This article first appeared in The Edge Financial Daily, on January 26, 2016.

KUALA LUMPUR: Both Rubber City projects in Kedah and in southern Thailand will engage in friendly competition to attract investments in downstream rubber product manufacturing, according to Kedah state executive councillor Datuk Dr Ku Abd Rahman Ku Ismail.

“We will be engaging in friendly competition. They will do promotion, but the investors will make their decision,” Ku Abd Rahman told The Edge Financial Daily over the phone.

The preparation for Kedah’s Rubber City, located in Padang Terap, was started about four years ago, at about the same time as the Thai government’s Rubber City in Hadyai, which was launched on Dec 28, 2015.

Ku Abd Rahman said the state government is in the midst of acquiring land in Padang Terap for the project, and expects to complete the acquisitions and land clearing by the third quarter of 2016.

While the acquisitions are being conducted, so is planning of the project, which includes the necessary infrastructure, waste management and zoning of the city, according to Ku Abd Rahman, who is in charge of the state’s industry and investment, domestic trade, cooperatives and consumer affairs.

While the land acquisitions and clearing are ongoing, Ku Abd Rahman said the state had been promoting the project to investors for the past one year.

He foresees Kedah’s 1,500-acre (607ha) Rubber City will be fully utilised in 2025, and should achieve RM10 billion investment and create 15,000 to 20,000 jobs for the local people in eastern Kedah by then.

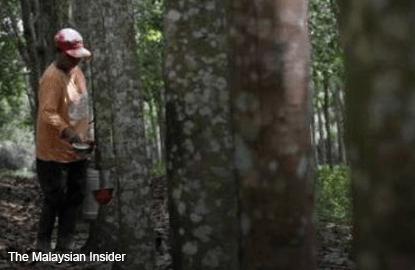

Apart from job creation, Ku Abd Rahman said the success of the project will raise the price of rubber, which will enable smallholders and rubber tappers to get a better price.

In 2015, the average offer price of 1kg of standard Malaysian rubber was between 691.57 sen and 521.90 sen, a sharp decline from the average price of 919.07 sen/kg and 774.68 sen/kg in 2013. For bulk latex, the average price in 2015 was 412.88 sen/kg against 560.48 sen/kg in 2013, according to the Malaysian Rubber Board.

The price slump has been largely attributed to a supply glut and the slowdown in China, the world’s largest rubber consumer.

The Rubber City project in Kedah, a federal government project that is led by the state, has been allocated RM320 million under Budget 2016, according to Prime Minister Datuk Seri Najib Razak’s announcement last October. It remains to be seen if the allocation would be affected under the revised budget that is set to be announced on Thursday.

Meanwhile, Thailand ambassador to Malaysia Damrong Kraikruan told reporters at a media briefing last Thursday that both Malaysia and Thailand’s Rubber City projects should complement each other.

“I don’t think we have to compete. We should be complementing each other,” he said.

Thailand’s Rubber City will be built on 900 acres of land. The first phase, 360 acres, is expected to be completed and be operational in 2017, as key infrastructure like road, telecommunication, water reservoirs and electricity will be in place by then.

The Thai government expects the project, once completed, to attract US$10 billion (RM42.6 billion) in investment monies and help the country use up the oversupply of rubber in Thailand by raising local consumption to as much as 30%.

“The ultimate goal is to process everything,” Damrong said.

In 2015, the country, the world’s largest natural rubber producer, produced four million tonnes of rubber, of which only 10% was domestically consumed.

To attract investors, the Thai government will allow foreign investors to buy land, bring in foreign technicians and experts, as well as to remit foreign currency abroad. Investors will also benefit from exemptions of import duty, value-added tax, excise tax on machinery and raw material, corporate income tax and tax on dividends for up to eight years.

Back in Malaysia, Ku Abdul Rahman said there will be very attractive incentive packages for investors, such as a five-year corporate tax exemption with the opportunity to extend for another five years, import duty exemption on machinery, as well as subsidy for the training of workers, to name a few, adding that the state is still finalising the details with the finance ministry.

Incentives aside, Ku Abdul Rahman believes Malaysia is very competitive in terms of rubber product manufacturing, compared to some of its neighbours, which is a point of attraction for investors on its own.

“In the upstream, midstream and downstream of the rubber industry, we are better than other countries. We are far ahead and we have good foundation.

“We want to use the strength and expertise of our manufacturer in Malaysia in the Rubber City. We have the infrastructure that we need to ensure success,” said Ku Abdul Rahman.