This article first appeared in The Edge Malaysia Weekly on July 23, 2018 - July 29, 2018

THE local airport industry will be liable to a fine for subpar services from September onwards.

The penalty, which may amount to as much as 5% of an airport’s aeronautical revenue, is the revenue-at-risk element in the Malaysian Aviation Commission’s (Mavcom) Quality of Service (QoS) framework, designed to keep airport operators on their toes.

The Kuala Lumpur International Airport (KLIA) and klia2 are the first to be monitored under the framework, which was rolled out in May. During a shadowing period, the commission will determine the service level targets.

“It is important that we set appropriate targets ... a high enough benchmark for minimum standards expected by consumers,” says Mavcom chief operating officer Azmir Zain.

“But we also don’t want to be overly draconian or punitive by setting too high a standard because that would defeat the purpose.”

KLIA is the flagship airport of Malaysia Airports Holdings Bhd (MAHB), which operates 38 other airports in the country.

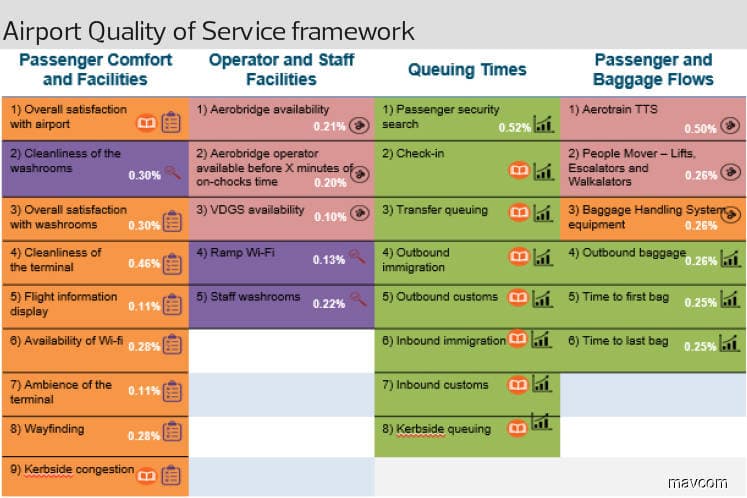

Under the framework, a maximum penalty of 5% of an airport’s aeronautical revenue is calculated based on performance across 20 service level indicators, with each given a certain weightage of the revenue.

There are eight other service level indicators that do not carry a revenue-at-risk element, but will be assessed for publication purposes to give a clearer picture of an airport’s performance levels.

So far, three service level indicators have been rolled out with a combined revenue-at-risk weightage of 0.65%. Another five will be included by October.

While the financial hit from failures to meet individual service level targets may not seem big at a glance, the fines could mount when all the indicators are included by July next year and when the QoS framework is expanded to MAHB’s other airports. For example, failing to keep washrooms adequately clean may cost the operator 0.3% of its aeronautical revenue from KLIA and klia2, which amounts to about RM3.3 million, based on the terminals’ annual aeronautical revenue of about RM1.1 billion.

Last year, MAHB reported a net profit of RM237.1 million on revenue of RM4.65 billion. Close to half of its turnover is from the aeronautical segment.

It is worth noting that the operator taps a handful of profitable airports to cross-subsidise loss-making ones, which include 18 short take-off and landing airports that facilitate rural air connectivity.

“Next year, we will introduce a version of this framework at some of the other airports. We will prioritise the higher-volume international airports such as the Kota Kinabalu and Penang airports,” says Azmir.

The framework will be adjusted to suit each airport while the core ideas and principles will be maintained, he adds.

Ultimately, Mavcom hopes the rollout of the QoS framework will benefit not only consumers but also the civil aviation sector in general.

Azmir says based on Mavcom’s engagement with international stakeholders, the success of the framework could attract more carriers to fly into Malaysia.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.