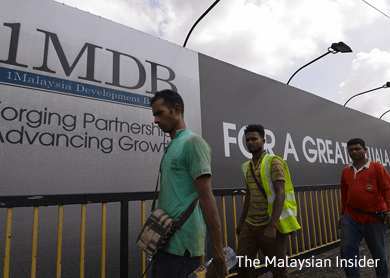

KUALA LUMPUR: PKR demanded yesterday that statutory bodies which have done business transactions with 1Malaysia Development Bhd (1MDB) list all transactions with the debt-laden strategic investor. This follows reports that Kumpulan Wang Persaraan (Diperbadankan) [KWAP], the civil service pension fund, has bought a plot of land in the Tun Razak Exchange (TRX) from 1MDB.

PKR secretary-general Rafizi Ramli said the public should know the extent of public funds involved in 1MDB’s dealings, and that the deals listed must include bond purchases, loans and land purchases.

The KWAP report comes on the heels of last week’s revelation that pilgrims’ fund Lembaga Tabung Haji had purchased of a plot of land in TRX from 1MDB for RM188.5 million.

“Prime Minister Datuk Seri Najib Razak should also order that the land be sold back to the federal government at the same price that was paid by 1MDB to acquire it in the first place,” Rafizi said in a statement.

Tabung Haji bought the land at a price 43 times higher than what 1MDB paid the federal government for it three years ago, while KWAP is reportedly buying the land at 30 times the original purchase price.

“This easy profit is being used to service 1MDB’s debts worth millions that needed to be paid several times a year while the original RM42 billion borrowing from 1MDB remains unaccounted for,” Rafizi said.

In 2011, KWAP itself had lent RM4 billion to SRC International Sdn Bhd, which was then a 1MDB subsidiary, for investments in coal mining in Mongolia. Of that money, RM3.1 billion has been classified as unspecified investments, according to SRC’s latest audit report. SRC has since been absorbed as a wholly-owned subsidiary of the Ministry of Finance.

“Najib must immediately order that any agreements pertaining to land sales by 1MDB to statutory fund bodies must be terminated by mutual agreement,” Rafizi said. — The Malaysian Insider

This article first appeared in The Edge Financial Daily, on May 12, 2015.