This article first appeared in The Edge Malaysia Weekly on May 8, 2017 - May 14, 2017

COME Monday, Iskandar Waterfront City Bhd (IWC) is expected to be heavily sold down. Without Bandar Malaysia, the proposed one-for-one share swap with Iskandar Waterfront Holdings Sdn Bhd (IWH) is not as attractive anymore.

Sure, 6,773 acres around Johor Baru, priced at RM93 psf, may be alluring, but is that enough to convince shareholders to hold on to the stock at last Wednesday’s closing price of RM3.08 a share?

Probably not.

Nonetheless, Astramina Advisory Sdn Bhd managing director Wong Muh Rong argues that the value of the merger remains intact.

“From day one, we did not price the Bandar Malaysia project into valuations used in the one-for-one share swap. The deal was not yet completed at the time. It would have been a bonus,” explains Wong, who is advising IWH on its corporate exercises.

Hence, she says, the unilateral termination of the Bandar Malaysia deal by TRX City Sdn Bhd should not affect IWH’s swap offer.

Recall that IWH is offering to acquire the remaining 61.7% stake in IWC it does not own at an offer price of RM1.50 per share, to be satisfied with the issuance of new IWH shares on a one-for-one basis.

In contrast, the merged entity would have an estimated revised net asset value (RNAV) of RM4.50 a share (fully diluted). Hypothetically, if IWC’s share price were to hit limit down on Monday at RM2.16, the stock would be valued at a theoretical 52% discount to RNAV.

It is worth noting that the RNAV is not based on the gross development value like other property stocks, but the open market value of the land.

Nonetheless, the negative sentiment on counters linked to Tan Sri Lim Kang Hoo is expected to weigh on IWC this week. After all, even Lim’s 32.4%-controlled Ekovest Bhd, which has nothing to do with Bandar Malaysia, took a beating last week. The stock lost 16.8% of its value after the Bandar Malaysia termination was announced.

In light of recent events, the restructuring exercises related to the merger will be slowed down. In particular, the injection of an additional 3,598 acres by Lim, Kumpulan Prasarana Rakyat Johor and the Sultan of Johor.

The land has an open market value of RM4.3 billion.

Wong explains that the group will be diverting resources to deal with the Bandar Malaysia issue, slowing down the completion of individual agreements needed for the asset injection.

Interestingly, without the asset injection, the RNAV of the merged entity is much higher at RM5.98 per share. This is largely due to the dilutive effect of issuing 2.19 billion new redeemable convertible preference shares in consideration for the asset injection. On paper, this means the stock would be priced at a much steeper discount to RNAV.

However, note that management has indicated that it is still committed to undertake the asset injection. It will just take place on a slower timetable.

Greenland payments a silver lining

On a more positive note, IWC has finally secured payment for the land it sold to China-based developer Greenland Group.

Recall that Greenland acquired 128 acres from IWC for RM2.4 billion but payment has been deferred. The payment will be spread out over the next three years — up to May 2020.

This year, only RM231.6 million will be paid. In 2018, 2019 and 2020, Greenland will pay RM343.75 million, RM432.2 million and RM1.13 billion respectively.

It is evident that the payment schedule is loaded towards the tail end, which is less than thrilling for investors. Nonetheless, it is a positive sign that Greenland is finally paying for the land.

Based on IWC’s 2015 annual report, the land disposal was estimated to book a gain of RM1.39 billion or RM1.89 per share.

Johor Baru property market continues to soften

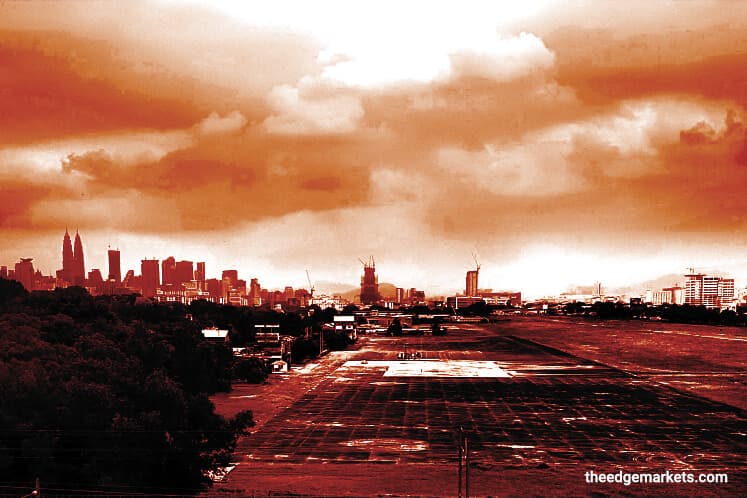

Looking beyond the turbulence of the Bandar Malaysia deal termination, investors will have to pay close attention to the prospects of the 6,773-acre land bank of the merged entity.

The problem is, the property market in and around Johor Baru has been softening. Checks with various developers in the area show that inventories have been on the rise while selling prices have stagnated.

Occupancy also remains low, especially in high-end landed and high-rise developments.

It is a good thing that the merged entity does not plan to become a property developer. Instead, it will focus on selling land to property developers.

But in this climate, land sales to developers may be slow going. In turn, this may translate into lacklustre earnings in the near term.

However, it can be argued that IWH should be a long-term investment, as should be the case for property. It is interesting to note, however, that the company does not plan to pay dividends. Instead, it aims to be a new type of “capital appreciation” stock.

Instead of paying dividends, profits will be rolled over into acquiring more land.

For this business model to work, it rests on Lim to deliver a steady stream of land sales and to constantly replenish his land bank. In fact, he may even have to play an active role in driving economic development in Johor.

It remains to be seen if Lim can convince investors of his vision for IWH without the Bandar Malaysia deal. To be fair, Lim has managed to turn IWC into the top performing stock so far this year.

But without the market’s bullish sentiment, Lim must deliver results to sustain investor interest in IWH, something he would have needed to do, with or without Bandar Malaysia.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.