This article first appeared in The Edge Malaysia Weekly on September 11, 2017 - September 17, 2017

IT is not just banks that will be affected by MFRS 9. Pension funds like the Employees Provident Fund (EPF) and corporates that adhere to the Malaysian Financial Reporting Standards (MFRS) and International Financial Reporting Standards (IFRS) are expected to be impacted as well. However, experts say the impact on them will not be as significant as for the banks.

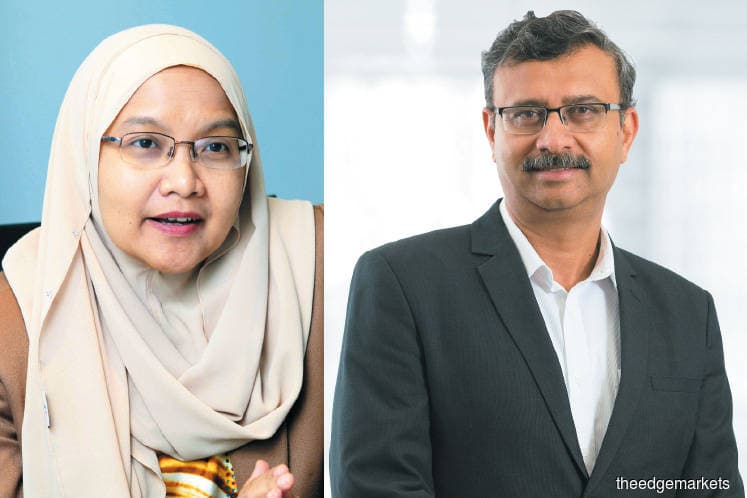

“MFRS 9 is a standard of financial instruments and therefore, its implementation is not confined to the financial reporting of banks,” Malaysian Institute of Accountants (MIA) CEO Dr Nurmazilah Mahzan tells The Edge.

To assess the awareness and readiness of companies in implementing MFRS 9,the Securities Commission Malaysia says it is currently conducting a survey of 220 companies, excluding financial institutions, listed on the Main and ACE Markets, covering a diverse range of industries in Malaysia. Responses to the survey are due by mid-September.

“The significance and impact of MFRS 9 on corporates will depend on the financial assets and exposure that they have and how they are managed. Under the revamped forward-looking loss model, it is expected that higher impairment provisions will be required up front,” an SC spokesperson tells The Edge.

The regulator expects all public-listed companies to be able to comply with the new accounting standard when it becomes mandatory on Jan 1, 2018.

The EPF, one of Asia’s biggest retirement funds, had three significant categories of financial assets on its balance sheet as at Dec 31, 2016: investment assets held-to-maturity valued at RM228.07 billion; financial assets available for sale (AFS) at RM362.74 billion; and loans, advances and financing at RM93.11 billion.

The EPF’s investments in equities are categorised under financial assets available for sale. Last year, the retirement fund’s impairments swelled to a historical high of RM8.17 billion, with the bulk of it — RM8.05 billion — stemming from listed equities.

This led to the EPF declaring a dividend of 5.7% last year — the lowest since 2009. In contrast, the retirement fund paid a dividend of 6.4% in 2015 after recording impairments of RM3.07 billion.

These impairments were taken in accordance with MFRS 139. Now, with MFRS 9 taking over, what will happen to dividend payments? Will they be negatively affected? The answer, however, is not so simple.

This is because under MFRS 9, investments in equity instruments do not need to be assessed for impairment. Instead, they are measured at fair value with changes recognised in profit or loss, or at fair value with changes recognised through other comprehensive income.

The risk that accounting practitioners worldwide have been debating about IFRS 9,which is the international equivalent of MFRS 9, is whether these changes in fair value recognised in profit and loss would lead to more income statement volatility, which, in turn may affect dividend payments.

An industry observer tells The Edge that due to the technicalities of the transition to MFRS 9, it is still too early to gauge the impact the standard will have on dividend payments for retirement funds such as the EPF.

“I think it is premature to make assumptions about the impact on dividend payments and to judge whether it’s a good thing or bad thing as the transition is made from MFRS 139 to MFRS 9. It comes down to what kind of methodology is used to measure the financial assets that would ultimately determine the impact on dividend payments, and I don’t think anything has been set in stone yet at this point,” he says.

The EPF declined to comment for this article.

Meanwhile, Nurmazilah says that while MIA does not express views on the financial statements of specific organisations, in general, it expects that under MFRS 9, the financial assets of pension funds would need to be classified according to their measurement categories, namely at amortised cost, at fair value through other comprehensive income, or at fair value through profit or loss.

For financial assets stated at fair value through profit or loss, no further impairment is assessed. Impairment for the other asset categories would use the general approach of MFRS 9.

“Under the general approach, the credit quality of the financial asset is compared at initial recognition (that is, when the financial asset is acquired) and at the reporting date. The change in the credit quality is split into three stages. For stage one, where the change in credit risk has not increased significantly, credit losses provided result from default events that are possible within the next 12 months.

“In stage two, where the change has increased significantly, a loss allowance is required for credit losses expected over the remaining life of the exposure (that is, lifetime expected credit losses). This is where the provisioning really gets heavier. As the credit risk worsens, it goes to stage three, which is when the financial asset is credit impaired.

“The simplified approach, on the other hand, is more straightforward as it provides lifetime expected credit losses, regardless of the credit risks attached to the asset. Although no judgement is required to assess whether the changes in credit risk are significant or not, entities will be required to provide for lifetime credit losses instantly. The simplified approach [for impairment of financial assets] is only available for trade receivables, contract assets and lease receivables,” says Nurmazilah.

For corporates, she says those that carry huge trade debtor balances may also be impacted by the standard as accounts receivables or trade debtors are financial assets.

“Corporations with huge consumer-based receivables, such as telecommunications and utility companies, could see an impact.

“However, the extent of the impact differs from that on banks [due to the recoverability period] ... when banks give out loans, there will be a payback period of 5 to 20 years, which is a longer term.

“In the telecoms industry, for example, when a subscriber doesn’t pay the bill after a month, the line gets cut. The implementation context of MFRS 9 here is different due to the nature of business,” she says.

Axiata Group Bhd chief financial officer Vivek Sood says the group is in the process of identifying the potential impact of MFRS 9.

Areas of focus for Axiata include hedge instruments/derivative financial instruments, receivables and investments.

“As the new accounting guidelines provide a broader effectiveness test on hedging, we see certain economic hedge instruments where Axiata could be eligible and qualify for hedge accounting.

“Once qualified, the fair value of the economic hedge instrument will be taken to hedge reserves rather than to profit or loss,” says Vivek.

As for receivables, he says the new MFRS 9 methodology will apply to receivables of postpaid customers, finance lease receivables, interconnect customers and other trade-related receivables.

“On investments, Axiata will be reviewing its equity investment portfolio and will take appropriate action with the new standard allowing fair value through other comprehensive income instead of fair value through profit or loss,” he explains.

A DiGi.Com Bhd spokesman tells The Edge that the telco sees minimal financial impact from adopting the new standard.

“MFRS 9 mainly changes the classification and measurement of financial assets. The largest component of financial assets on DiGi’s book is receivables, where the standard allows the application of a simplified approach as a practical expedient.

“Our preliminary assessment indicates that implementation of MFRS 9 will have no significant impact on DiGi’s receivables or financials.”

PwC assurance partner and risk assurance services leader Elaine Ng Yee Ling opines that the implementation of MFRS 9 at non-banks will not have a detrimental impact. “It’s not going to be so significant. It won’t shake them. For non-banks, it’s more about getting ready for the implementation as the excessiveness is less compared with banks.

“For example, when it comes to disclosure, under the general approach, banks need to disclose stages one to three for the expected losses provisioning model, but for telcos that apply the simplified approach, [the disclosure is not so detailed] as lifetime expected credit losses are applied throughout,” she says.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.