This article first appeared in The Edge Malaysia Weekly on May 8, 2017 - May 14, 2017

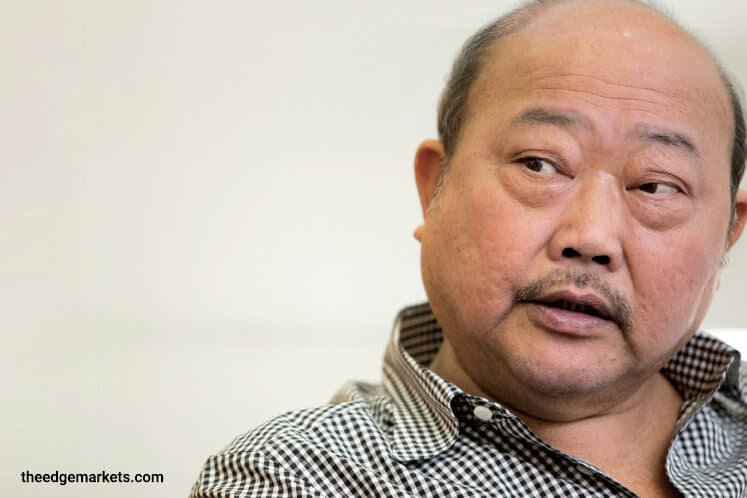

THE last day of 2015 was momentous for Tan Sri Lim Kang Hoo. It was the day his flagship company — Iskandar Waterfront Holdings Sdn Bhd (IWH) — partnered China Railway Engineering Corp (CREC) in inking a RM7.41 billion deal with 1Malaysia Development Bhd to acquire a 60% stake in the 483-acre Bandar Malaysia development in Kuala Lumpur.

The RM741 million deposit paid by the consortium proved a boon to 1MDB, which was cash-strapped at the time.

“The consortium is a highly attractive development partner for Bandar Malaysia and their bid was fully in line with the objectives outlined in the RFP (request for proposal), namely value maximisation, acceptable commercial terms and certainty of transaction execution,” 1MDB CEO Arul Kanda Kandasamy was quoted in the press as saying at the signing ceremony.

He probably breathed a huge sigh of relief as with the sale of the 60% stake in Bandar Malaysia and power assets to China General Nuclear Power Corp, there was cash coming in like rain during a prolonged drought for 1MDB.

IWH’s Lim was probably equally thrilled to secure the opportunity to develop one of last sizeable tracts of land in the city that was only 10km from KL Sentral and the Petronas Twin Towers. Furthermore, Bandar Malaysia is slated to become the city’s new transport hub with a proposed high-speed rail terminus and MRT station.

The estimated gross development value of Bandar Malaysia is in excess of RM150 billion, which would give the KL-born tycoon, most of whose land bank is in Johor, a foothold in the city.

Furthermore, he could proudly claim that he had won the land by edging out more than 40 other bidders in an international tender.

Down south, Lim’s property business had been growing slowly but surely. His knack for creating value saw the entry of three large China-based developers — Country Garden, R&F Properties and Greenland Holdings Corp Ltd. His developments on reclaimed land in Danga Bay and facing Singapore have been called audacious.

Country Garden bought 11ha of waterfront land for RM900 million from IWH in December 2012 and its project — Country Garden Danga Bay — is the first massive development undertaken by a China-based developer in Malaysia. In less than four years, Country Garden has completed 9,800 residential units with private sandy beaches and recreational facilities. The keys to the homes are to be handed over in July.

Like it or not, the tycoon has created demand in China for properties in Johor with the theme that the state is the gateway to Singapore.

Back to KL, some quarters believe the signing of the share sale agreement on Bandar Malaysia kick-started Lim’s lucky streak. Certainly, the past one year has been a bumper year for his other major company, Ekovest Bhd. Once shunned by institutional investors, it became a darling of the market when it struck a deal to dispose of a 40% stake in its wholly-owned subsidiary Konsortium Lebuhraya Utara-Timur (KL) Sdn Bhd (KESTURI) to the Employees Provident Fund (EPF) for RM1.13 billion cash.

KESTURI is the holding company for the first and second phase of Ekovest’s Duta Ulu-Kelang Expressway (DUKE). The second phase is expected to be completed in the first half of this year.

Lim owns 32.38% of Ekovest, together with Datuk Harris Onn Hussein, who pared down his stake after the stock rallied from 43 sen at end-2015 to a high of RM1.43 in early March this year. Lim is also the company’s executive chairman.

Also last year, Ekovest received approval for the third phase of DUKE. On top of that, the concessionaire secured a RM560 million interest-free advance from the government to support its debt repayments. The advance made Ekovest’s issue of sukuk worth RM3.64 billion much easier.

In short, the government is helping Ekovest load the interest cost of the highway from the first eight years of the concession to the subsequent 15 years under a reimbursable interest assistance scheme.

Boosted by the strong tailwind, Lim unveiled the proposed merger of listed entity Iskandar Waterfront City Bhd and IWH. The plan was well received by investors as IWC soared to a record high of RM3.22 on May 2 — the day before news of the termination of the stake sale in Bandar Malaysia broke. The abrupt end of the deal has certainly dealt the tycoon a big blow.

And for that reason, albeit a wrong one, he is likely to remain in the spotlight for some time to come.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.