. I think if the US market were to show some signs of recovery overnight, we should see a rebound in the Malaysian equity market tomorrow (today),” he said.

Hussein Sayed, chief market strategist at FXTM, agreed, saying that every aggressive sell-off in the equity market and move to safe havens on geopolitical risks have proven to be short-lived. “The best-case scenario is for the US to add more pressure on China and Russia, to increase sanctions against Pyongyang and pressure Kim Jong-un to sit around a negotiation table. However, as an investor, you should keep all options on the table,” he said.