This article first appeared in The Edge Malaysia Weekly on November 6, 2017 - November 12, 2017

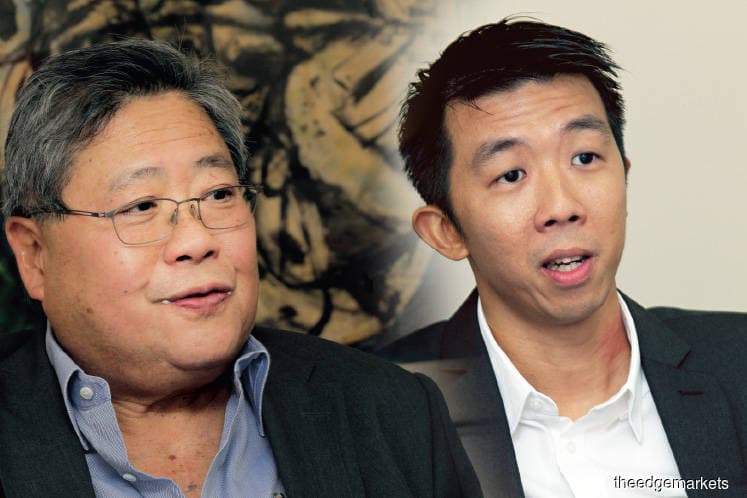

POWER transmission and telecommunications tower fabricator Rohas Tecnic Bhd aims to almost double its job replenishment next year from about RM400 million this year, says its chief executive Leong Wai Yuan.

The jobs that the group is confident of securing next year, apart from those clinched by its newly acquired 75% subsidiary HG Power Transmission Sdn Bhd (HGPT), will be worth RM500 million at least, he adds.

“We aspire for RM800 million of job replenishment next year. You have Rohas-Euco (a Rohas Tecnic subsidiary), which could get at least RM500 million, and you have HGPT, which would add another RM300 million to the order book,” Leong tells The Edge in an exclusive interview.

The bulk of HGPT’s contracts will come from Bangladesh, where the company has gained a foothold and is among the top three engineering, procurement, construction and commissioning (EPCC) companies in the country’s power transmission sector.

HGPT is also a strong EPCC player in Indonesia and Papua New Guinea.

The company’s capability will complement that of Rohas-Euco, which mainly fabricates power transmission towers, parts and fixtures at its plant in Bentong, Pahang.

To recap, on Oct 16, Rohas Tecnic’s shareholders approved the acquisition of a 75% stake in HGPT for RM91.66 million, which was satisfied via the issuance of 72.8 million new shares in the group at 95 sen each and RM22.5 million cash.

Following the acquisition, one of HGPT’s vendors — PT Safe Tower Systems Sdn Bhd — is now a substantial shareholder of Rohas Tecnic with a 15.4% stake. Tan Sri Wan Azmi Wan Hamzah and his wife together own 51.72% of the group.

Rohas Tecnic was known as Tecnic Group Bhd before Wan Azmi emerged as its largest shareholder by injecting Rohas-Euco Industries Bhd into it in January in exchange for 317.5 million new shares in the group at 63 sen apiece.

In its financial year 2016, Rohas-Euco posted a net profit of RM25.4 million on revenue of RM189.12 million. This will be the first year Rohas-Euco’s earnings will be reflected in Rohas Tecnic’s financial statements.

Following the acquisition of HGPT, Rohas Tecnic has set its sights on expanding in the region as the domestic power transmission EPCC market is saturated with many established players, such as the subsidiaries of public-listed Sarawak Cable Bhd, Malaysian Resources Corp Bhd and Pestech International Bhd. Delisted Ingress Corp Bhd is also a major player in this segment.

What is interesting is that the acquisition of HGPT will pit the group against its customers in the domestic market. Note that Rohas-Euco supplies power transmission structures, parts and fixtures to the EPCC contractors.

But to Rohas Tecnic managing director George Sia, the acquisition is a natural progression for the group as it seeks to extend its reach to the wider regional market. HGPT is thus a perfect fit as it has secured EPCC contracts in Bangladesh, Indonesia, Papua New Guinea and Sri Lanka.

“As HGPT gets about 60% of its contracts from the international market, it is sort of a platform for us to go international. There is not much upside for power transmission EPCC in Malaysia, except in Sabah and Sarawak,” Sia explains.

“It is more of where we can take ourselves in the future. HGPT has worked in countries like Indonesia and Bangladesh, which, we think, have huge potential.”

According to HGPT’s website, the company has completed and commissioned power transmission lines of at least 374km in Bangladesh, 213.5km in Indonesia and 991km in Papua New Guinea.

As for Rohas-Euco, it has supplied power transmission towers to Myanmar and has a RM306 million EPCC contract in Laos. However, its largest market for power transmission towers is still Malaysia, where it commands a significant 75% of the market.

Regardless of HGPT’s potential or having Rohas-Euco in its stable, Rohas Tecnic fared badly in the first half of FY2017 ending Dec 31. It made an operating profit of RM14.97 million on revenue of RM106.86 million but posted a net loss of RM15 million due to one-off expenses.

In its second quarter ended June 30 (2QFY2017), the group had to charge a one-off reverse acquisition listing expense of RM4 million and share-based payment expense of RM21.4 million to its financial statements.

If not for these expenses, the group would have achieved a profit after tax of RM10.3 million for the period, notes Rohas Tecnic in its 2QFY2017 result statement.

Meanwhile, Leong and Sia are confident that HGPT will account for about a third of the group’s bottom line from next year. In fact, the company will start contributing to the group’s earnings from this month.

The acquisition of HGPT will see Rohas Tecnic venturing into the same segment as Pestech, arguably the country’s foremost power transmission EPCC company. However, Pestech does not fabricate transmission towers, parts and fixtures — Rohas-Euco’s main business.

“With Rohas-Euco and HGPT in the Rohas Tecnic group, we can now compete better in the region as we now have the complete supply chain of the power transmission EPCC industry,” says Leong.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.