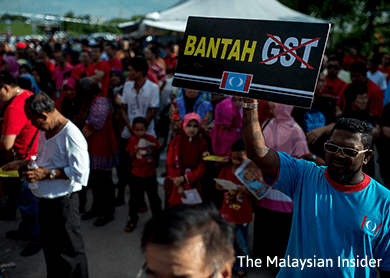

KUALA LUMPUR: As public anger over the newly introduced goods and services tax (GST) mounts, economists and tax experts have warned that a government backtrack would spell disaster for the economy.

In April, Malaysia implemented its biggest tax reform in decades with the introduction of GST, saying the multi-stage tax would allow for a much-needed increase in government revenue to offset a mounting national deficit.

Experts say the implementation of GST is long overdue — only two million out of a population of 28 million currently pay income tax — and the increased federal revenue will help to ease growing government debt.

“Essentially, the GST is spreading out the burden so it isn’t concentrated on a small group of taxpayers,” said RHB Research group chief economist Lim Chee Sing.

However, widespread confusion over how the tax works, its growing list of exemptions and price hikes of goods and services to up to 30% in some cases have beleaguered its implementation.

But economists and tax experts said scrapping the tax would result in further erosion of investor confidence and spell greater long-term problems for the economy.

Lim said studies into GST began more than two decades ago in Malaysia and the decision to implement it had been postponed many times.

Tax academic Jeyapalan Kasipillai said that while the government has the prerogative to revert on its decision to implement the GST, such a move would be “reckless and irresponsible”.

“The government has spent billions of dollars, and recruited some 3,000 people for the Customs Department. Businesses have spent a lot of money training their staff and buying software,” said Jeyapalan, who is a member of the Finance Ministry’s GST monitoring group.

“Every country goes through the teething stages of six months to a year. After a year, everything settles down, there’s acceptance, and the monitoring will have greater impact.”

However, public perception towards the GST has remained overwhelmingly negative.

“Our problem has never been a matter of revenue,” said Tony Pua, DAP’s publicity chief.

Pua said increasing tax collection to address Malaysia’s debt problem was like “prescribing treatment for symptoms of a disease instead of diagnosing the cause of our ailment”.

“The underlying reason for Malaysia’s persistent deficit is our institutionalised government spending behaviour,” he added. — The Malaysian Insider

This article first appeared in The Edge Financial Daily, on May 18, 2015.