HOW often do we hear of people investing in industrial properties? Chan F C is one of the few who had. He began investing in industrial properties five years ago.

“I started with residential property investment 10 years ago. Five years ago, I ventured into my first industrial property and now own four of them — three in Klang and one in Semenyih,” Chan shares with TheEdgeProperty.com.

For him, investing in this property type seems to be a long-term play that demands strong holding power. On the one hand, he has seen the value of one of his semi-dee factories in Klang rise by 75% from RM2 million to RM3.5 million in five years, but on the other, a factory unit in Semenyih that he purchased two years ago has been vacant since the developer’s handover more than a year ago.

Chan himself occupies a factory in Klang as a manufacturing facility while the other two properties in Klang are tenanted. He bought the Semenyih factory for RM3.7 million two years ago with the hopes that the market will recover soon so he could rent it out. Unfortunately, the market slowdown has prolonged.

As a business owner himself, Chan saw the potential in industrial properties, especially to gain long-term rental income. “An investor could enjoy good returns. But the problem is one must have strong holding power as it will take some time to find a suitable tenant. But once you secure the tenant, you can get stable returns,” he explains.

Furthermore, he notes that unlike residential properties, industrial properties require less attention in terms of maintenance and their value will not be affected even when left vacant for a long time.

One of his factories in Klang with a built-up of 9,000 sq ft and land area of 16,000 sq ft is rented out to a manufacturer from China at RM9,000 a month, which he considers decent.

“It may take two to three years to see investment returns, sometimes longer. I would advise people to invest only when they have extra money and when the economy is good,” says the 53-year-old investor.

Good rental yields

Zilin Properties Sdn Bhd founder Teo Zi Lin tells TheEdgeProperty.com that industrial property is often overlooked by investors due to their high entry cost of RM2 million and above.

“Normally, banks will only give 80% loan to industrial properties, which means buyers will need to fork out 20% in cash as deposit. It’s a big chunk of money,” he explains. In comparison, buyers could secure 90% financing for residential properties.

Furthermore, for new residential properties, developers often give attractive rebates. Hence, industrial properties seem less attractive to most property investors.

However, Teo notes that despite the higher entry cost and lack of “sophistication”, industrial properties still attract certain buyers especially those looking for stable long-term rental income.

According to him, there has been constant demand for industrial properties from the manufacturing or logistics sector to house their operations or storage space.

Based on his observation, the rental yield from semi-dee factories is about 5% on the average in the Klang Valley, especially those located in highly populated areas with good accessibility, while for larger properties, the rental yield could fetch 7% and above.

JLL Property Services (Malaysia) Sdn Bhd country head and managing director Y Y Lau also believes that industrial properties are able to command a higher rental yield than other property types.

“Industrial properties offer good investment potential due to land cost appreciation and rental increments. In the best-case scenario, the rental yield could sometimes exceed 7% compared with 5% to 6% for commercial and less than 4% for prime residential properties,” she adds.

However, Lau notes that about 80% of those who purchase industrial properties often buy them for their own use and demand has been stable.

“Although local manufacturing investments have declined by 22% to RM58 billion in 2016, foreign investments have risen by 25% to RM27.4 billion in 2016,” she says.

New opportunities

Knight Frank Malaysia executive director for capital markets Allan Sim observes that the emerging e-commerce sector has opened up more opportunities for industrial property developments, especially for large-sized warehouses.

“We have received a few requests from e-commerce portal operators who showed interest in setting up regional distribution hubs in Malaysia,” he says.

Sim explains that although e-commerce companies like Zalora and Lazada will have a warehouse in every country they have a presence in, they would still need a distribution centre cum warehouse regionally.

“International e-commerce operators like Malaysia because of our strategic location and attractive tax incentives for multinational companies to invest here. They can create job opportunities for the locals,” he notes.

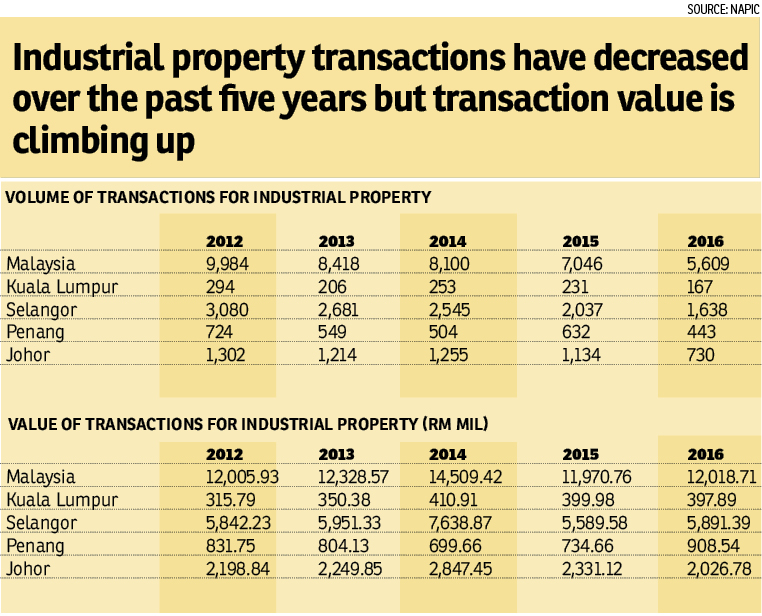

According to the National Property Information Centre, the industrial property sector last year recorded 5,609 transactions worth RM12.02 billion, a decrease of 20.4% in volume from 7,046 transactions worth RM11.97 billion in 2015. However, the total transaction value has increased, albeit by a slight 0.4%. Since 2012, transaction volume has slumped 40% from 9,984 in 2012.

However, Knight Frank’s Sim stresses that the weak performance is not due to the lack of demand but existing properties not meeting the requirements of a new business environment.

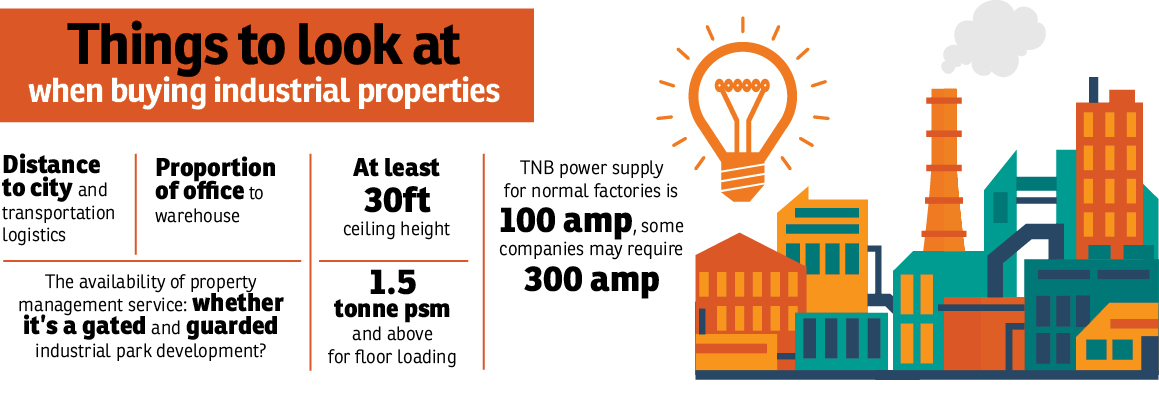

“The main problem is that our industrial property standards have not improved for the past 10 years. The existing properties in the old industrial parks mostly have low ceilings, lack facilities and are more suited for the own-use type of manufacturing facility,” offers Sim. However, Malaysia’s industrial sector has changed over the years, from manufacturing to assembly to the import-export business. Business operators, he says, are now looking for storage space rather than a manufacturing plant.

Zilin Properties’ Teo has also noticed the rising demand for bigger warehouses with modern specs and located in good accessible places. The modern warehouse property features office space as well and serves the needs of a distribution hub. It offers high ceilings of about 35ft to 40ft to allow operators to stack up their goods on high racks, a good floor loading of about 1.5 tonnes psm and sufficient power supply to cater to the needs of precision engineering companies.

Teo notes that a good location would mean highly populated places with easy accessibility to highways and main roads, and close to transport logistics such as ports and airports.

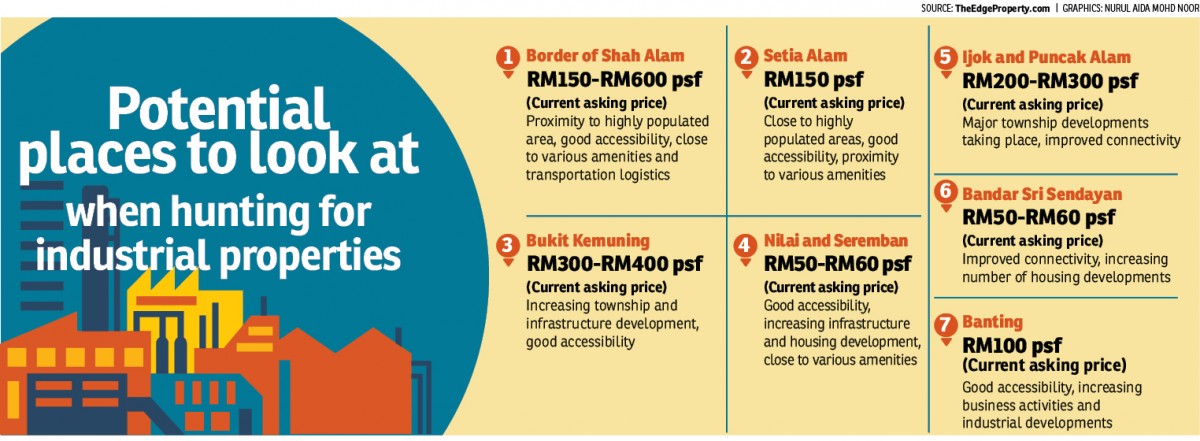

He cites areas such as Section 13 in Petaling Jaya, Shah Alam, Subang, Rawang, Jalan Tapah in Klang and Kota Kemuning. Investors could also look for new areas that have seen improved accessibility and proximity to transport logistics such as Puncak Alam, Banting, Batang Berjuntai and Setia Alam in Selangor, as well as Nilai, Seremban, Bandar Seri Sendayan and Setia Alam in Negeri Sembilan.

These locations have seen new major township developments coming up with improved road access system and new facilities as well as new stratified gated-and-guarded industrial park developments.

Although few consider investing in industrial properties at the moment, Knight Frank’s Sim thinks that the trend may change in the future as newer and more modern industrial property developments are introduced.

“Traditionally, most industrial park developments are led by the government. But now, there are more private companies building gated-and-guarded industrial parks or logistics parks,” he says.

Some of these modern industrial parks even offer property management services and have attracted multinational companies (MNCs) and investors’ attention, such as those located in Iskandar Malaysia, Johor.

JLL’s Lau concurs that market demand for industrial properties have been picking up with rising demand for well-managed industrial properties in Johor.

“Strong interest remains in Shah Alam, which offers proximity to the capital city as well as to the port for industries that export their products overseas. Penang mainland and industrial parks in Negeri Sembilan that are closer to Selangor also enjoy fairly good take-up rates,” she adds.

New development trends

Zilin’s Teo foresees multi-level warehouses to be the next trend due to land scarcity, especially in prime areas.

He says e-commerce operators prefer locations that are near city centres and also offer sufficient space for storage. Hence, multi-level warehouses with high ceiling and loading facilities will be something property developers may want to consider to attract logistics or e-commerce MNCs.

Meanwhile, JLL’s Lau says refurbishment or rebuilding may be able to rejuvenate the older industrial properties in prime locations.

“A lot of the industrial buildings that are old, dilapidated and not relevant to the current requirements are located in the mature industrial estates. There would be a need to refurbish or, in many cases, demolish and rebuild,” she explains.

She has observed some companies, including foreign e-commerce or logistics companies, choosing to build their own warehousing facilities. For instance, Mapletree has demolished an old factory at Section 23 in Shah Alam and rebuilt a logistics park that comprises three single-storey buildings featuring multi-tenanted logistics and warehousing facilities with mezzanine offices.

Land value supports capital appreciation

The value appreciation of an industrial property is usually supported by its fundamentals — the land value. Sim says that although transaction volume for the past five years has seen a significant drop of 40%, the transaction value has climbed by almost 50% over the same period. This is consistent with rising land prices.

For instance, in Shah Alam, which is popular for its industrial properties, the current average selling price of the semi-dee factories go between RM150 and RM160 psf compared with about RM100 psf five years ago. Nilai and Seremban have seen the average selling price of semi-dee factories there surge to RM50 to RM60 psf currently from RM15 to RM20 psf in 2012. Factories in Rawang, which were selling at about RM70 to RM80 psf in 2012, have now seen the average selling price reach RM100 psf.

As for rents, Zilin’s Teo says semi-dee factories in Shah Alam fetch an average monthly rental of about RM2 psf; Bukit Kemuning’s monthly rent ranges between RM1.50 and RM1.70 psf while bigger warehouses in Subang are rented out for an average of RM1.50 to RM1.80 psf.

Sim sees industrial property as a good choice for those who want to diversify their portfolio from residential properties to other property types.

“Despite the higher entry cost, industrial property prices are still lower than shop houses. They also offer low risk, as once the factories or warehouses are rented out, the owner will usually be able to get a long-term stable income. Furthermore, with rising land prices, one can expect good capital appreciation,” he explains.

Meanwhile, Teo says experienced investors who are already savvy in residential property investment may want to explore other investment opportunities, and industrial properties could be a good choice for them.

However, he advises them to do proper research or seek information before making any decision. “Industrial property investment is a long-term game; it might not be as attractive as other property types in the short term, but the growth potential is there. When the time is ripe, it will reward you well,” he concludes.

This story first appeared in TheEdgeProperty.com pullout on June 9, 2017. Download TheEdgeProperty.com pullout here for free.