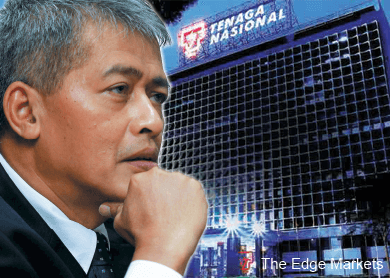

EVEN as he navigates the politically sensitive takeover of 1Malaysia Development Bhd’s failed power plant — Project 3B — Datuk Seri Azman Mohd, Tenaga’s president and CEO since 2012, is optimistic about the company’s prospects.

“In the past, the government has had a policy of letting us survive, but not allowing us to go beyond. Just look at Sabah. The SESB (Sabah Electricity Sdn Bhd) is just surviving. This is not the way for a country to get a reliable supply of power,” Azman tells The Edge.

The game changer for the group has been the gradual implementation of an incentive-based regulation (IBR) and the imbalance cost pass-through (ICPT) mechanism that allows Tenaga to pass on fuel costs to consumers.

The game changer for the group has been the gradual implementation of an incentive-based regulation (IBR) and the imbalance cost pass-through (ICPT) mechanism that allows Tenaga to pass on fuel costs to consumers.

Under the IBR, Tenaga’s transmission and distribution businesses are regulated by virtue of being natural monopolies and have their return on rate base capped at 7.5% per annum.

Meanwhile, Tenaga has to compete with the independent power producers for its power generation business, even if fuel costs are now borne by the consumers.

The increased predictability of Tenaga’s earnings has seen a stronger financial performance by the group and a soaring share price.

For the financial year ended Aug 31, 2014, Tenaga’s profit rose 20.74% from the previous year to RM6.47 billion. Likewise, its revenue grew 15.2%. Public Investment Bank Research estimates that the group’s FY2015 net profit will accelerate by 6.1% to RM6.86 billion.

In the last two years, Tenaga’s share price has risen 74%, to RM13.88 last Friday, giving it a market capitalisation of RM78.3 billion.

On the flipside, consumers are wondering whether they are paying for Tenaga’s strong financial performance since it came in tandem with an electricity tariff hike last year.

As part of the IBR, Tenaga is supposed to unbundle its accounts to show that each of its units — transmission, distribution and generation — are being run efficiently. However, the Energy Comission (EC) has yet to publish the unbundled accounts.

That said, Azman warns that the ICPT has yet to be tested in an environment where fuel prices are on the rise.

“It still needs to be tested. So far, we are having a good run. Ideally, it should be written in law or something that we will follow this (ICPT) regardless what happens — high or dry. But it is unlikely they (the government) can do this kind of thing,” he says.

Although the fuel costs are supposed to be passed through, the government still has the last say in the tariff. If populist politics take over when fuel prices are on the rise, there is a chance the government would be reluctant to pass on the cost to consumers. In this situation, Tenaga’s profits would take a big hit, reminiscent of the gas supply shortage of 2011 that cost the company more than RM3 billion.

“If you can make ICPT a sure thing during good times and trying times, our share price can go up a few more notches. My next challenge is to make sure, rain or shine, we can pass through the cost. Right now, the sun is shining,” explains Azman.

Coal, Tenaga’s largest fuel cost component, has seen a downward trend over the past year or so, falling below US$88 (RM314) per tonne on average. On top of that, liquefied natural gas prices have also inched downward, tracking the decline in global oil prices.

In the past six months, Tenaga has already racked up some RM1.5 billion in savings. Some will be passed back to the consumers over the next few months and the rest will be “saved for a rainy day”, says Azman.

In the meantime, Azman will have to carefully navigate the politically sensitive takeover of Project 3B from 1MDB that encapsulates the delicate tightrope he walks.

Tenaga cannot allow the project to fail as the country sorely needs the 2,000MW coal-fired power plant to be commissioned with minimal delays. As it stands, Azman estimates that Tenaga can complete it with only a six-month delay.

Azman will have to ensure that the project does not fail and is done at the lowest cost to consumers but with a positive return for the group. To achieve this he may even have to ask 1MDB to take a haircut on Project 3B.

Recall that 1MDB had trouble raising capital to finance the project after its RM8.4 billion sukuk issuance fell through last year. Hence, 1MDB will not be including Project 3B in the listing of its energy unit, Edra Global Energy Bhd.

Azman insists that the takeover of Porject 3B should not be deemed as a bailout for 1MDB. “We are a listed company. We have our own governance. Everything must be subject to the governance. The final decision lies with our board.”

But before Tenaga can consider the deal, the government and the EC will first have to make a decision on what to do with Project 3B. This could involve giving it to Tenaga, or even another player. Nonetheless, industry executives say Tenaga is already in discussion with 1MDB and is concluding its due diligence on the project.

Likewise, if Tenaga is approached to take a stake or acquire Edra Global from 1MDB, Tenaga’s board would also have the final say, notes Azman, addressing concerns among shareholders that Tenaga may be asked to take over 1MDB’s power assets.

Note that Tenaga’s largest shareholder is Khazanah Nasional Bhd, which is in turn controlled by the Ministry of Finance. Prime Minister Datuk Seri Najib Razak is the chairman of Khazanah and 1MDB’s advisory board.

“We are a power company. We do power generation. If any opportunity comes along, we will consider. It is our core business. But, of course, the question is, at what price? All deals must be done in a way that makes commercial sense for Tenaga,” Azman says.

This article first appeared in The Edge Malaysia Weekly, on May 18 - 24, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.