KUALA LUMPUR: Trade associations are projecting a challenging year ahead, with many expecting growth to be “conservative” at best.

The goods and services tax (GST) that takes effect in April 2015 is the oft-mentioned concern. Business owners believe the new tax system will burden consumers and add to the already high cost of doing business, despite repeated assurances from the government that its impact will be minimal.

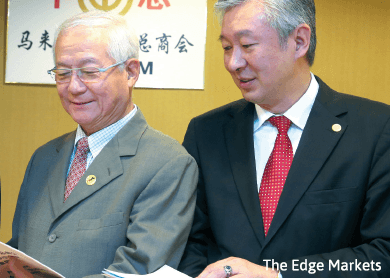

Associated Chinese Chambers of Commerce and Industry of Malaysia president Datuk Lim Kok Cheong said the biggest concern of the business community is how GST will affect spending patterns.

“It (GST) will affect all of us, businesses and consumers. While companies will have to incur a higher cost of doing business, consumer sentiment will be affected — that is for sure. The concern then is businesses will be less willing to invest or expand,” he told The Edge Financial Daily.

Lim is concerned that the implementation of GST at a time when the economy is uncertain could hurt growth.

He said cost-cutting is one of the few options available for businesses to remain competitive.

The sharp fall in global crude oil prices could be a boon when GST is implemented. However, business owners are yet to see much benefit from this, although the government has said prices could drop further in the months ahead.

“There is a need for the government to restructure the tax system. But I foresee there will be problems in the implementation of GST in the first two years. Are we ready to do so when the economy is feeble?” said Malay Economic Action Council (MTEM) CEO Mohd Nizam Mahshar.

Many of MTEM’s 500,000 members are roadside hawkers or petty traders who are not required to register for GST as long as their business do not generate more than the taxable annual revenue threshold of RM500,000.

Yet, this does not mean micro SMEs will be spared from squeezed margins that will eventually affect overall consumption, Mohd Nizam said, citing unfavourable macroeconomic indicators such as high household debt and the widening Gini Coefficient (a measure of income inequality).

Meanwhile, many businesses are still not familiar with the GST mechanism.

According to Federation of Malaysian Manufacturers (FMM) president Datuk Saw Choo Boon, most of the FMM’s 2,771 members admitted they were not ready for the implementation of the GST.

Based on responses from the FMM-MIER Business Conditions Survey June 2014, 72% of the respondents said the biggest challenge in being GST-compliant is staff training. Almost half were unsure of the documentation and procedures involved.

Other challenges include high software costs and readiness of the GST portal (43%), high consultancy fees (41%), need for more staff (24%), and high hardware costs (21%), said Saw.

The 6% consumption tax, which has been mooted for years, was officially announced in Budget 2014 to replace the “regressive” sales and services tax (SST) so the government could widen its revenue base.

In announcing Budget 2015, Prime Minister Datuk Seri Najib Razak said the government expects to collect RM23.2 billion in revenue from the GST next year, although the net addition from replacing SST will only amount to RM690 million in 2015.

The government has given Malaysian individuals and businesses more than a year to prepare to comply with the GST. Yet, the high one-off cost to switch to the GST regime has dissuaded SMEs from meeting the deadline.

Kuala Lumpur and Selangor Chinese Chamber of Commerce and Industry president Datuk Ter Leong Yap hopes the government will be lenient on SMEs that are genuinely unable to be GST-ready by April 1.

“We also feel that SMEs should be given alternative means to coordinate and implement GST practices as most consultants are charging exorbitant fees.

“In addition, the government should be more forgiving in its penalties for genuine negligence in the compliance of declaration, by giving [companies] a grace period of one to two years. This time should be spent on giving guidance rather than punishment,” he told The Edge Financial Daily.

The cost of complying with the GST aside, the consumption tax is expected to create a domino effect that will affect every single Malaysian.

Ter, who is Sunsuria Bhd executive chairman, expects an average increase in operational costs of 3% to 4% for developers once the GST applies.

This article first appeared in The Edge Financial Daily, on December 22, 2014.