This article first appeared in The Edge Malaysia Weekly on December 17, 2018 - December 23, 2018

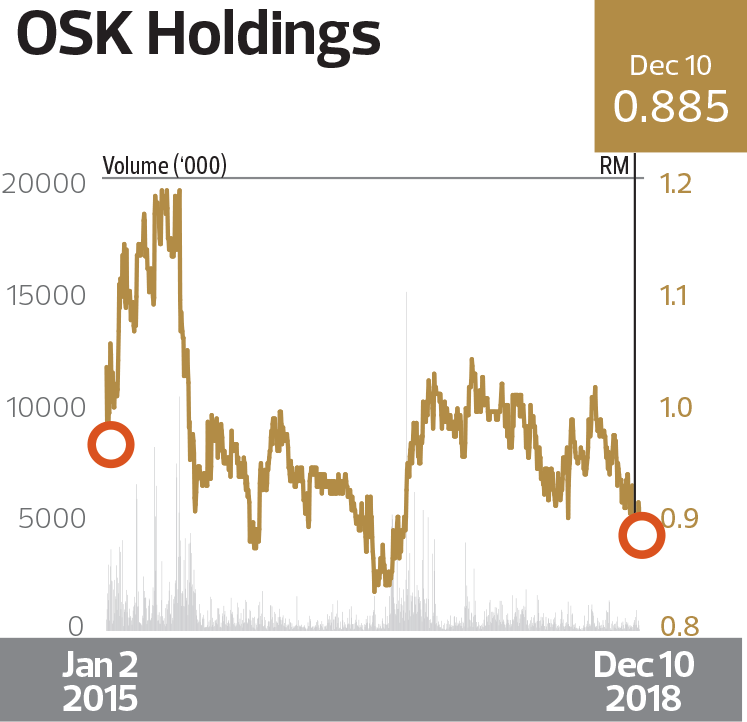

OSK Holdings Bhd, the flagship of business tycoon Tan Sri Ong Leong Huat, is gaining a foothold in property development at home and abroad.

The group ended its financial year ended Dec 31, 2017 (FY2017), with a phenomenal growth of 60% in its profit after tax (PAT). At RM400.22 million, PAT was up nearly 62% from RM247.27 million in FY2016. The huge leap was partly due to a gain on deemed disposal of RM177.6 million, arising from the dilution of equity interest in a subsidiary in Melbourne, Australia, and realisation of foreign exchange reserves.

The group’s PAT was even higher at RM561.53 million in FY2015 compared with RM204.26 million in FY2014. The sharp rise was attributed to the negative goodwill of RM375.3 million, arising from the acquisition of OSK Property Holdings Bhd and PJ Development Holdings Bhd and the subscription for a rights issue in RHB Bank Bhd.

Revenue exceeded RM1 billion in FY2016 and FY2017, at RM1.3 billion and RM1.17 billion respectively.

Between FY2014 and FY2017, the group’s PAT grew at a three-year compound annual growth rate (CAGR) of 25.1%, helping OSK Holdings capture The Edge BRC award for the highest growth in profit after tax over three years among companies with below RM3 billion market capitalisation in the property sector, which is experiencing a longer-than-expected slowdown.

OSK Holdings’ property division marked a milestone when it tied up with the Employees Provident Fund (EPF) to develop its maiden overseas project, Melbourne Square, in Australia.

The five-acre mixed-use development, located in Southbank, Melbourne, has an estimated gross development value of over RM9 billion. The project will be developed in five phases over 8 to 10 years.

Through the partnership, the EPF owns 49% equity interest in Yarra Park City Pty Ltd, which holds the development rights for Melbourne Square, while OSK Holdings holds the remaining 51% through its subsidiaries and associated companies.

The project has recorded a take-up rate of more than 60% since its launch in June 2017, and construction is progressing as scheduled.

Ong says in the group’s latest annual report that its success today is attributable to the dedication, passion and professionalism of its management and employees. “Today, OSK is a conglomerate with business interests in five different segments, namely property, financial services, construction, industries and hospitality. This is no easy feat and we attribute this success to our hardworking and committed employees, guided by the vision and leadership of our experienced management team.”

As at Sept 30, OSK Holdings’ land bank stood at 1,759 acres with an estimated gross development value of RM9 billion. “As at Sept 30, 2018, the group had unbilled sales of RM1.43 billion with minimal unsold completed stocks as there was continuous effort to sell these unsold properties,” OSK Holdings says in the latest release of its quarterly earnings.

Moving forward, the group says its property investment division is expected to receive steady rental income from its commercial and retail tenants. It notes that occupancy rates in Plaza OSK and Faber Towers rose gradually in 3QFY2018 due to the many initiatives implemented, including the completion of the lift modernisation and enhancement at Faber Towers to attract tenants.

Despite the challenging retail environment, OSK Holdings says the average occupancy rate at its Atria Shopping Gallery remains fairly strong at above 90% after the renewal of tenancies for an average of two to three years.

In its construction business, the group’s outstanding order book stood at RM421.59 million as at end-September.

Nevertheless, OSK Holdings group managing director Ong Ju Yan acknowledges in the group’s annual report that the construction industry is facing continuous challenges from rising material costs and a heavy reliance on foreign workers. The group has thus taken steps to improve its internal efficiencies and quality of service. “This includes nurturing and strengthening the capabilities of our people through structured training and development, investing in system frameworks, using more precast materials and upgrading our existing plant and machinery to avoid unnecessary downtime.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.