Value investing is one strategy that has stood the test of time, having been used successfully in various economic conditions since the 1920s. Renowned investors Warren Buffett and Irving Kahn are among those who have espoused this strategy.

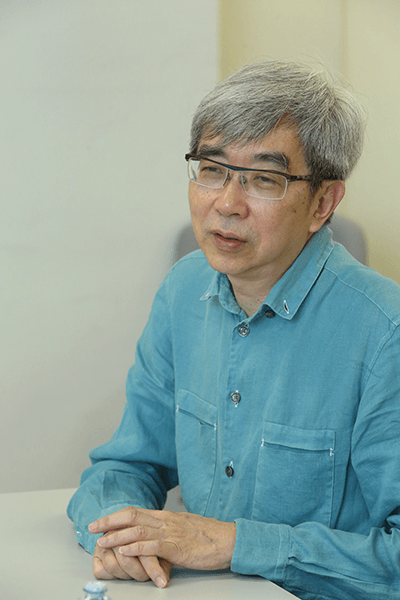

Capital Dynamics Sdn Bhd founder and CEO Tan Teng Boo is a fund manager who subscribes to the principles of value investing, but does not follow the textbook definition of it.

According to Tan, conventional value investing can be limiting when it is applied in developing countries, due to lack of established institutions and weaker market forces. Instead, he focuses on the time-tested value investing approach of seeking intrinsic value and applying the principle margin of safety on companies.

In addition to being the founder and CEO of Capital Dynamics, Tan is the founder of Capital Dynamics Asset Management Sdn Bhd, a licensed fund manager registered under the Securities Industry Act.

Capital Dynamics Asset Management manages icapital.biz Bhd, a RM140 million closed-end fund listed on the Main Market of Bursa Malaysia.

In an interview with Personal Wealth, he provides some insight into how we can spot opportunities using his value investing strategy.

Intrinsic value and margin of safety

According to Tan, the beauty of value investing is that one can invest in low-risk, high-return assets, mainly because a risk assessment is done before one invests in a particular stock.

“We value a company on a long-term basis [usually more than five years] and find out its intrinsic value [the actual value of a company through fundamental analysis, including tangible and intangible factors without reference to its market value].

“If the intrinsic value of a company is RM10 and the current share price is RM5, it provides a good margin of safety on the potential downside risk. Once an investor takes care of the downside risk, the upside potential will take care of itself,” he says.

The margin of safety required varies depending on factors such as reputation and nature of the industry. “The margin of safety required for well-established companies with multinational operations, such as Starbucks, is much lower than, say, a start-up. If the business environment is unpredictable and dynamic, the margin of safety required will be higher,” he points out.

According to Tan, sentiment also plays a role in determining whether there is a margin of safety in a market. “For instance, commodity prices are trending down and are on the negative side. A wider discount is seen in such stocks. Meanwhile, global technology companies and Internet stocks seem to provide lower or no discount now due to the strong confidence in the prospects of the sector.”

The margin of safety is computed by comparing a company’s current share price against its long-term valuation. “The fact that commodity prices have fallen 30% does not necessarily mean that the shares are undervalued,” says Tan.

As a value investor, he adds, one should look at the long-term average performance to derive value, taking into consideration the good and bad years. An example is the recent poor performance of crude oil.

“Even though crude oil prices have fallen, the long-term valuation of an oil and gas company should not be computed based on the current depressed price.”

Tan points out most research analysts only look at the earnings forecasts for the next six to nine months to derive the value of a company. He disagrees with such short-term valuations. Investors, he says, should think like business owners.

“If you want to invest in a banking stock, you should think like a bank owner. Do you think [Public Bank Bhd chairman] Teh Hong Piow will sell the company during a recession, or will he sustain the business until the economy recovers?”

Ultimately, it is the business model that matters. Investors have to understand why the business works in order to have a good sense of the valuation, Tan says. “If you are not familiar with the business, stay away from it. If you know the business well, you don’t need sophisticated financial models to derive the long-term value.”

To further illustrate the concept, Tan uses the example of a pastry shop that has been operating for the past 10 years. “Over the years, the business has had good profit with no competitors around. Let’s assume it makes a profit of RM500,000 a year. [The next step is to] analyse the sustainability of this amount by carrying out supply chain research.”

Supply chain research can be done by gathering information from stakeholders of the business, including suppliers, customers, employees and even the state council. “This allows us to find out whether the profit is sustainable and will be consistent in the future by considering different risks,” says Tan.

For example, he adds, good consistent profit over the years could be due to the pastry shop’s strategic location and the right pricing, or there could be regulations that prevent competitors from setting up shop.

Unlike conventional belief, profit is not necessarily the most important element when evaluating a company. Other factors, such as low barriers to entry, also play a crucial role in determining the sustainability of a company’s business model.

Tan illustrates: Take an oil and gas company with a market capitalisation of RM2.9 billion, recent sales of RM290 million and a 50% profit margin. Based on its strong order book and high profit margin, should one invest in this company?

An investor who thinks like a business owner would not, he says. “The revenue of RM290 million is not sustainable due to the low barrier to entry [in this industry]. Many players will enter the industry and eventually profit margins will be slashed. So, paying RM2.9 billion would not be a good option.”

How a company manages its business is also important in assessing its potential long-term average profit. “For example, IOI Corp Bhd chairman Tan Sri Lee Shin Cheng inspects oil palm plantations on weekends. If he finds a fresh fruit bunch on the floor [that could have been processed], he will throw it in front of the plantation manager’s house. This is why IOI has less wastage and higher yields than other players.”

However, it is not easy to find out such details about the management of a company. Tan recommends reading its annual reports — past and present.

“If a company has been listed for more than 20 years, read all of them. Try to find out what the management did during economic downturns. If the business can perform in bad times, it means the management is competent.”

Pay attention to the company’s financial statements, especially its notes to the accounts, to find out details on how it derives its profit for the year. Often, this will provide a clearer picture and help investors better analyse the company’s performance and also versus that of its peers in the industry.

“For instance, if there are changes in the depreciation policy [which are indicated in the notes], profits are no longer an apple-to-apple comparison, and adjustments are needed,” he says.

This article first appeared in Personal Wealth, a section of The Edge Malaysia, on February 9 - 15, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.