This article first appeared in The Edge Financial Daily on June 28, 2017

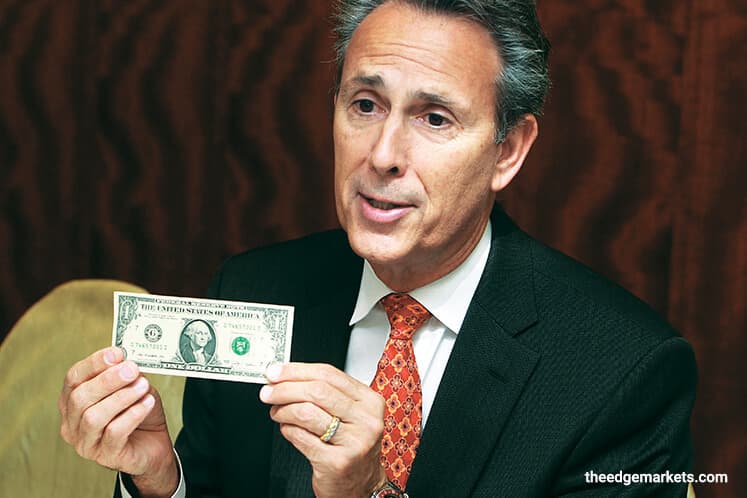

KUALA LUMPUR: Digital payments’ rapid growth in support of the rising digital economy notwithstanding, US Federal Reserve (Fed) systems’ director for banknotes Michael Lambert (pic) does not believe the alternative payment method will mark the end of using cash, not yet at least.

“Cash is an alternative to digital payments, and the Fed supports both payment methods. For at least a decade, I have been hearing the end of cash. I don’t share that view, and this is evident both quantitatively and qualitatively,” Lambert told The Edge Financial Daily in a recent visit here.

“On average, the yearly volume of the dollar banknotes has been growing by 5% in the last five years,” Lambert said. To date, Lambert said the US Treasury Department has printed some 40 billion pieces of dollar notes worth a total of US$1.5 trillion (RM6.44 trillion), the bulk of which in US$1 and US$100 denominations.

The amount of cash in circulation has risen rapidly in recent decades, with much of the increase caused by overseas demand. “About half or two-thirds” of the dollar notes, mostly the US$100 notes, are being circulated outside the US, said Lambert. Inversely, the demand for banknotes in Scandinavian countries such as Sweden and Norway has “pared down, [though it is] still positive”.

Lambert said the growing demand for US banknotes should not be construed as undermining a concerted effort to encourage digital payments. He also acknowledges that many economists have called on central banks to phase out the use of cash, but to him, the proverbial “cash is king” adage still resonates today.

“If you take a long view, and the long stability of the US government, people [would] hold on to the US dollar as they consider it a safe haven,” he cited as an example.

“Definitely, many economists have been wanting to do away with cash. But as far as I know, many central banks don’t share that view. Rogoff’s book is dedicated to negative interest rate. For that to happen, they want cash to be gone,” he said, adding that the end of cash is “just a myth”.

Lambert is referring to economist Kenneth Rogoff’s book The Curse of Cash, where Rogoff has similarly called on the Fed to phase out the use of paper money, particularly the US$100 bill, arguing that it facilitates tax evasion and money-laundering crime, which could thwart aggressive monetary policy.

“In some countries, cash is seen as an instrument to hedge against hyperinflation. Phasing it out could create some unnecessary consequences in that [it] could result in economic and political instability,” said Lambert.

On the idea of establishing a single unified global currency, Lambert said it may not be feasible in practice.

“[The] euro is a success story in which the member countries migrated into a single bloc with its own currency. However, [speaking from] my role as overseeing the whole operation of issuing banknotes, it (doing so) may pose an extremely high risk as counterfeiters will only need to concentrate on imitating a single currency. Imagine the catastrophic consequences it could bring to the financial markets.”

The idea of a single unified currency is not new. In 2015, the People’s Bank of China governor Zhou Xiaochuan wrote an essay calling for such a currency as the global economic crisis shows the “inherent vulnerabilities and systemic risks in the existing international monetary system”.

Zhou recommended creating the currency from a basket of global currencies, and to be controlled by the International Monetary Fund, saying this would help “to achieve the objective of safeguarding global economic and financial stability”.

Meanwhile, Lambert said the misperception that the Fed’s quantitative easing (QE) programme is equivalent to printing trillions of US dollars to inject liquidity into the financial markets must be corrected.

“I oversee the entire circulation of banknotes and I can tell you, the QE is not exactly about printing money to provide liquidity to the market. Injecting liquidity can be done in many forms, and I have not seen our banknotes printing order rising just because of the QE.”

On whether India’s move to demonetise its large notes could set an example for other countries, including the US, to follow, Lambert said “no”. “I can’t speak on behalf of any government wanting to demonetise its currency. However, the Fed has no plans to do so.”

Last year, India shocked the world when it demonetised the 1,000 rupee and 500 rupee notes to battle corruption, counterfeit and the black money market. The move affected some 86% of cash circulating in the world’s largest democracy.