This article first appeared in Personal Wealth, The Edge Malaysia Weekly on October 30, 2017 - November 5, 2017

In 2012, two Malaysians bankers working in Singapore got together to set up a boutique asset management firm at 412A Joo Chiat Road, located some 8km from the city’s financial district. The street had been notorious for pubs, massage parlours, karaoke lounges and by-the-hour hotels, but it was slowly being gentrified. Nevertheless, it is still far from being Raffles Place — the island republic’s financial hub.

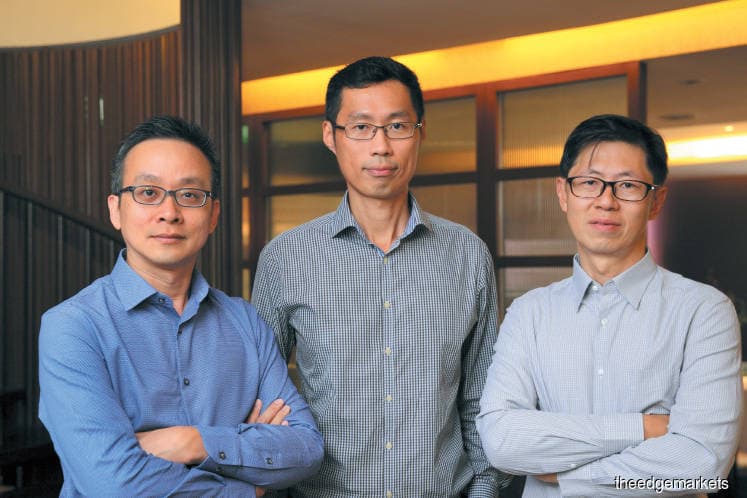

Eric Kong and Wong Seak Eng knew they were off the beaten track, but it was fitting in a way. What they were attempting to do — start a fund that does not impose a hefty sales charge but only a performance fee should it make money — was a radical idea at the time.

They were joined by Singaporean Kevin Tok, who became executive director in charge of the firm’s marketing, client acquisitions and public relations. Fellow co-founders and executive directors Kong and Wong would manage the fund.

Five years down the road, they talk cheerfully about serving high-net-worth clients — who were willing to trudge up to their office in the middle of nowhere (or so it seemed at the time) — plain water from a water filter near the washroom. One of them, irritated, even asked why he was being served “toilet water”.

But champagne and caviar were not the point. They were looking to address a real problem faced by private banking clients that had grown steadily worse following the global financial crisis.

It was a bold move. The firm they created — Aggregate Asset Management (AAM) — would charge investors a 20% performance fee based on a high water mark value instead of an annual management fee.

What is a high water mark and how does it work? Let’s say an investor puts S$500,000 in AAM’s fund and it earns a return of 15% — a gain of S$75,000 — during the first six months. This brings the total investment to S$575,000, which is the high water mark. Thus, the investor has to pay a performance fee of 20% on the S$75,000 gain, which works out to S$15,000.

The investor is not charged a performance fee if his investment does not exceed the high water mark at the next review in six months. He is only charged a performance fee if his total investment continues to grow. Basically, the high water mark ensures that the fund manager does not get unduly rewarded for poor performance.

“We totally broke away from the sales charge and adopted the high water mark model. This was at a time when banks and asset management firms could charge clients as much as 5% and an annual management fee of about 1%, which is fixed,” says Kong.

It took a lot of guts to adopt such a model. “We were confident of beating the index and delivering competitive returns. Otherwise, we would not have ventured out on our own,” says Wong, who has more than 15 years of experience in auditing, accounting, taxation, investment research and management.

“We find that our structure instils confidence in our clients that we are focused on generating absolute returns,” says Kong, who had held senior positions at several large financial institutions, including Citibank and United Overseas Bank, in the city state. He was also a partner at a Singapore-based boutique investment management firm.

Tapping into a frustrated market

The three founders had witnessed the frustration of private banking clients, who were unhappy about the high fees imposed by banks, which ate into their returns.

The 2008 global financial crisis exacerbated the situation. Lehman Brothers, the fourth largest US investment bank at the time, went bankrupt and global markets plunged into turmoil due to toxic assets such as subprime mortgages. Millions of people lost their jobs and some, their life savings.

Singaporeans were not spared. Financial institutions in the city state had distributed structured products, such as the Lehman Brothers Minibonds, to investors under different names and promised them high returns. When the US investment bank collapsed, about 10,000 retail investors in Singapore suffered losses of more than S$500 million.

Following the crash, investors became more discerning about fees and charges. They were frustrated when the investment products offered by banks underperformed their benchmarks, says Tok. “That was how we were able to grow over the years. Most of our clients have experienced private banking and were disappointed by their performance.”

The reason for their underperformance is simple, he notes. “In a private banking outfit, the funds they generally invest in carry 30 to 50, mostly blue-chip, counters. These stocks, in general, have a long-term performance of about 6% across all regions.”

So, any upside is cancelled out by the sales charge or annual management fee, which costs the investor about 6%. “If you invest at the right time, your long-term return is only about 4%,” Tok points out.

“We do not impose a sales charge and we diversify into small and mid-cap stocks in different countries and companies in Asia to look for better investment opportunities. This gives us double-digit returns.”

Five and a half years later, the three founders have proven the solidity of their approach. There is a demand in the market for actively managed funds with an attractive fee structure that provide good returns.

AAM’s Aggregate Value Fund has seen its assets under management grow from S$5 million in 2012 to S$460 million in August this year — a total return of 65.88%. This is a compound annual growth rate of 11.24%, according to the firm’s website. The fund’s benchmark index — the MSCI All AC Asia Pacific ex-Japan — roughly increased by 48% during the corresponding period, or about 18% lower than AAM’s fund.

The Aggregate Value Fund only caters for accredited investors, defined as those with personal assets exceeding S$2 million. The minimum investment amount is S$150,000 and investors are allowed to make a withdrawal of 5% annually based on the amount invested. Investors who withdraw more than that have to pay a 5% exit fee. However, the full amount can be withdrawn without any fee after three years.

AAM’s fund has attracted interest across the Causeway and there are already some Malaysian investors on board.

More than 600 stocks across Asia

Kong and Wong point out that the Aggregate Value Fund is a long-only equity fund that invests regionally. It buys undervalued stocks and holds them for the long term to realise gains. The fund managers do not employ hedge fund strategies such as using the investments as a form of leverage or even hedging against currency risk. The latter is taken care of naturally because of the investments in different countries.

So, what are AAM’s key differentiating factors? “First, our portfolio is extremely diversified and we invest in more than 600 stocks in Asia. Each stock only has a weightage of about 0.5% to 1%. This is the opposite of most of the other funds, which have 30 to 50 stocks in their portfolio,” says Kong.

“Second, we conduct a lot of quantitative research. We don’t do company visits. Yes, it is a key investment process of many value fund managers, who rely on their understanding of a company’s management to make investment decisions. But we do all our research on the screen by crunching numbers and identifying as many investment opportunities as possible.”

This is not the conventional approach, so it is no wonder that Kong has had to field questions from many investors over the years. The most common question is how the firm is able to keep track of a portfolio of more than 600 stocks. Also, how can the fund outperform its benchmark given the size of the portfolio?

Kong says the monitoring is possible as AAM’s investment process eliminates the need for company visits. This frees up their time to keep track of the stocks and conduct research and analysis.

The founders also use Bloomberg and Reuters terminals to alert them of stock price movements so they can take profit or cut their losses. “It is really not rocket science and many fund managers use the same tools,” says Kong.

Wong says outperformance is achieved by adhering to a deep-value investing philosophy and an extremely diversified investment style. This means the fund buys into stocks that are traded at a hefty discount to their earnings and assets. These opportunities surface from time to time when an event causes a knee-jerk reaction in the market and an unusual sell-off.

Examples include the largest organised anti-graft effort in the history of China’s Communist rule launched by President Xi Jinping in 2012. The campaign hurt the country’s retail stocks, partly because corporate and government officials stopped hosting extravagant parties and events.

A more recent example of an unusual event is the increasing tension between Donald Trump and Kim Jong-un, which have driven down the prices of some stellar South Korean companies.

AAM buys into undervalued stocks and holds them until the market recovers. Sometimes, the stocks appreciate by three to four times. “In some cases, they even go up tenfold,” says Kong. These huge gains are more than enough to cover the losses made by wrong calls, adds Wong.

Some of the firm’s better calls include APT Satellite Holdings (Hong Kong), PMB Technologies (Malaysia), Road King (Hong Kong), Posco (South Korea), Aapico Hitech (Thailand) and Darwin Precision (Taiwan).

“Yes, sometimes cheap stocks can fall further because of things beyond our control. But because each stock accounts for only about 0.5% of our portfolio, the impact is not significant,” says Kong.

He says the portfolio’s turnover rate is 20%, implying a “buy-and-hold” strategy as opposed to actively trading the stocks. The turnover rate is measured by taking either the total amount of new securities purchased or sold over a particular period of time, usually in the last 12 months. The lower the rate, the lower the trading activity.

The Aggregate Value Fund, which has invested in 637 stocks, had a price-to-net tangible asset and price-earnings ratio of 0.58 times and 13.96 times respectively as at 2Q2017. It has a dividend yield of 3.12% and a return on equity of 4.3%.

The fund’s top five holdings are Hung Hing Printing Group Ltd (1.09%), Road King Infrastructure Ltd (1.04%), Ming Fai International Holdings Ltd (0.97%), Oriental Watch Holdings Ltd (0.96%) and Weiqiao Textile Co Ltd (0.91%),which are listed on the Hong Kong stock exchange. On a country basis, the fund’s largest allocation is in Hong Kong (34.81%), South Korea (19.75%) and Malaysia (10.21%).

Not an easy journey

Because of its humble beginnings, the firm started out with clients who were basically friends and relatives of the founders. It was only three to four years later, when they started to show real results, that other investors started to come on board.

“Some of our clients had been tracking our performance over the years before they would trust us with their money,” says Tok.

He remains optimistic about the future of boutique asset management firms in Singapore, mainly because they actually produce results. “I believe boutique firms will continue to add value for investors. That is why I quit my job to venture into this space.”

Tok spent 20 years as a district director at AIA Singapore before co-founding the firm. He is a chartered financial consultant and certified financial planner.

AAM has grown over the years and is looking to expand its team to enable the fund managers to crunch numbers and identify investments faster and more efficiently. “We are looking to hire a few more people next year. One will be a mathematician while the others will do some programming and help develop some analytical tools. We are building a team,” says Kong.

Stock picks

Aggregate Asset Management co-founders, executive directors and fund managers Eric Kong and Wong Seak Eng do not claim to be macroeconomic experts. They don’t really care if the global economy is at a tipping point as they believe that stocks always fare better in the long term.

They focus on identifying stocks which they feel are being traded at a discount. “For instance, if you randomly pick 10 companies in Malaysia and look at their annual reports over the past 10 years, you will most probably see that their value has appreciated during that time. That is why people should stay invested and participate in the long-term growth,” says Kong.

Also, even when the overall market is down, there are always investment opportunities. For now, Kong favours Hyundai Motor Co — the third largest vehicle manufacturer in the world. It has been profitable since the Asian financial crisis and has paid dividends to shareholders every year since 1999. As at Oct 19, the stock was trading at a price-earnings ratio (PER) of 9.74 times and had a dividend indicated gross yield of 2.62%.

He also likes China Petroleum & Chemical Corp and Swire Pacific Ltd, which are listed on the Hong Kong stock exchange, as well as Japan Post Holdings Co Ltd.

China Petroleum & Chemical Corp produces, refines and trades petroleum and petrochemical products. The stock is currently trading slightly below book value and has a modest PER of 11 times. In the last two years, the company recorded lower revenue due to the drop in oil prices, but it has been profitable and has paid out dividends consistently.

Swire Pacific owns Cathay Pacific and Coca-Cola’s distribution rights in Hong Kong, among others. “We see this as a neglected blue chip. Swire Pacific’s valuation is currently cheap, but the company has a proven track record. It has been profitable and has paid dividends to shareholders every year since the Asian financial crisis,” says Kong.

Japan Post Holdings is currently loss-making. “It operates a network of post offices, banks and insurance companies. It is a typical ‘fallen big cap’ that is being sold at a 60% discount to its net asset value and pays a yield of more than 3%. Although its earnings are lacklustre, we think there is a sufficient margin of safety,” says Kong.

He is also eyeing a few Malaysian companies with attractive valuations. New Hoong Fatt Holdings Bhd, PBA Holdings Bhd and OSK Holdings Bhd are some companies investors can look into, he says.

Why these in particular? Kong points out that New Hoong Fatt, which distributes automotive parts and accessories, has a management with a proven track record in terms of profitability and has been rewarding shareholders with steady dividends year after year. “Its current valuation is considered cheap.”

Water treatment company PBA Holdings has a strong record of paying dividends annually, he adds. Its revenue has been growing for the last seven years, allowing it to remain profitable.

Meanwhile, OSK Holdings has a few prized assets whose values have yet to be unlocked. “We like the fact that the company has been paying dividends every year since the mid-1990s. The stock is currently trading at a deep discount to its assets,” says Kong.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.