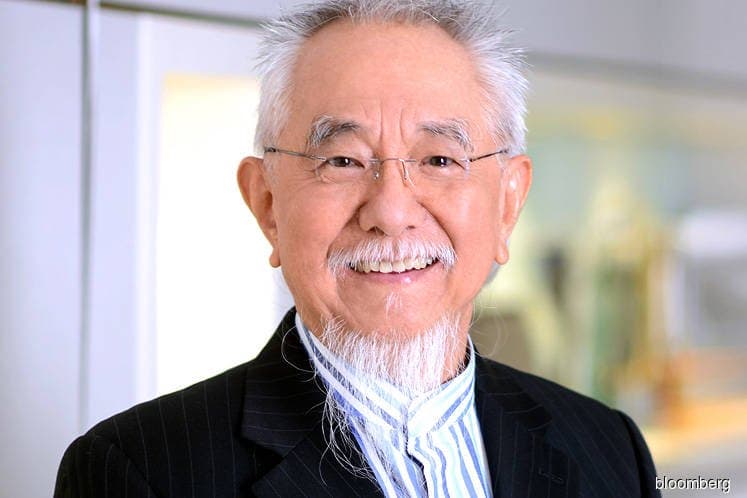

KUALA LUMPUR (Jan 12): Increasing investments is also an important driver of economic growth, former Bank Negara Malaysia deputy governor Tan Sri Lin See Yan said, adding that economic performance should not focus solely on private and public consumption.

"Focus should be placed more on increasing investments, which seem to have slowed down," he told reporters after the "TN50: The Road Ahead" lecture organised by the Jeffrey Cheah Institute on Southeast Asia today.

According to Malaysian Investment Development Authority latest data, approved investments in the manufacturing, services and primary sectors for the period of January-September 2017 declined 26.5% to RM113.5 billion compared with the year-ago period, dragged down by a 37.6% drop in the services sector and a 15.5% reduction in the manufacturing sector.

Lin also noted that there is a disconnect between the official statistics and the economic reality, suggesting the need to reconsider economic impetuses.

"You can't size up the economy by just looking at the country's gross domestic product (GDP). It seems that the real economy has lost its edge, you have the World Bank saying the economy is on a high but what it seems is that it's on a sugar high. It's not sustainable," he added.

The World Bank's Malaysia Economic Monitor report issued on Dec 14, 2017, projected Malaysia's economy to continue at a strong pace of 5.2% this year, though slightly slower compared with the expected 5.8% growth in 2017. The 5.8% year-on-year growth would be the country's highest annual growth rate since 2014.

"Consumption as a growth factor is not reliable. What's important is investments (foreign and domestic), but that seems to have slowed down over the years," said Lin.

"We are told the thrust of growth is consumption but there is clearly a loss of purchasing power, and retail sales are down. Furthermore, I frequent hawker stalls during the weekend. I talk to the food seller and he tells me he does not feel the 5% growth that is being talked about," said Lin.

He urged the need for better economic policies, including the need to relook education policies to nurture sustainable talent. "Government also needs to move away from using cheap labour, use the talent we have and utilise and improve them for our manufacturing and electrical & electronics sectors," he added.

Lin, who is also the chairman and independent non-executive director of IGB REIT Management Sdn Bhd, the manager of IGB Real Estate Investment Trust, said retail sales have also been affected as a consequence of declining consumer purchasing power.

"I am the chairman of the largest mall in town (Mid Valley Megamall). We are rated as having the best retail space (and yet,) we are having problems. We have plenty of retail shops, but part of the problem is getting people to buy," he added.

IGB REIT's property portfolio includes Mid Valley Megamall and The Gardens Mall here.

At 4.36pm, IGB REIT units were unchanged at RM1.61, with 1.83 million shares done, bringing a market capitalisation of RM5.69 billion.