This article first appeared in Capital, The Edge Malaysia Weekly on April 9, 2018 - April 15, 2018

WHILE government-linked corporations are aiming to be regional champions in their respective industries, many Malaysian businesses in the private sector are also expanding their presence beyond the local shore, be it to enter new markets or to seek a more cost-efficient production base.

The rising trend of investing abroad has led to growing demand for cross-border financial services from commercial banks. These services include financial arrangements or products and services that cross national borders.

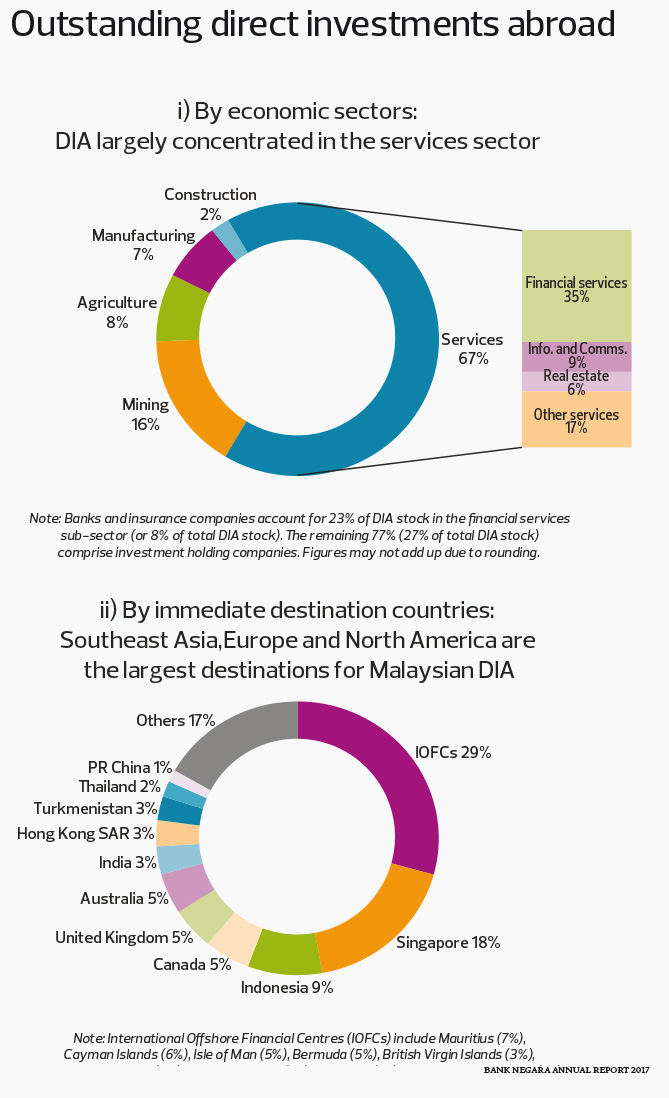

According to Bank Negara Malaysia’s 2017 annual report, direct investment abroad (DIA) by Malaysian companies has increased at a rapid pace — reflecting the maturity of domestic firms and the limited domestic natural resources — facilitated by strategic national policy initiatives.

Since 2001, DIA has grown at 20.7% per annum on average, from RM31.7 billion in 2001 to RM522.5 billion at the end of last year.

From 2005 to 2014, DIA flows averaged RM39.1 billion a year, or 4.7% of nominal gross domestic product.

Since 2015, however, the flows have moderated somewhat, with average outflows amounting to RM33.7 billion a year or 2.7% of GDP, reflecting a more cautious approach given greater uncertainty in global growth and low global oil and commodity prices since December 2014. The depreciation of the ringgit during this period, which rendered investments abroad more expensive for domestic firms, may also have contributed to the moderation.

“We’re certainly witnessing a boom in cross-border trade. And with this comes an increase in inbound and outbound regional business requirements and engagements.

“A good example is China’s Belt and Road Initiative and how the agents across countries facilitate the large network of business opportunities across the region and in several levels of businesses, for instance, from main to subcontractors to their related value chain of suppliers,” says Jeffrey Teoh, head of corporate and commercial banking at OCBC Bank (M) Bhd.

“It is a natural progression for mid-cap companies to go overseas as they expand their business, in addition to large corporates entering new markets both regionally and globally.”

Teoh expects demand for cross-border financial services to see a compound annual growth rate of 20% in three years, substantiated by the rising level of Chinese investments in Malaysia in the last two years, and vice versa.

He says the provision of cross-border banking solutions is in line with rising global demand for a business value proposition to sell to local markets and may not be confined to conventional geographical borders anymore.

“Regional financial support and guidance is about reaching out to markets with regional needs and demand.

“A case in point is the need to set up power transmission lines in Third World countries within Asia, which then give rise to regional cross-border opportunities. Businesses can consider entering this market whereby the price point would be lower as they would be entering a lower-cost country and meeting its needs, which leads to the betterment of the local community,” he explains.

Banks that could bridge this link for corporates are expected to be knowledgeable in regional developments and have a substantial regional and global network to assist them in financial solution arrangements.

In some cases, these developments achieve more than commercial aspirations and work towards enhancing the livelihood of the communities in the vicinity of the developments.

As businesses engage in more intra-regional trade and investment activities, banks need to be able to effectively facilitate cross-border trade and business flows by supporting their clients’ regional expansion of capital flows, including being ready with integrated or interlinked, cost-efficient transactional systems that can cater for local and regional payments and settlements.

With their highly regulated and compliance-driven infrastructure, banks are also well positioned to offer advisory services for tackling compliance-driven governance matters such as foreign exchange administration rules to smooth the delivery of financial solutions.

Banks must first have a regional platform, supported by capable and relevant expertise, to play a role in enabling cross-border solutions, says Teoh.

“With the regional platform, banks can then leverage the strength of their core countries with their network presence. This becomes a fundamental base to link customers with business opportunities.”

Nonetheless, the recent increase in protectionist government policies could affect demand for cross-border financial services, Teoh acknowledges.

“Hence, it is imperative to engage the relevant local agency partners to understand and familiarise oneself with the related policies that may need to be addressed before embarking on regional business opportunities. In addition to local agency partners, businesses are also encouraged to work with regional commercial banks, such as OCBC Bank, that have the expertise to add value and even provide networking or business match-making opportunities.”

Teoh says the key challenge in offering cross-border solutions is understanding and assessing the localised risks of both the domestic and foreign countries.

“Entering a different market that has its own set of laws, regulations, custom and culture, alongside engaging with a new business market or an industry with possibly different business profiles and characteristics do present their own challenges,” he says.

“At OCBC Bank, these risks are mitigated by our network of regional support, augmented by the local experts and champions who handle the regional and international businesses.”

For businesses that have begun thinking about expanding regionally, Teoh says they should approach banks and explain at length their regional business aspirations and operational plans, including all related financial matters.

“They can also prepare ahead of time by approaching supporting partners with regional reach for guidance and advice. These could include company secretaries who may point them in the right direction, so they are able to reach the relevant regional government and business-related agencies that are well versed in their respective areas, for example, the Ministry of International Trade and Industry, Malaysian Investment Development Authority, Malaysia External Trade Development Corporation, Export-Import Bank of Malaysia Bhd and regional commercial banks with relevant expertise such as OCBC Bank.

“The key is to engage with parties and partners who have the expertise and are familiar with the business destination, such as the relevant central banks, as there is a fundamental need to familiarise oneself with local laws and custom before embarking on business tie-ups. In this regard, knowledge of the central bank of the country of origin is also paramount,” he explains.

Overseas project financing is one of the many available cross-border financing options in the market. It is meant to finance the development, upgrade or expansion of infrastructural facilities, plants and buildings, and fixed asset purchases such as machinery and equipment.

Meanwhile, overseas contract financing assists businesses in financing working capital and bond requirements for the undertaking of overseas contracts.

As for overseas investment financing, it provides financing to Malaysian investors who want to undertake cross-border investment by way of purchasing overseas assets, including fixed and current assets such as buildings, factories, machinery and raw materials.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.