BISWAROOP says Standard Chartered only invests in investment-grade global bank and corporate bonds that carry an equivalent rating of at least BBB- by Standard and Poorís and Fitch Ratings or Baa by Moodyís Investors Service.

“What is different about us is that the bond we make available to our clients must meet the investment-grade requirements of all three international agencies. So, if a bond does not meet the requirements of any of these agencies, it will be treated as a sub-investment grade under our methodology,” he says.

What about countries where the international rating agencies have yet to move in and carry out their ratings? Biswaroop says Standard Chartered has an in-house system to equalise all the ratings done by rating agencies around the world to an international standard.

In Malaysia, corporate bonds are required to have at least an AA rating by Malaysian Rating Corp Bhd (MARC) or RAM Rating Services Bhd.

Biswaroop recommends bonds with tenors of three to six years. “A medium-term bond works better in most interest rate environments,” he says.

“If you have a three to six-year tenor, the impact of rising interest rates on the price of that bond will be more moderate. Hence, rising interest rates are not likely to lead to immense volatility in this sector of the market.”

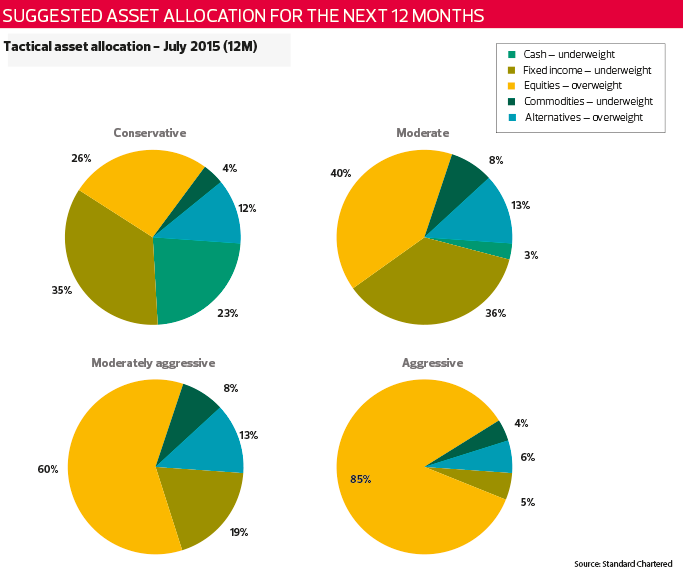

Bonds should feature heavily in one’s investment portfolio, even during volatile times. However, the allocation for fixed income will depend on the investor’s risk tolerance. According to Standard Chartered’s global market outlook report published on May 22, the recommended asset allocation for fixed income as at June was 35%, 36%, 19% and 5% for its conservative, moderate, moderately aggressive and aggressive portfolios respectively.

Chang says the asset allocation reflects the bank’s view for the next 12 months and changes over time are expected to be really minimal. “Unless there is a black swan event, even if there is such a change, it will be around 1% to 2%. From our point of view, our client gets that consistency. This is not a trading view; you don’t change it every single day or month. We live by it and take it as a point of reference.”

In the same report, the bank favours US treasuries for sovereign bonds as it believes yields have risen markedly, owing to a combination of a sharp increase in German yields, rising expectations of inflation and low market liquidity.

“However, we believe the rise in yields will remain capped and the recent increase in the difference between the 2-year and 10-year yields should reverse. Hence, we continue to prefer a moderate maturity profile in US dollar bond portfolios,” the report says.

Standard Chartered also likes local Asian currency bonds, such as the rupee, yuan and Hong Kong dollar bonds. The report notes that the high yields and scope for capital gains in the Indian currency should more than offset its depreciation, while the yuan and Hong Kong dollar bonds offer an exceptional diversification option owing to their low correlation with other asset classes.

The hunt for yield is something Biswaroop advises against for individual investors, as they would need to take on additional risk. “Pushing the envelope on risk happens when investors have a specific numerical return in mind. It is all about the context of the environment, a 10% yield in Malaysia may be massive, but in Zimbabwe, it is nothing. If you are gunning for 10% yield in Singapore and Malaysia, you are driving and hunting and pushing for yield. That will cause you to take risks that are not necessarily appropriate to you.

“If the risk-free interest rate is 1% and now you want 10%, then you are looking at something like a 900-basis-point premium over the risk-free rate. This type of yield is given by bonds with risks that you certainly don’t want to get into.”

What kind of yields would be considered acceptable? He suggests looking at those within 4% to 5% above a certain benchmark or risk premium.

“You can take the local interbank interest rate or the government treasury interest rate [as a reference]. Then the yield on a given bond tells you the risk premium you are earning for taking that specific corporate risk,” says Biswaroop.

“As long as you keep it in context, you should be satisfied. Because if you understand 4% to 5% over a certain benchmark yield may be good enough, then it doesn’t matter if the interest rate is high or low. As long as you have that premium you are okay.”