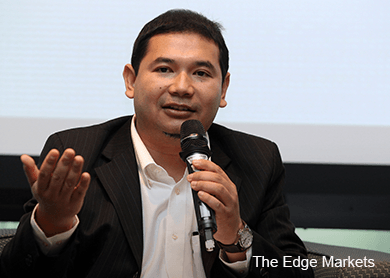

KUALA LUMPUR (Apr 7): PKR's Pandan MP Rafizi Ramli today questioned the removal of Bank Negara Malaysia's (BNM) representation from the Investment Panel of Kumpulan Wang Persaraan (Diperbadankan) (KWAP), under an amendment to the Retirement Fund Act 2007.

Rafizi alleged the removal of the central bank's sole representative from the Investment Panel was to purposely remove the checks and balances by BNM in the pension fund.

Deputy Finance Minister Datuk Ahmad Maslan yesterday tabled the Retirement Fund (Amendment) Act 2015 for first reading at Parliament. The bill sees amendments to Section 7(2) of the Retirement Fund Act which provides for the membership of the Investment Panel set up under the Act.

One of the amendments sees the removal of BNM's representative from the Investment Panel and giving power to the Ministry of Finance (MoF) to appoint a person to replace the central bank's representative, which brings the number from three to four.

However, Rafizi pointed out that the explanatory note in the bill stated that the removal of the BNM representative was not from the Investment Panel, but from the Board.

"The minister will need to explain this," Rafizi told a press conference at Parliament lobby today.

Rafizi noted that the bill could be tabled for second reading by tomorrow.

He urged the government to retract the whole bill on the principle that any amendment was meant to improve governance and not to cover up.

Rafizi also pointed out that the bill has expanded the scope of KWAP's investment activities, to enable the fund to invest in the development of buildings, infrastructure and natural resources, and the interest within.

He noted that it also allows KWAP to invest in many risky financial instruments such as purchasing securities or subscribing to any product for the purpose of hedging the investment of the fund.

Thus, Rafizi opined that the removal of the BNM representative is so that KWAP's risky investments would not be scrutinised.

"The most dangerous thing is to remove the checks and balances by BNM in KWAP. This is because companies under the government such as 1Malaysia Development Bhd (1MDB) are incline to invest overseas and are financed by statutory bodies such as KWAP.

"The presence of a BNM representative will make such (overseas) investments difficult as it involves transfer of funds across border which is under the purview of the BNM. The presence of the representative will surely be seen as an obstacle over the questionable investments made by KWAP," Rafizi added.

Rafizi, who is mulling legal action against the pension fund on the basis of negligence in KWAP's investments, said the amendment to the Act will make it difficult for him to file a case against the fund with its expanded investment scope.

"The legal action can be filed on the ground that the Investment Panel and KWAP acted beyond the mandate and not acted on due considerations and negligence," he added.

The amendment comes at a time when KWAP is under the spotlight for extending a RM4 billion loan to SRC International Sdn Bhd, a wholly-owned subsidiary of MoF.