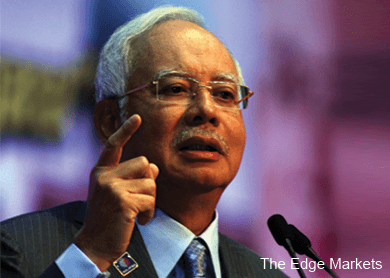

KUALA LUMPUR (March 24) : Prime Minister Datuk Seri Najib Razak said the perception that a particularly high interest rate that 1Malaysia Development Bhd (1MDB) had paid for the RM5 billion Islamic bond to Goldman Sachs International was "baseless".

"Goldman Sachs was chosen to manage the RM5 billion Islamic bonds was because the company is one of the very few banks in the United States that has the capacity to monitor such sizeable bond issuance with large amounts.

"Concerns on the 5.75% interest rate charged for the Islamic bonds back in 2009, with the perception that the interest rates are particularly high is baseless merely because the Islamic bond issued was the first Islamic bond issued in Malaysia that has a 30-year tenure," said Najib in a written reply to Parliament obtained today.

Raub MP Datuk Mohd Ariff Sabri Abdul Aziz had asked Najib who is the Finance Minister on the criterias used to appoint Goldman Sachs to mange the RM5 billion Islamic bonds at a 5.75% annual interest rate as compared to a Petronas bond that paid an interest rate of 3.60% during a a period when Goldman Sachs was involved in the "subprime loans" scandal in the United States.

Mohd Ariff also raised concerns if the interest rate was the best rate for 1MDB.

To recap, 1MDB in a lengthy statement issued in October last year said it took the allegations about its bonds and debts issuances, commissions, debt levels and overpayment of assets "very seriously", and intended to present its own side of the story to every claim.

It also noted that the issuance of its bonds and debts had been "unfairly compared" to that of Petronas's, as in terms of the interest rate both companies first paid to investment firms.