_20181102215535_edgeprop.my_.jpg&w=1920&q=75)

PETALING JAYA (Nov 2): While the Real Property Gains Tax (RPGT) rate will be increased after the fifth year, industry experts believe it will not adversely impact the property market as the quantum of increase is rather minimal.

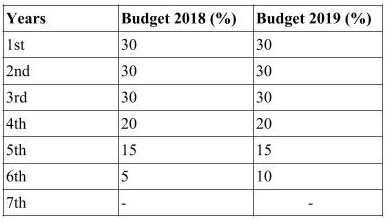

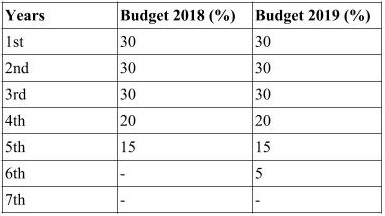

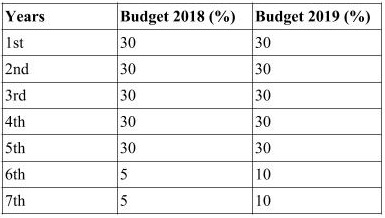

In the Budget 2019 tabled by Finance Minister Lim Guan Eng today, the government proposed that the RPGT rates to be revised for disposals of properties or shares in property holding companies after the sixth year as follows: for companies and foreigners, the rate shall be increased from 5% to 10%; and for Malaysian individuals, the rate shall be increased from 0% to 5%.

However, low cost, low-medium cost and affordable housing priced below RM200,000 will be exempted from RPGT.

In response to this announcement, Henry Butcher Malaysia chief operating officer Tang Chee Meng said although this is not a positive news to the market, it is not expected to create a significant impact due to the low increase in tax rate.

VPC Alliance (KL) Sdn Bhd managing director James Wong concurred, adding that this will not have an adverse effect on the property market as the tax is only 10% and 5% respectively, and only if there is a capital gain.

However, Tang noted that the increased stamp duty for property transfers worth more than RM1 million is expected to have a negative impact on the high-end property market, which is already suffering from slow sales.

In the budget, the government proposes to increase the stamp duty on the transfer of property priced over RM1 million from 3% to 4%.

“Regarding the two-year stamp duty exemption for first RM300,000 for houses priced up to RM500,000, at least there is some relief for those who are buying properties up to RM500,000.

“And the six-month stamp duty exemption for first-time buyers of houses priced between RM300,000 to RM1 million will also provide temporary help to offset the extra burden of the higher stamp duty [for properties worth more than RM1 million],” he told EdgeProp.my.

Meanwhile, Wong noted that while Budget 2019 has outlined a few laudable moves to assist the lower income group to own a home, there are no concrete measures to address the overhang in the property market.

“My only regret over the Budget 2019 is there are no concrete measures to address the huge oversupply in the residential and office sectors. And there are no concrete plans on how the 200,000 affordable homes are to be completed by 2020, which was mentioned in the mid-term review of the 11th Malaysia Plan,” he told EdgeProp.my.

Nevertheless, he thought the proposal of the allocation of RM1 billion fund under Bank Negara Malaysia to assist lower income group to own a home priced up to RM150,000 at a concession interest rate of 3.5% per annum is commendable.

Meanwhile, the proposed airport real estate investment (REIT) trust is a very innovative way for the government to raise fund and to defray the cost of future airport expansion and refurbishment, he noted.

“We are eagerly looking forward to how the government is going to implement this airport REIT.

The success of this REIT will lead to the creation of hospital and infrastructure REITs as the vehicle to raise fund,” he said.

For citizens and permanent residents

For non-citizens

For companies