NEW YORK (Nov 3): There were no bids during the auction of the 47-storey Park Lane Hotel — priced at US$1 billion — here last week, New York Times reported.

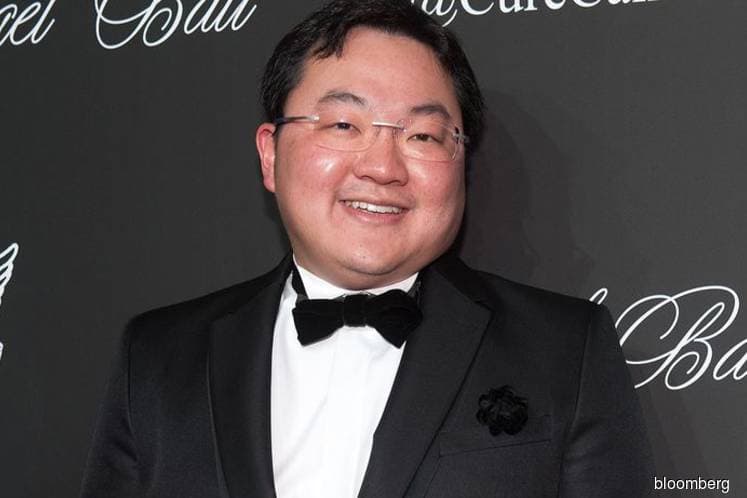

The hotel on Central Park South is partly-owned by financier Jho Low, who is embroiled in the 1Malaysia Development Bhd (1MDB) scandal.

Jho Low is at the center of an international scheme in which the Justice Department contends that billions of dollars were stolen from 1MDB and used to acquire a hotel in Beverly Hills, mansions, condominiums, a yacht, jewelry, art and the Park Lane Hotel, New York Times reported.

The seller claims the hotel is in one of the best locations in the world, a stretch of Midtown Manhattan that has become known as Billionaires’ Row. It came with development rights that would allow a new owner to build a taller, sleeker skyscraper with ever more expensive apartments offering unobstructed views of Central Park.

“No bids came in,” or at least none that came anywhere near the US$1 billion the seller was looking for, according to three people who had been briefed on the auction but were not authorized to discuss it, New York Times reported.

The Park Lane Hotel was one of the assets seized by the Justice Department which had initiated a civil forfeiture action in 2016 to seize many of the assets purchased in the course of the fraud.

Under a cooperation agreement with the Justice Department, the owners of the Park Lane, led by the developer Steven C. Witkoff, agreed to sell the hotel. The government planned to put Jho Low’s share in escrow as a criminal investigation into the fraud proceeds, New York

Times reported.

Witkoff and his partners — the developer Harry Macklowe and the investment firms New Valley L.L.C. and Highgate Holdings — bought the hotel in an auction in 2013, paying US$654 million, and they put up 15 percent.

Jho Low initially agreed to put up the remaining 85 percent, including a US$100 million nonrefundable deposit. At the last minute, however, Jho Low took a 55 percent stake in the building and brought in Mubadala Investment Company, a fund based in Abu Dhabi, for the final 30 percent, New York Times reported.

Their plan was to raze the Park Lane and erect an undulating glass tower designed by the Swiss architects Herzog & de Meuron that would rise 855 feet, using development rights from adjoining properties. Every apartment would have views of Central Park, and the five penthouses would have outdoor swimming pools on the exterior galleries.

But in July 2016, Jho Low failed to put up his share of a loan payment on the Park Lane mortgage. Almost simultaneously, the Justice Department filed a civil complaint seeking to recover more than US$1 billion in assets. Nearly a year later, Witkoff worked out an agreement with federal prosecutors to sell the Park Lane.

The dearth of bids reflects the softness of the real estate market, particularly at the upper end. And Asian and Middle East buyers who had been so eager in recent years to scoop up New York real estate trophies — the Waldorf Astoria Hotel, the Plaza Hotel and the Sony Building — have left the building, New York Times reported.

“I think it’s the world’s greatest site for development,” said Jeffrey Davis, director of the hotels and hospitality group at JLL, a real estate firm not involved in the sale. “The problem was timing.”