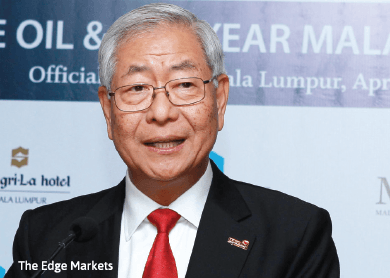

KUALA LUMPUR: Crude oil storage capacity at Phase 1 of the Pengerang independent terminal in Johor could be doubled, said Dialog Group Bhd executive chairman Tan Sri Dr Ngau Boon Keat, but this is subject to a study on the oil storage market which will be completed in two to three months.

He said if the study deems it feasible, the group is expected to spend between RM100 million and RM300 million on the expansion.

“We are conducting a feasibility study to gauge the possibility of building more storage tanks for crude oil. The [current] market situation is very positive for crude oil storage,” he told reporters after the launch of The Oil & Gas Year’s new magazine and awards ceremony yesterday.

Ngau said if the plan materialises, the storage tanks could take about two to three years to be built, adding that Dialog (valuation: 0.5; fundamental: 2.1) should “not wait for too long” to cater for the potential demand.

“I am not sure of the number of tanks we will build as it will depend on the study, [but] we have land, and all the infrastructure is there.

“We reclaimed enough land (69ha) for this expansion. [We] did not just secure land for Phase 1 of the Pengerang Terminal. There must be land for expansion.

“We can double our current capacity in Phase 1 if there is demand,” he said.

This follows from the fact that the total storage capacity of 1.3 million cu m in the first phase of the Pengerang terminal is now fully leased amid the protracted low oil prices, which bodes well for the oil tank business as cheap barrels can be bought and held in tanks to sell at higher prices in the future.

“When we decided to build the storage tanks five years ago, we never forecast the sharp drop in crude oil price at the end of 2014. But once it dropped, the [storage] terminal [in Pengerang] was highly in demand.

“We became popular among traders because they could store their crude oil there. The price of oil [has since] moved up, and in the last few weeks they (traders) made money,” said Ngau.

Ngau is also of the view that the global crude oil price would hover between US$60 (RM214.20) per barrel and US$80 per barrel in the medium term.

Ngau also said the development of the liquefied natural gas regasification facilities as well as a storage capacity of five million cu m for petroleum and petrochemical products is on track.

Dialog also has no plans to reduce its capital expenditure for 2016, he said.

Phase 1 of the Pengerang Terminal, which is owned by Pengerang Independent Terminals Sdn Bhd — a joint venture between Dialog (46%), Koninklijke Vopak NV (44%) and the State Secretary of Johor (10%) — commenced operations in the second quarter of 2014. Phase 1 involves the construction of an initial storage capacity of 1.3 million cu m, together with six deepwater berths at a cost of RM2 billion.

Dialog shares closed unchanged at RM1.67 yesterday, with a market capitalisation of RM8.44 billion.

The Edge Research’s fundamental score reflects a company’s profitability and balance sheet strength, calculated based on historical numbers. The valuation score determines if a stock is attractively valued or not, also based on historical numbers. A score of 3 suggests strong fundamentals and attractive valuations. Go to www.theedgemarkets.comfor more details on a company’s financial dashboard.

This article first appeared in The Edge Financial Daily, on April 28, 2015.