KUALA LUMPUR: The recent global equity sell-off triggered by mixed signals from US Federal Reserve (Fed) officials on the Fed’s upcoming interest rate decision may continue as investor concerns over upcoming events and doubts about the effectiveness of the unconventional easy monetary policy of major central banks spread.

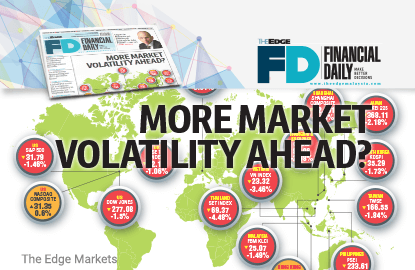

Month to Sept 15, the FBM KLCI had fallen 1.49% or 25.07 points to 1,652.99; it started the year at 1,692.51. Meanwhile, other indices saw volatile trading last week.

Affin Hwang Asset Management head of equity strategies and advisory Gan Eng Peng shared with The Edge Financial Daily that the recent correction in the market was mainly due to comments surrounding the rate hike decision in the US that indicated that cheap and easy money might no longer be available.

“While the comments by the Fed officials have either been hawkish or dovish, it has generally been quite ‘neutral’ but in the near term, the market is slightly shaken by all these comments,” Gan said.

Gan also said that a source of weakness in the market was the reversal of foreign inflows.

“There have been foreign inflows in the last one to two months but since the last couple of weeks, it has turned net sellers, in line with the global sell-off. Net outflow in the equity market is reflected in the stock market and the weaker ringgit. We think the global sell-off is just a correction. It’s not [a] prelude to a market crash,” he said.

He added that the ringgit appears undervalued, but noted that the undervaluation had been there for some time. “We should see some recovery once the outflow stops, which could be in the next couple of weeks,” Gan said.

Gan shared that a lot of market observers are looking towards the upcoming budget and wondering whether it will be a big budget to drive an early general election in 2017. If it is, it will be positive for the market especially for the smaller cap and politically linked companies.

He said that the US election in November will not be a major market event because a lot of the risks have been priced in.

“The risk of Donald Trump’s presidency has been reflected in the market and I don’t think he’s as radical as his political rhetoric suggests,” Gan also said.

On whether the month of October could be another bad month for financial markets as suggested by history, Gan added: “While some of the worst periods had occurred in October in the past, the correlation is very little to suggest any connection. We still need to look at the economic data and the underlying drivers of the market.”

The October Effect refers to the notion that stocks tend to decline during the month although statistics prove otherwise. Nevertheless, notable market declines have occurred in the month of October, namely Black Monday in 1987 and the crash of 1929.

Inter-Pacific Research Sdn Bhd head of research Pong Teng Siew expects the market to head downwards with more volatility setting in.

“We have a very interesting market, developing in a way that is somewhat scary to me. We are faced with a very volatile period. This is because since the early part of this year, there has been a general investing trend with very similar investment strategies. They all crowd into one strategy and that strategy becomes a secret pull strategy that reinforces the stability of equities. That stability in turn reinforces inflows into equity. It has caused an upward spiral. But it looks like it has ended.

“What might unfold next could be somewhat unsettling. I don’t know how bad it will get, but it seems the strategy that reinforces its way up could also reinforce its way down in a similar manner. I’m hoping for the best, but the outcome could be bad for the equity market in the short term,” Pong said.

Just as volatility begets more volatility, Pong cautioned that the volatile period is likely to continue.

Chris Eng, head of research at Etiqa Insurance & Takaful said that the market outlook depends on what happens with the Fed and the Bank of Japan (BoJ)

“There could still be some selling pressure, but I expect the market to stage some recovery on Monday (today) and Tuesday (tomorrow),” Eng said.

According to Eng, the market has priced in a small possibility of a Fed rate hike in September, but the BoJ has disappointed for failing to stimulate the economy further.

This was also in line with Forex Time chief market strategist Hussein Sayed’s view that rising scepticism about the effectiveness of future central bank actions will be a major reason for volatility to resume in the months ahead.

“Concerns that the Fed will soon tighten monetary policy has been an excuse to keep cash off the table as investors want to get past the meeting on Sept 21 to adjust their portfolios.

“The real question which should be asked is, what have the years of unconventional easy monetary policies by central banks done to the global economy? And the answer is simple, very little,” he said.

Eng said that the October month has not been so bad in the last couple of years for the market, and he expects the first half of October to be fairly positive. However, uncertainties surrounding the US election in November could be a risk factor.

Mercury Securities research head Edmund Tham, however, expects the volatility to taper as there are only a few days left before the Federal Open Market Committee meets on Wednesday and Thursday.

According to Bloomberg, the market sees only an 18% chance of a hike in September, 25% in November and 51.6% in December.

Yvonne Tan, general manager of investment services at Eastspring Investments Bhd agreed that there is some volatility in the market, but indicated that the local factors are the bigger concerns for the local markets.

Among the most important factors was a poor and unattractive valuation based on corporate numbers, according to Tan.

“The corporate earnings have been poor and valuation is not attractive right now with some incidents impacting the sentiment among the small- and mid-cap sectors. Malaysia is not cheap right now. We are not seeing growth in overall earnings and we don’t see the market EPS (earnings per share) to grow,” Tan said.

While no particular reason could be offered, Tan shared that the month of October tends to see poorer investor sentiment. She also does not think the Budget 2017 nor the US election will bring much excitement to the market.

“While the US election is an event that the market is closely monitoring, the effect on the Malaysian market should be quite minimal,” she added.

From a technical point of view, Loui Low, Malacca Securities Sdn Bhd technical analyst, said that volatility is expected in the coming weeks with the technical trend indicating that the market will move downwards.

“It has breached below the immediate support level of 1,660 and has given a more negative sign for us to take note of the market. The short-term indicator has already triggered a sell signal so any rebound is likely to be short-lived,” Low said.

Low also said that there might be some truth in what Pong said about the upward spiral in the beginning of the year, saying that there had been net foreign inflows of about RM7.7 billion in the first few months of this year.

“The buying interest has been depleting and on the selling side recently. The current juncture will be a very crucial one because once it crosses the 1,600 support level, it will be quite alarming, triggering a serious sell signal,” Low added.