This article first appeared in The Edge Malaysia Weekly on December 25, 2017 - December 31, 2017

BUSINESS tycoon Tan Sri Abu Sahid Mohamad, via his flagship Maju Holdings Sdn Bhd, is eyeing the entire stake in PLUS Malaysia Bhd held by UEM Group Bhd and the Employees Provident Fund (EPF), in a deal expected to cost more than RM30 billion.

UEM Group — a wholly-owned subsidiary of the country’s sovereign wealth fund Khazanah Nasional Bhd — controls a 51% stake in PLUS Malaysia, while the EPF holds the remaining 49% equity interest in the highway operator.

In an exclusive interview with The Edge in late July, Abu Sahid revealed that he intends to buy the entire stake in PLUS Malaysia from UEM Group and the EPF.

“I’m very, very confident of pulling it off. I have everything ready — I have the money, I have the blessing from the highest levels in the country, I have the advisers and bankers all ready, and I have the formula to do it,” he had said.

To recap, UEM Group and the EPF took over the assets and liabilities of PLUS Expressways in 2011 in a RM23 billion deal, which resulted in the EPF’s stake increasing to 49% from 12.03% , while UEM Group’s holding fell to 51% from 55%.

In early August, EPF CEO Datuk Shahril Ridza Ridzuan said it had not received any offer for its stake in PLUS Malaysia. He added that PLUS Malaysia still contributes significant earnings to the EPF and that there is no particular reason for it to dispose of its stake at this juncture.

PLUS Malaysia chairman Tan Sri Mohd Sheriff Mohd Kassim, however, confirmed in September that he had received a copy of an offer, which implies a total enterprise value in excess of RM36 billion for the company. But he was quick to add that Maju Holdings and Abu Sahid would have to deal with PLUS Malaysia’s shareholders — Khazanah and the EPF.

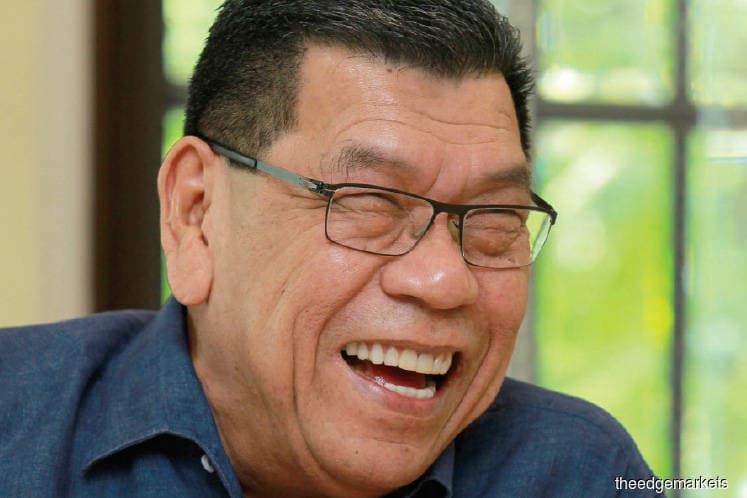

Tan Sri Abu Sahid Mohamad

Group executive chairman

Maju Holdings Sdn Bhd

While little is known about Abu Sahid’s forays as most of his companies are privately held, he has a 31.23% stake in Ipmuda Bhd, which supplies building materials and finishing products to the construction industry.

He also wholly owns highway operator Maju Expressway Sdn Bhd, which holds the concession for Maju Expressway (MEX) that links Kuala Lumpur with Cyberjaya and Putrajaya, and will eventually be connected to the Kuala Lumpur International Airport and klia2.

His flagship Maju Holdings has a subsidiary — Maju Assets Sdn Bhd — that has strategic land bank in Johor and Melaka with a total gross development value in excess of RM4 billion. In Ulu Tiram, Johor, Maju Holdings has a 1,000-acre development that includes an international standard, 18-hole golf course designed by Greg Norman.

Another unit, ASM Development Sdn Bhd, has commenced the development of an integrated township on 200 acres in Kemaman, Terengganu — known as Bandar Baru Bukit Mentok. It is also building medium-cost apartments in Bukit Saujana, Johor.

Also under the Maju Holdings banner is ASM Green Sdn Bhd, which operates the Sungai Layang Estate, a 481.04ha oil palm plantation.

While Abu Sahid has done well with MEX and other assets, such as the bus terminal in Bandar Tasik Selatan, his involvement in ailing steel company Perwaja Holdings Bhd — which he listed on his birthday on Aug 20, 2008 — as well as his sudden departure have remained a mystery.

Market talk had it that Abu Sahid stepped down as chairman of Perwaja in July 2013 after a series of disagreements with Tan Sri Pheng Yin Huah of Kinsteel Bhd.

It is worth noting that Abu Sahid’s offer to take over PLUS Malaysia in 2017 is the second in recent years. Tan Sri Halim Saad of Renong Bhd had in March 2014 put in an unsolicited bid to take over PLUS Malaysia via his private investment vehicle, Idaman Saga Sdn Bhd, but the offer was rejected by the government.

PLUS Malaysia has five concessions held under five companies. The first is Projek Lebuhraya Utara-Selatan Bhd, which holds an 846km concession that includes the North-South Expressway, New Klang Valley Expressway, Federal Highway Route 2 and Seremban-Port Dickson Highway.

Secondly is Expressway Lingkaran Tengah Sdn Bhd, with a 63km concession that includes the North-South Expressway Central Link. Thirdly is Linkedua (M) Bhd, with the 47km Malaysia-Singapore Second Crossing. Fourthly is Konsortium Lebuhraya Butterworth-Kulim Sdn Bhd with the 17km Butterworth-Kulim Expressway, and lastly, the Penang Bridge Sdn Bhd with the 13.5km Penang Bridge.

All PLUS Malaysia’s concessions end in December 2038.

A check with the Companies Commission of Malaysia reveals that for the financial year ended Dec 31, 2015, PLUS Malaysia registered an after-tax profit of RM23.12 million from revenue of RM4.17 billion. It paid a dividend of RM815 million to its parent company in FY2015.

As at Dec 31, 2015, the company had non-current assets of RM30.22 billion and current assets of RM3.26 billion, while its non-current and current liabilities stood at RM31.27 billion and RM1.56 billion respectively.

In an interview with The Edge in early October, Abu Sahid claimed to be able to run PLUS Malaysia profitably without the need to raise toll rates for another 20 years. He claimed that the company paid three times more than it should have for resurfacing the roads and that its thin margins are due to many related-party transactions.

Among the salient features of his proposal is the freezing of toll rates for the next two decades as opposed to PLUS Malaysia’s agreement with the government for a hike every three years. Abu Sahid also seeks to forfeit the government’s compensation of about RM900 million owed to the toll road operator, which arose as a result of toll hikes not being implemented.

Thus far, gauging by the comments and reports, government officials have been lukewarm about Abu Sahid’s proposal.

But will he put the heat on and continue pursuing PLUS Malaysia?

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.