This article first appeared in The Edge Financial Daily on August 30, 2018

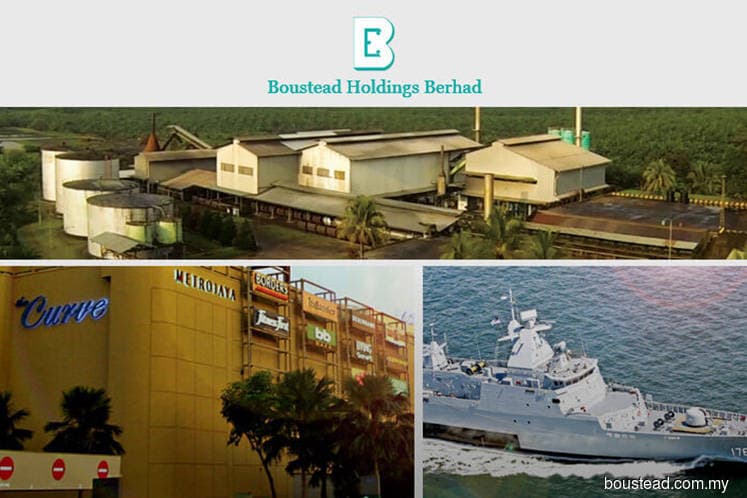

KUALA LUMPUR: Boustead Holdings Bhd slipped into the red in the second quarter ended June 30, 2018 (2QFY18), mainly due to reduced contributions from plantation, heavy industries and property divisions, as well as after allocation to non-controlling interests and perpetual sukuk holders.

The group posted a net loss of RM27.6 million for 2QFY18 compared to a net profit of RM52.5 million a year ago.

It posted a loss per share of 1.36 sen for 2QFY18 compared to earnings per share of 2.59 sen for 2QFY17. Quarterly revenue also fell a marginal 0.5% to RM2.37 billion from RM2.39 billion a year ago.

Nevertheless, the group declared a second interim dividend of one sen for the financial year ending Dec 31, 2018 (FY18), payable on Oct 5.

For the cumulative six months ended June 30, 2018 (1HFY18), the group also posted a net loss of RM21.5 million compared to a net profit of RM48.5 million a year ago, as revenue dropped 3% to RM4.62 billion from RM4.76 billion in 1HFY17.

“The trading and industrial division was the key contributor for the six-month period, recording an increased profit of RM74 million. This was primarily attributable to stockholding gains, as well as better operating margins and sales volumes recorded Boustead Petroleum Marketing Sdn Bhd,” Boustead said in a separate statement.

On prospects, Boustead said the outlook for 2HFY18 remains favourable in both the global and domestic fronts although it warned that the escalating US-China trade war poses risks to global trade and will have an impact on Malaysia.

“Moving forward, the group will continue to leverage on the strength of our diversified core businesses to deliver sustained results,” it said.